TCF bank provides commercial, business and personal banking services and products. TCF Financial Corporation owns TCF bank which operates as their subsidiary.

- Branch / ATM Locator

- Website: https://tcfbank.com/

- Routing Number: 122106183

- Swift Code: See Details

- Telephone Number: +1 800-823-2265

- Mobile App: Android | iPhone

- Founded: 1923 (101 years ago)

- Bank's Rating:

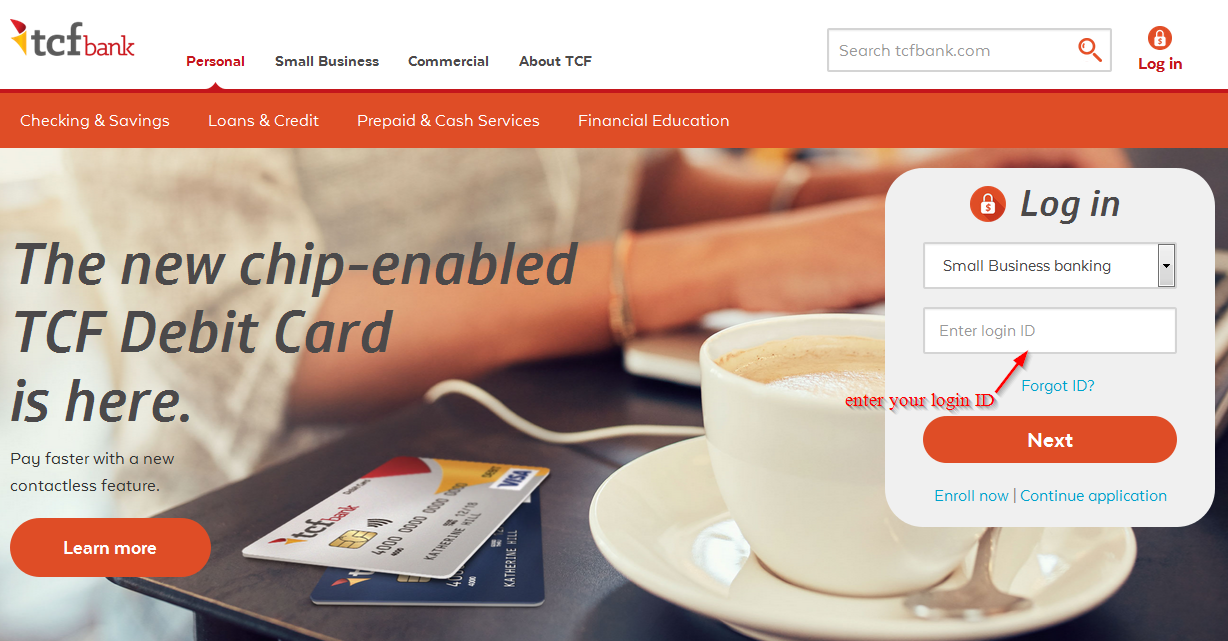

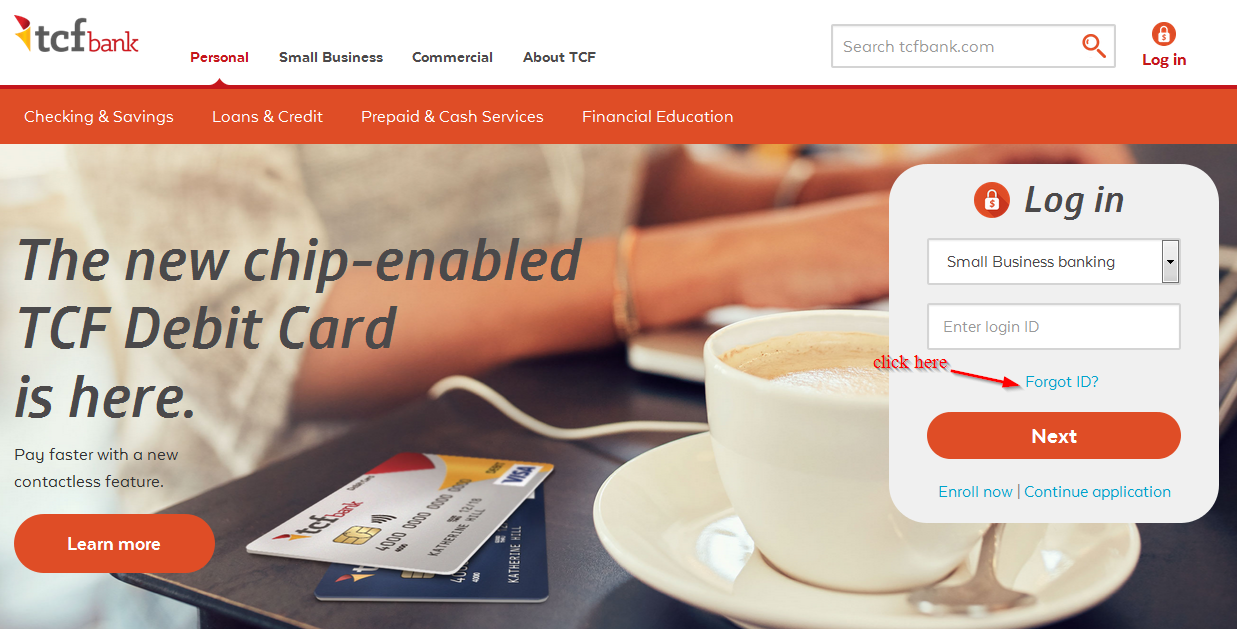

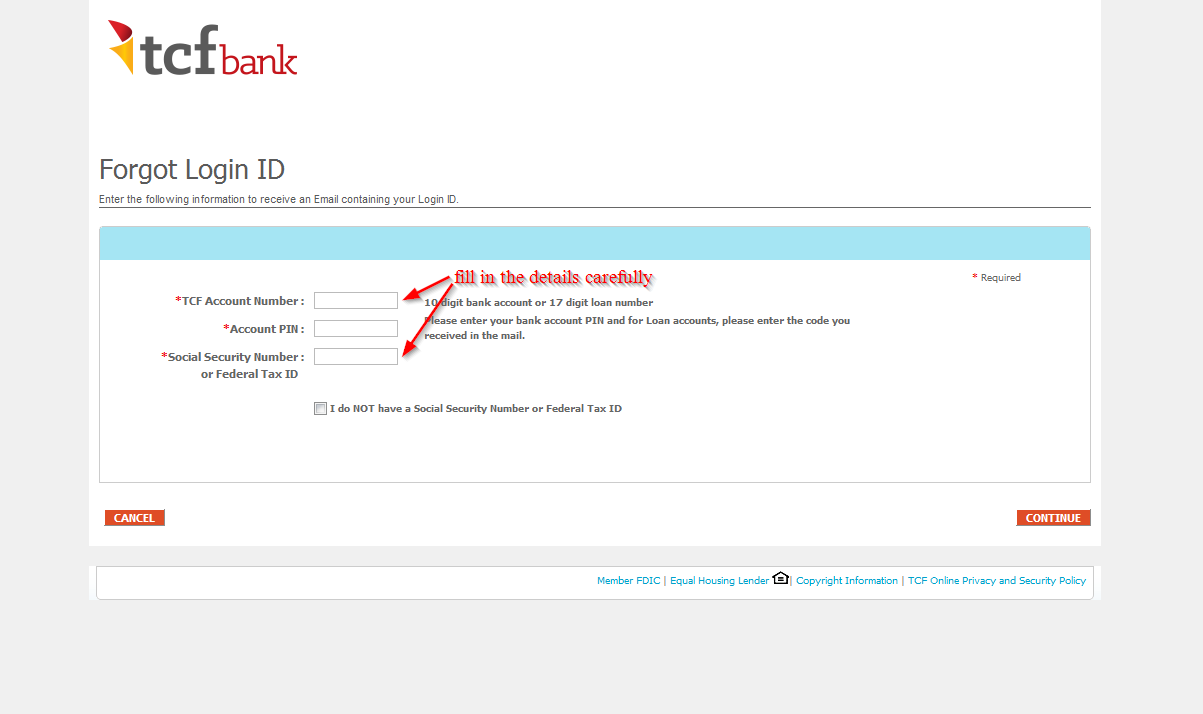

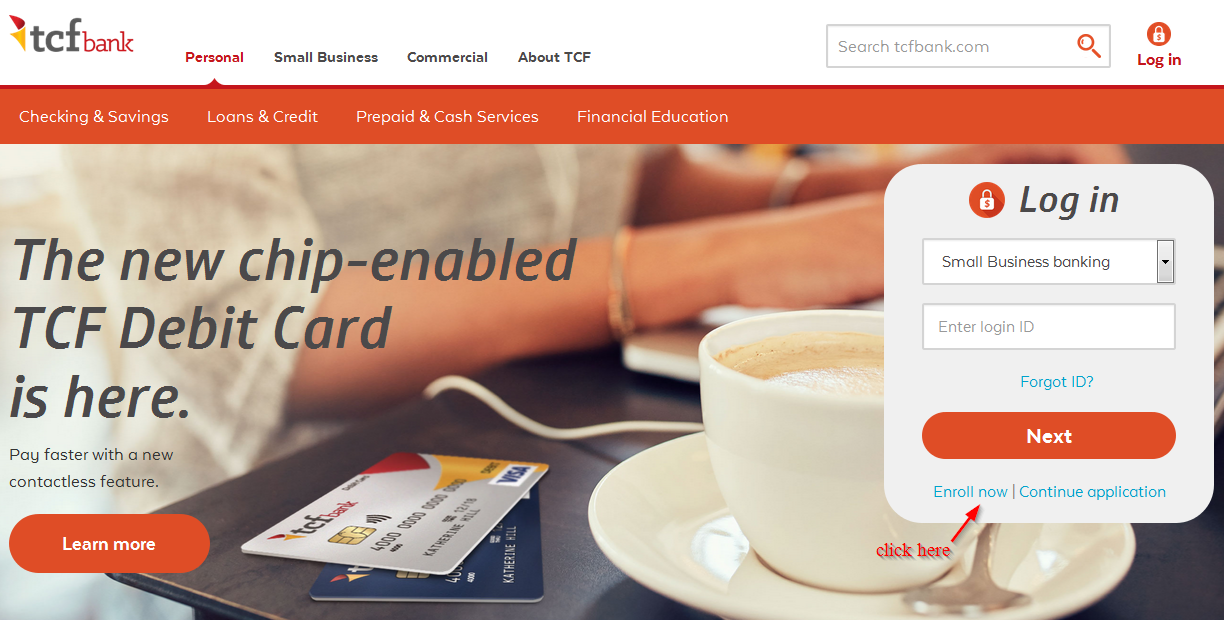

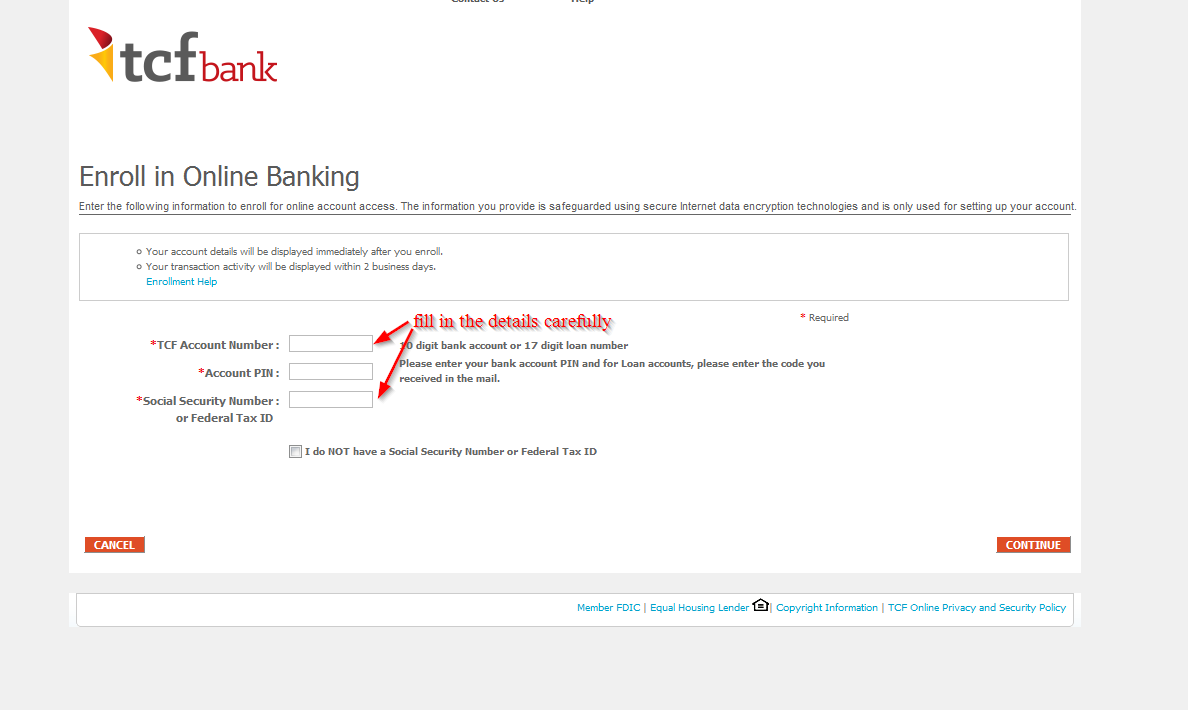

TCF Bank, one of the top banks in the US, offers internet banking services that have made it easy for their customers to comfortably manage their bank accounts from their computer or smartphone or any other. It’s also free to register for the online banking services and customers can login anytime provided they are connected to the internet. In this post we will be taking you through the necessary steps required to login into your online account, resetting your password and registering for the internet banking services.