US Bank operates a subsidiary of US Bancorp, a diversified financial services company. Founded in 1968, the bank provides commercial banking services for institutions, businesses and individuals

- Branch / ATM Locator

- Website: https://www.usbank.com/

- Routing Number: 122105155

- Swift Code: See Details

- Telephone Number: +1 800-872-2657

- Mobile App: Android | iPhone

- Founded: 1968 (56 years ago)

- Bank's Rating:

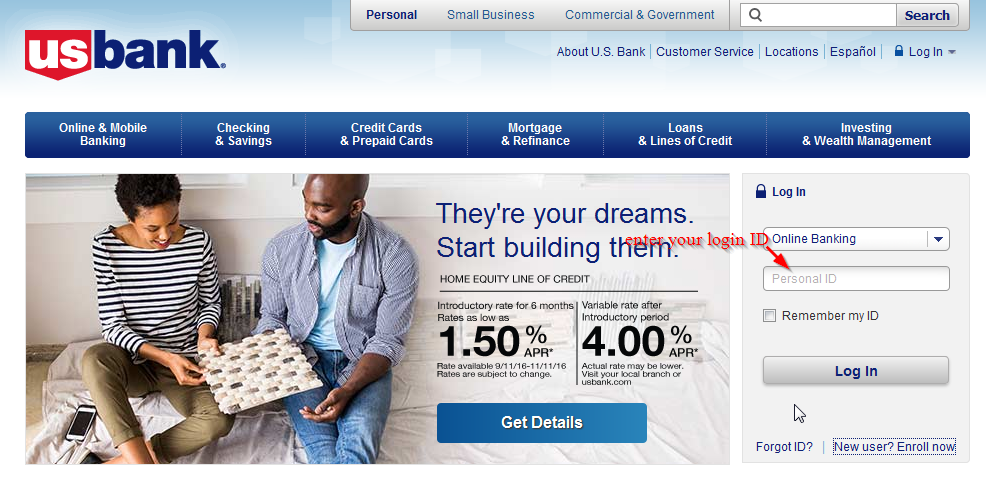

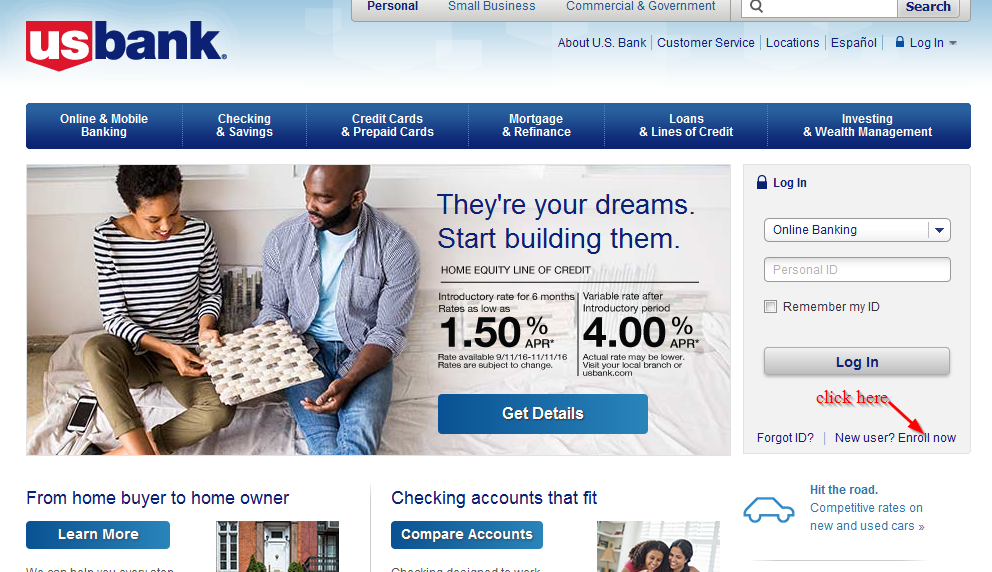

