MUFG Union Bank, N.A. offers retail, corporate and commercial banking services, as well as wealth management solutions in the United States. The company operates as a subsidiary of MUFG Americas Holdings Corporation.

- Branch / ATM Locator

- Website: https://www.unionbank.com/

- Routing Number: 122000496

- Swift Code: See Details

- Telephone Number: +1 800-238-4486

- Mobile App: Android | iPhone

- Founded: 1996 (29 years ago)

- Bank's Rating:

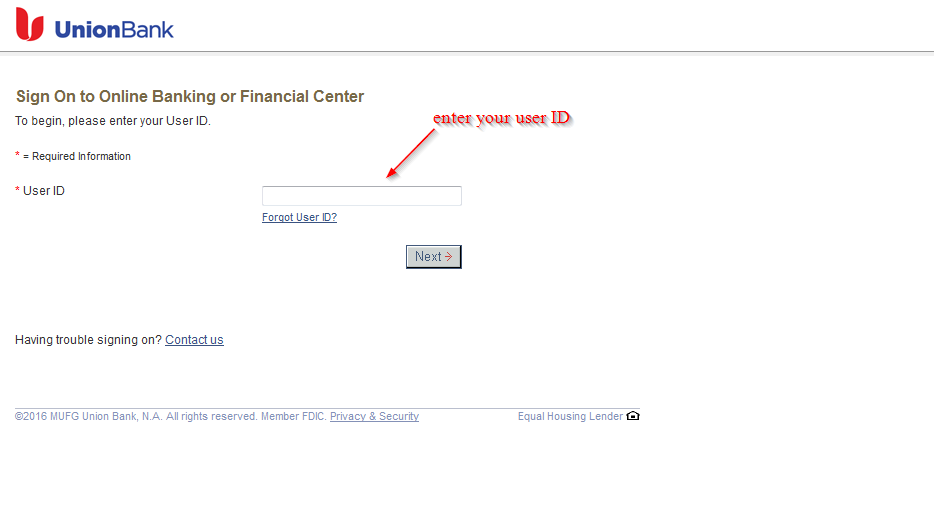

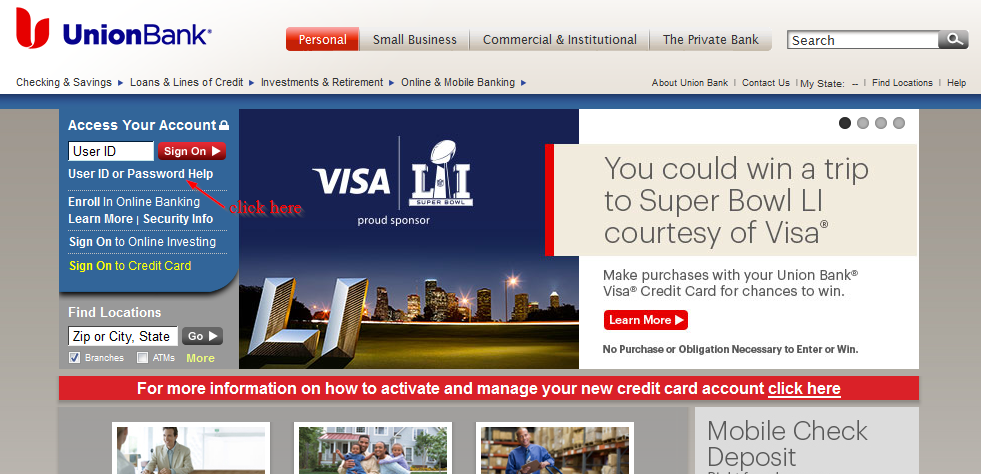

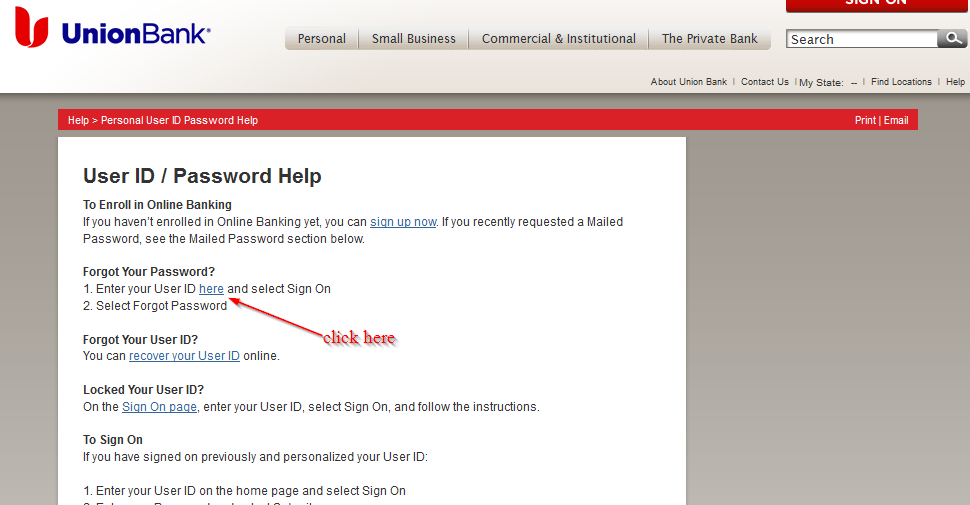

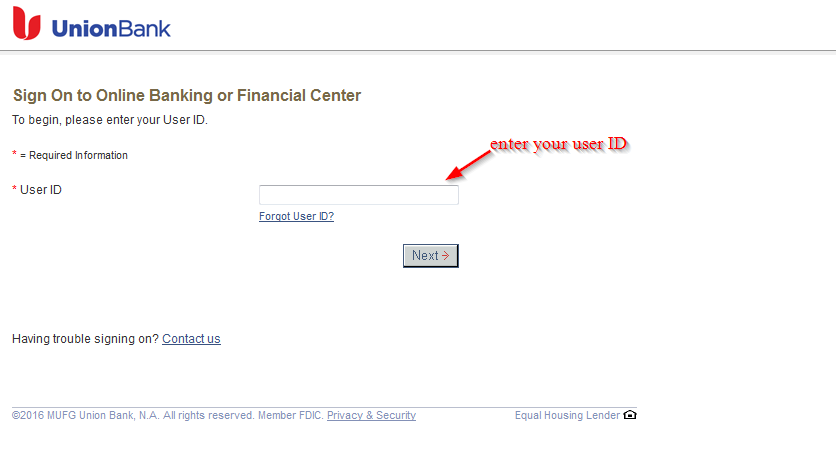

