Chase Bank provides financial service, which includes commercial and consumer banking. Founded in 1799, the bank operates as a subsidiary of J.P. Morgan Equity Holdings, Inc.

- Branch / ATM Locator

- Website: https://www.chase.com/

- Routing Number: 122100024

- Swift Code: See Details

- Telephone Number: 1-800-935-9935

- Mobile App: Android | iPhone

- Founded: 1799 (225 years ago)

- Bank's Rating:

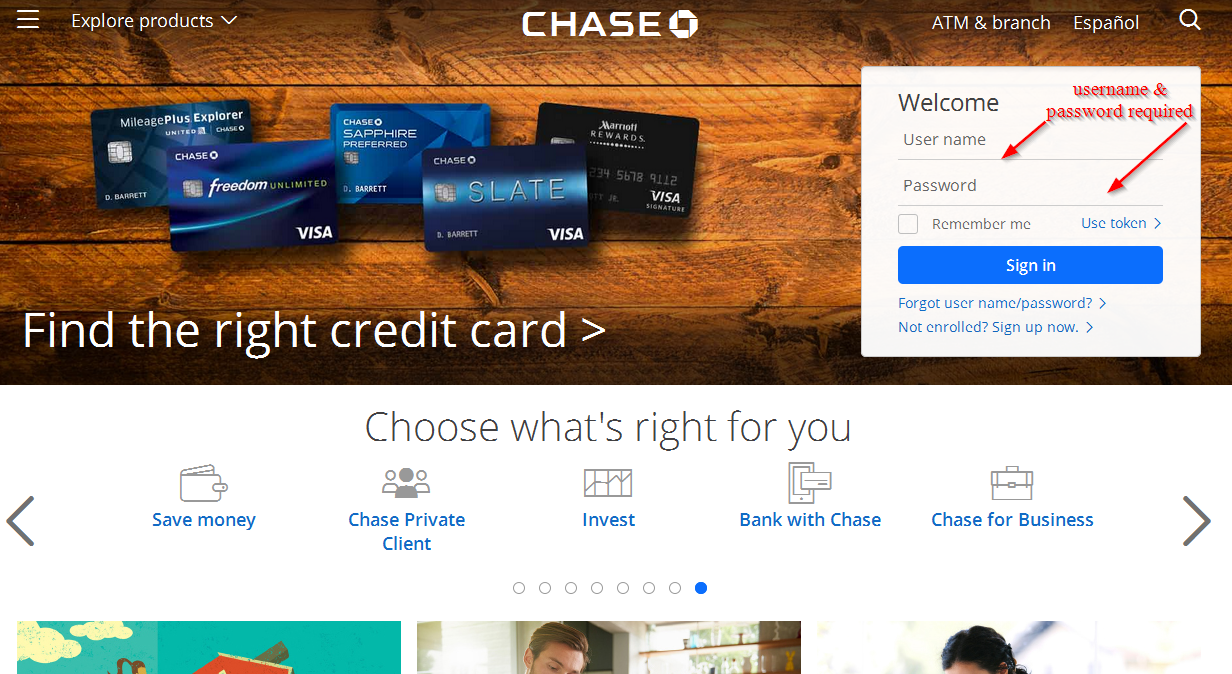

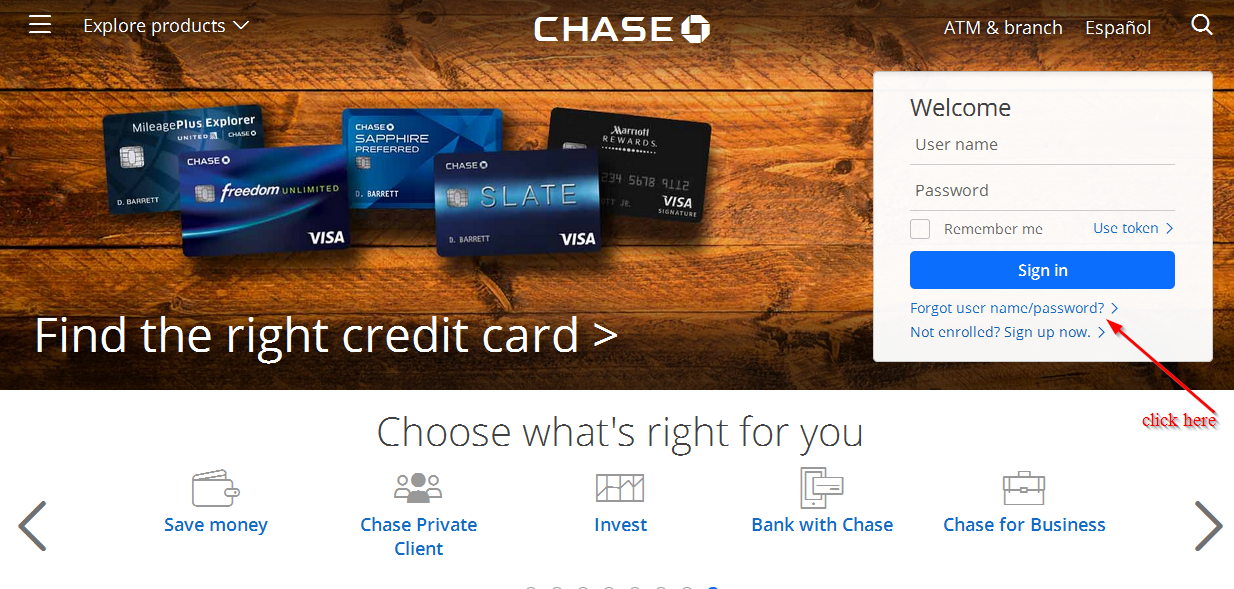

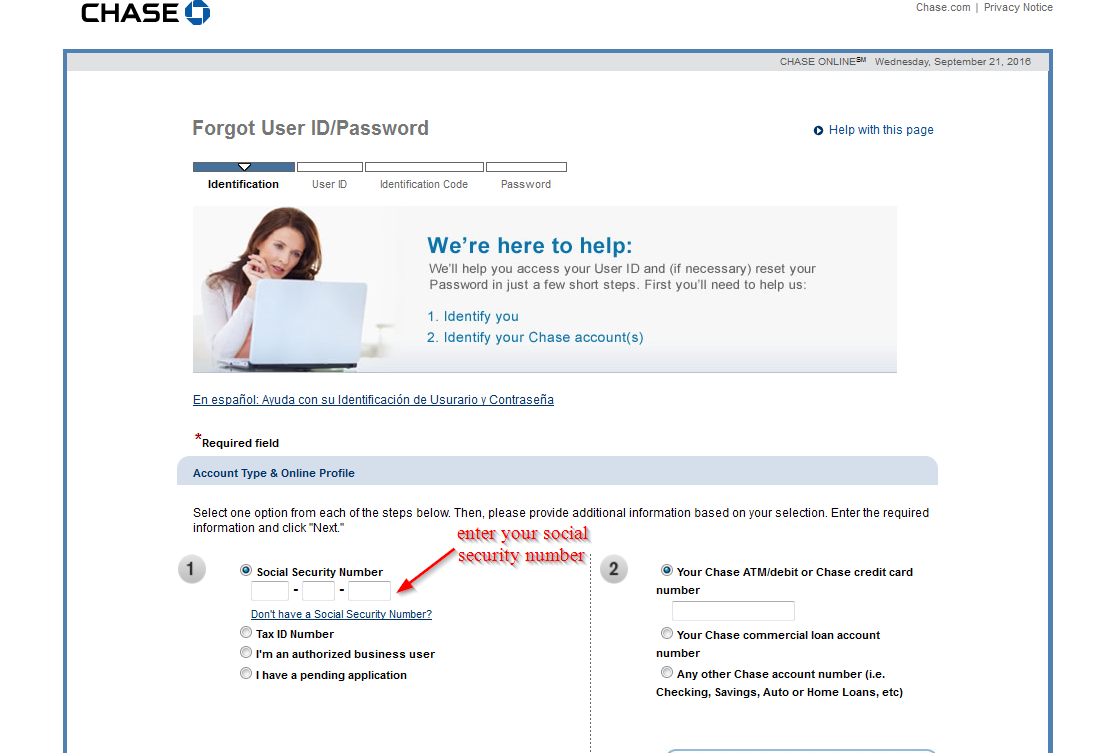