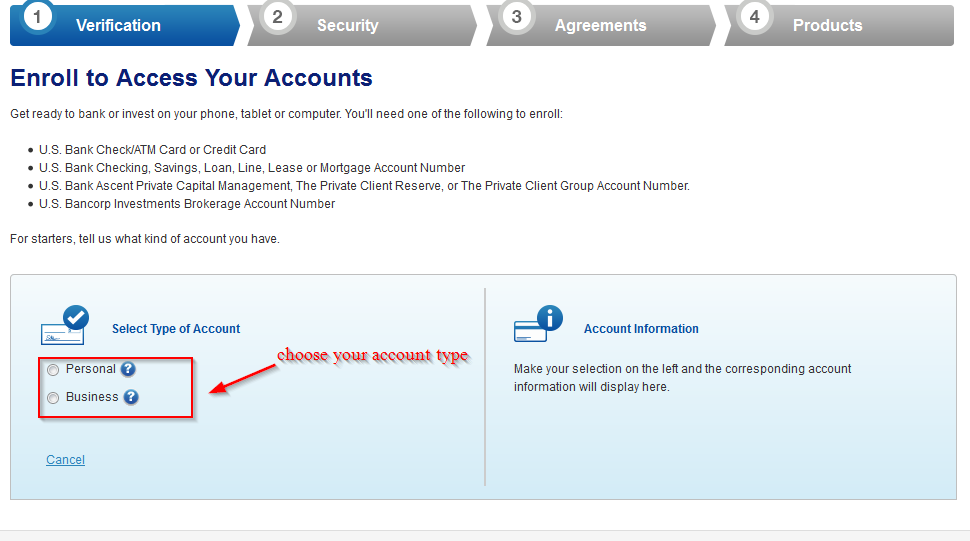

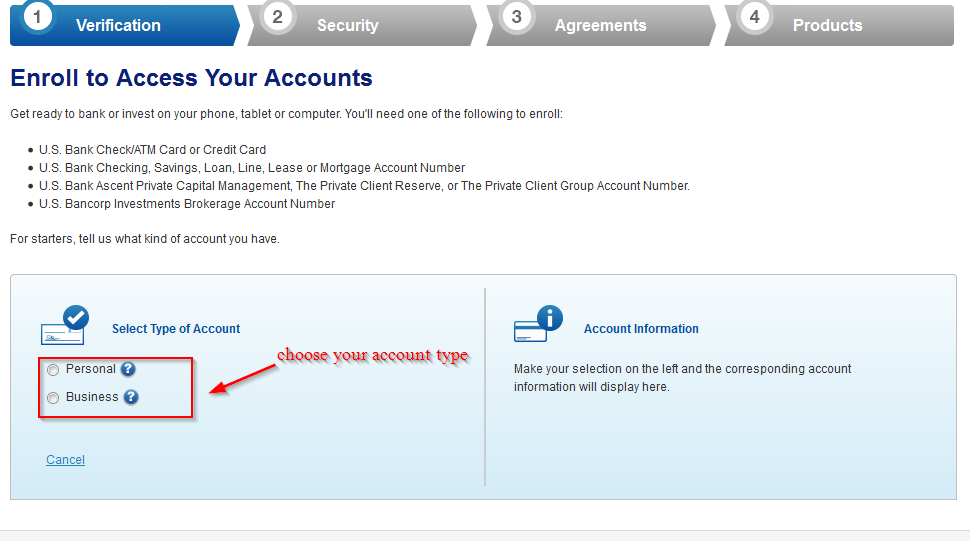

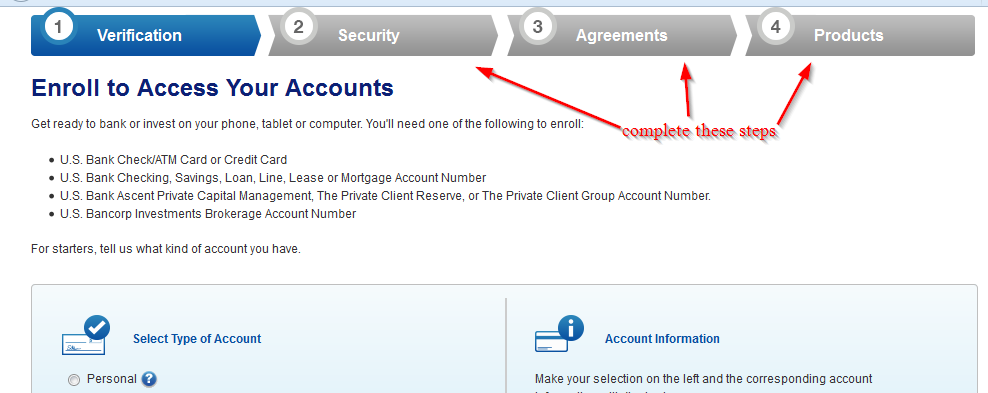

The US Bank strives to give their customers the best banking experience and with its internet banking services, customers can have access to their bank accounts from anywhere around the world as long as they are connected to the internet. And those who have mobile phones can download an app on their phones and login. Here is a guide to take you through the internet banking services.