Through its subsidies Arvest bank provides banking products and services. The bank was founded in 1976 and is based in Lowell, Arkansas.

- Branch / ATM Locator

- Website: https://www.arvest.com/

- Routing Number: 082900872

- Swift Code: See Details

- Telephone Number: +1 866-952-9523

- Mobile App: Android | iPhone

- Founded: 1976 (49 years ago)

- Bank's Rating:

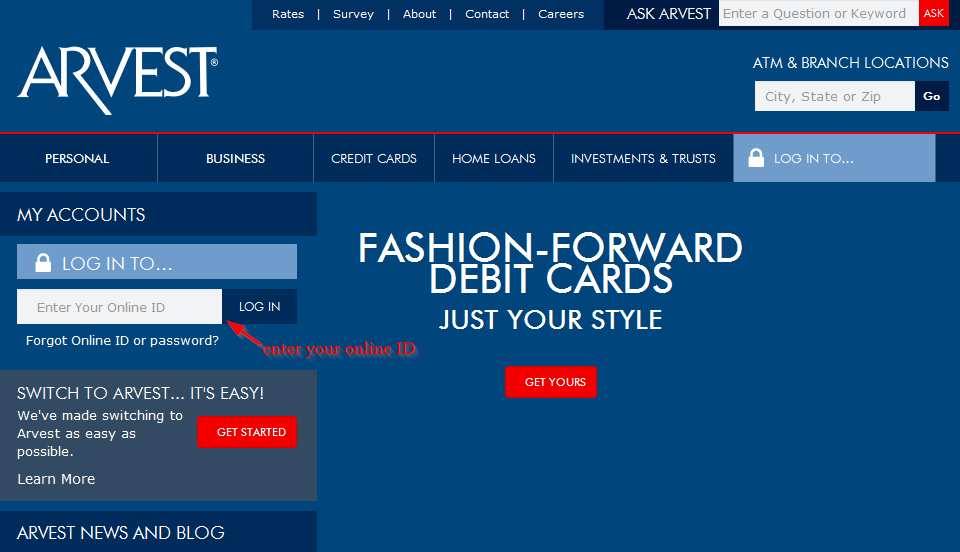

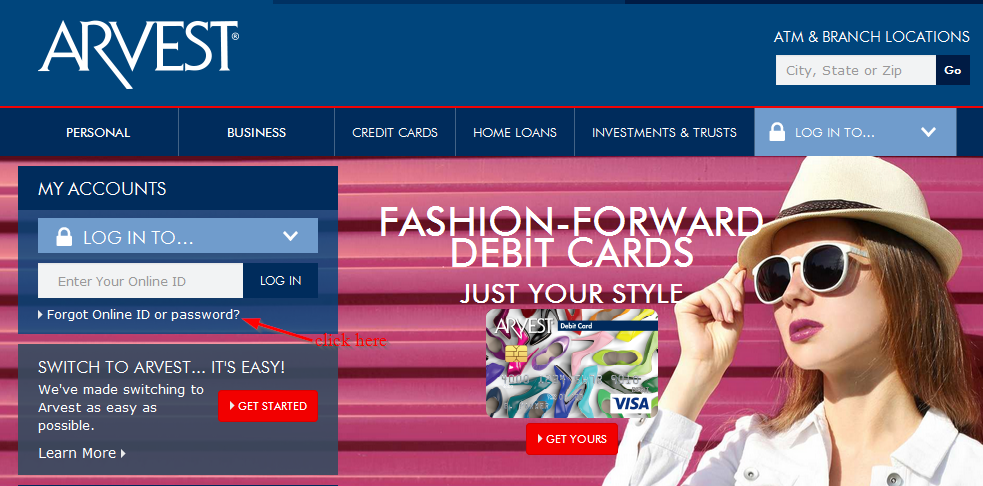

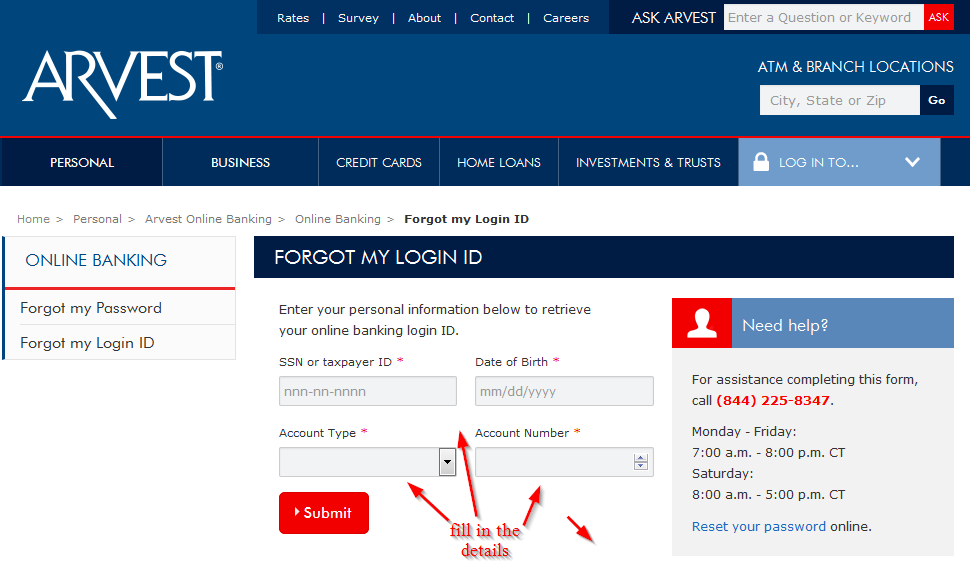

Arvest Bank offers internet banking services that make it easy for customers like you to manage their bank accounts. The bank has embraced technology and with its internet banking services, it has become convenient for customers to manage their bank accounts. And with smartphones, customers can also download apps and use them to login into their online accounts. Here is a guide on how Arvest Bank customers can login, reset their passwords and enroll for the online banking services.