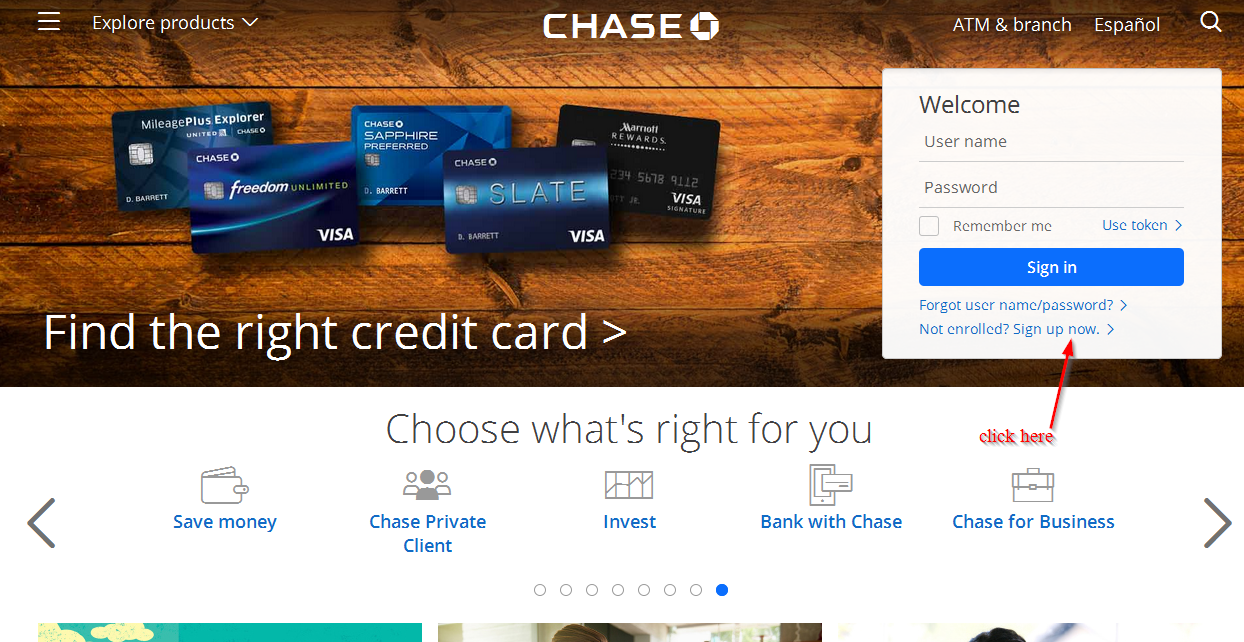

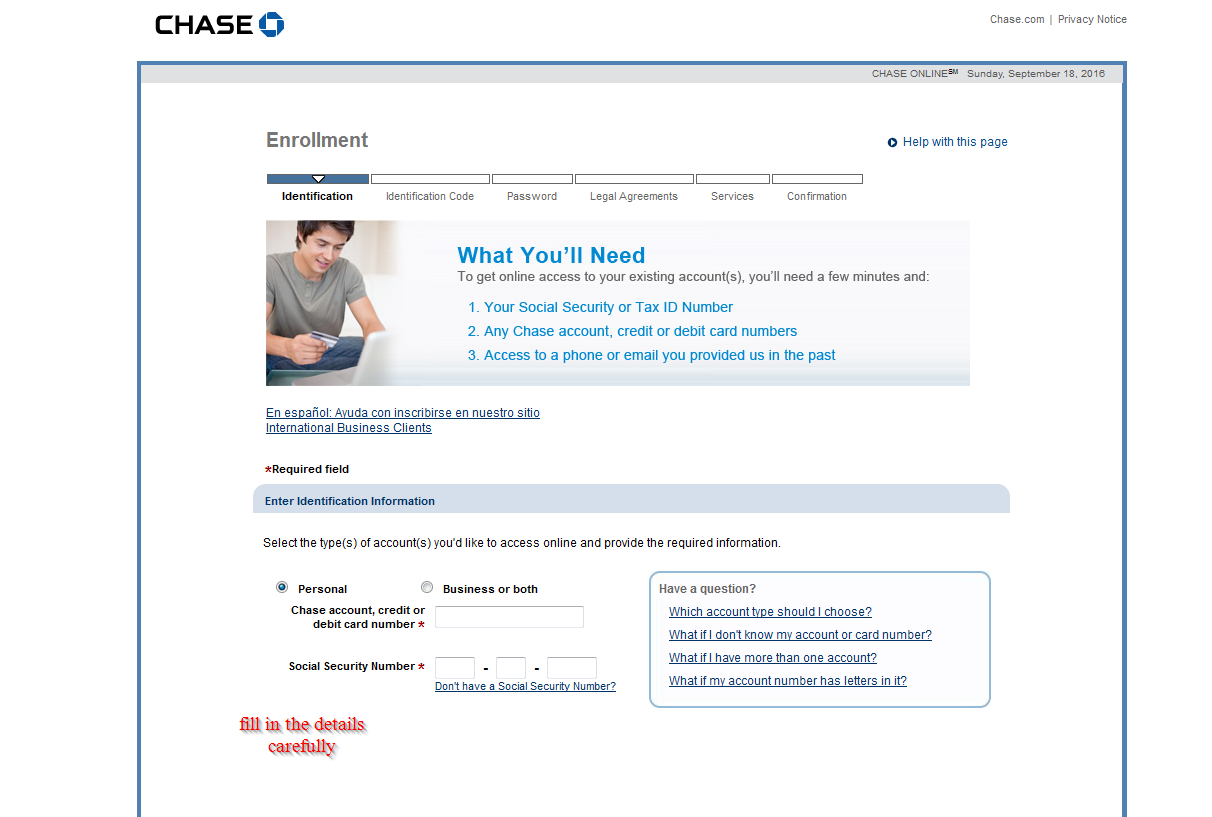

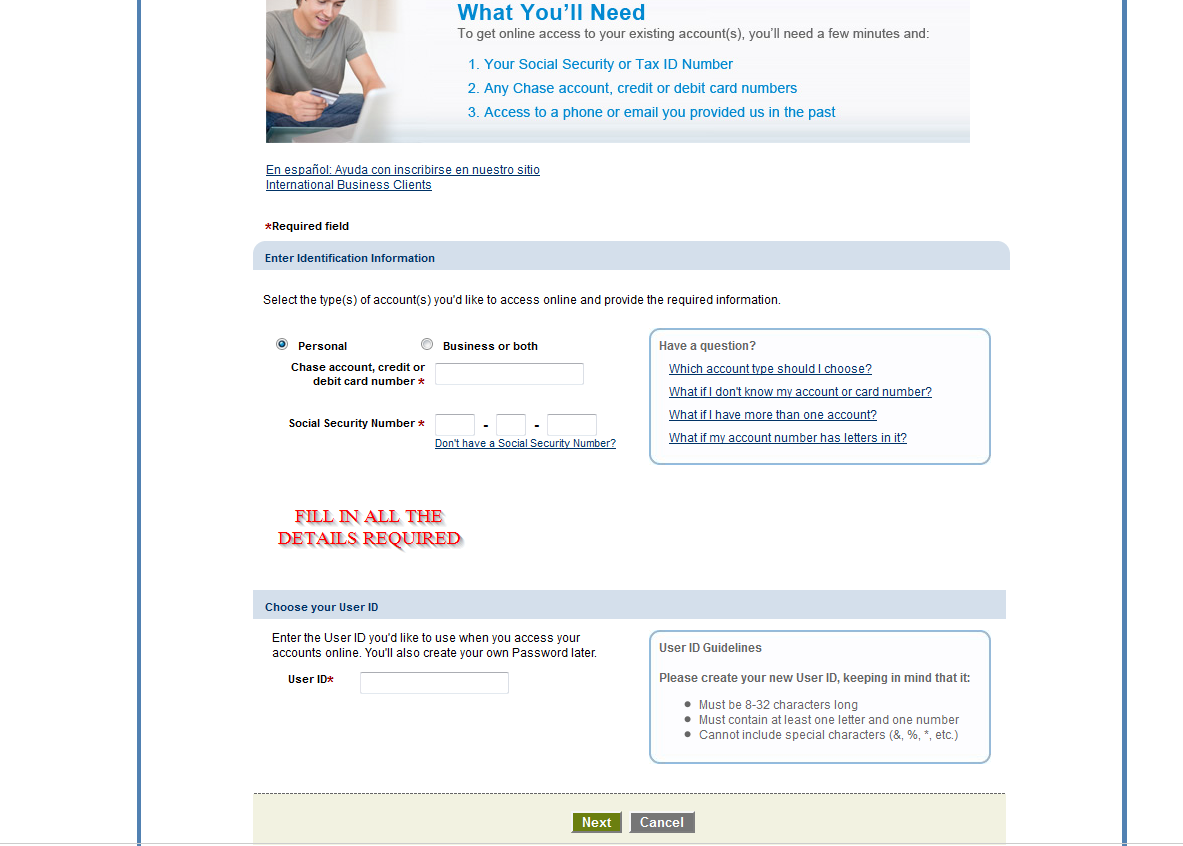

With your Chase Bank online account, you can make payments, request an eStatement, and do many things that will save you the time you would have spent queuing at the bank. These services are free and only accessible to customers who enroll. This guide will help learn how to log in, how to reset your password in case you forgot and registering for the online banking services offered by the Bank.