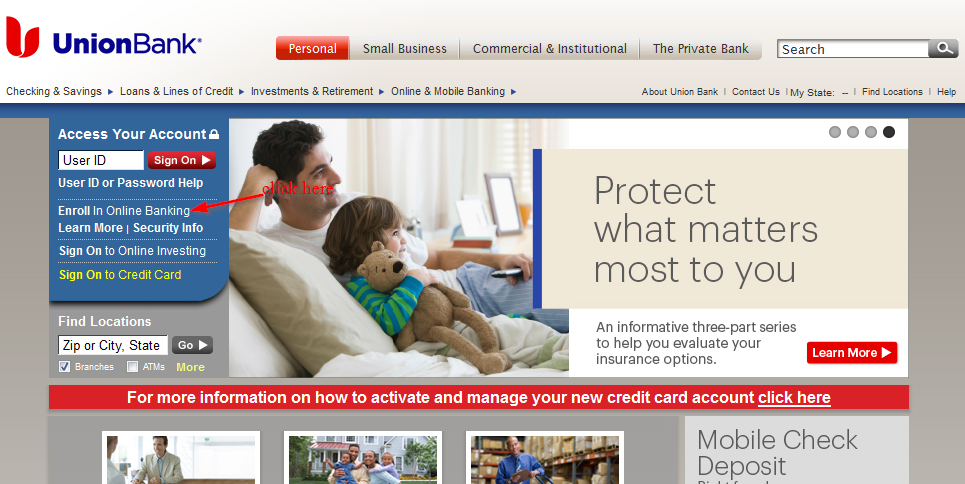

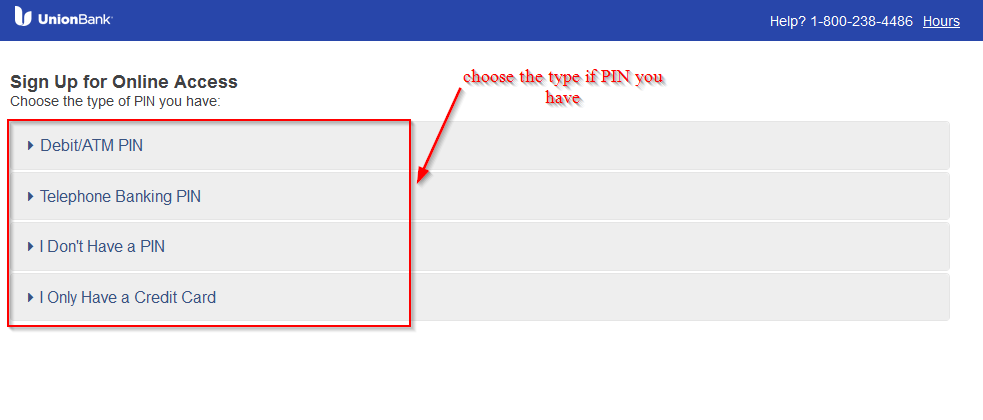

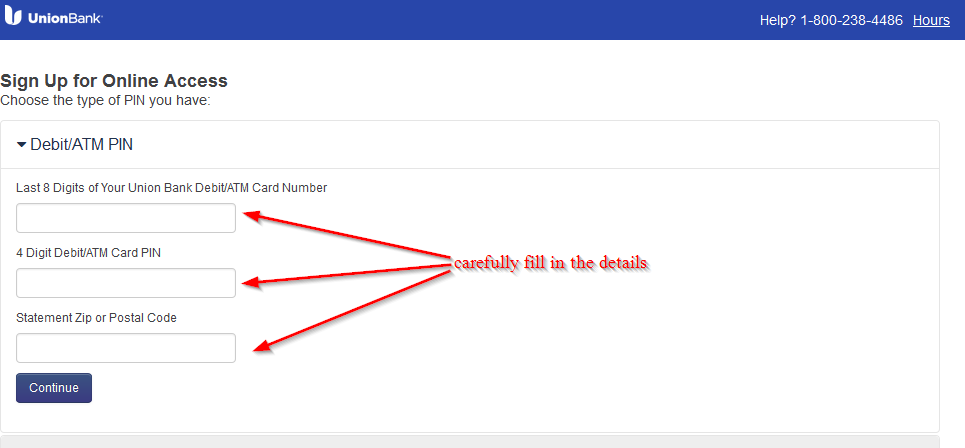

Union Bank offers online banking services, which includes the latest technologies and securities, to enable customers to access their bank accounts anywhere anytime. It’s free to enroll to the internet banking services offered by the bank and customers can access their online accounts from anywhere around the globe. This guide will illustrate the steps you need to take to login into your account, reset your password and register for the internet banking services.