Regions bank is one of the nation’s best full-service providers of commercial and consumer banking, mortgage, insurance services and products. The bank was founded in 1971.

- Branch / ATM Locator

- Website: https://www.regions.com/

- Routing Number: 082000109

- Swift Code: See Details

- Telephone Number: +1 800-734-4667

- Mobile App: Android | iPhone

- Founded: 1971 (54 years ago)

- Bank's Rating:

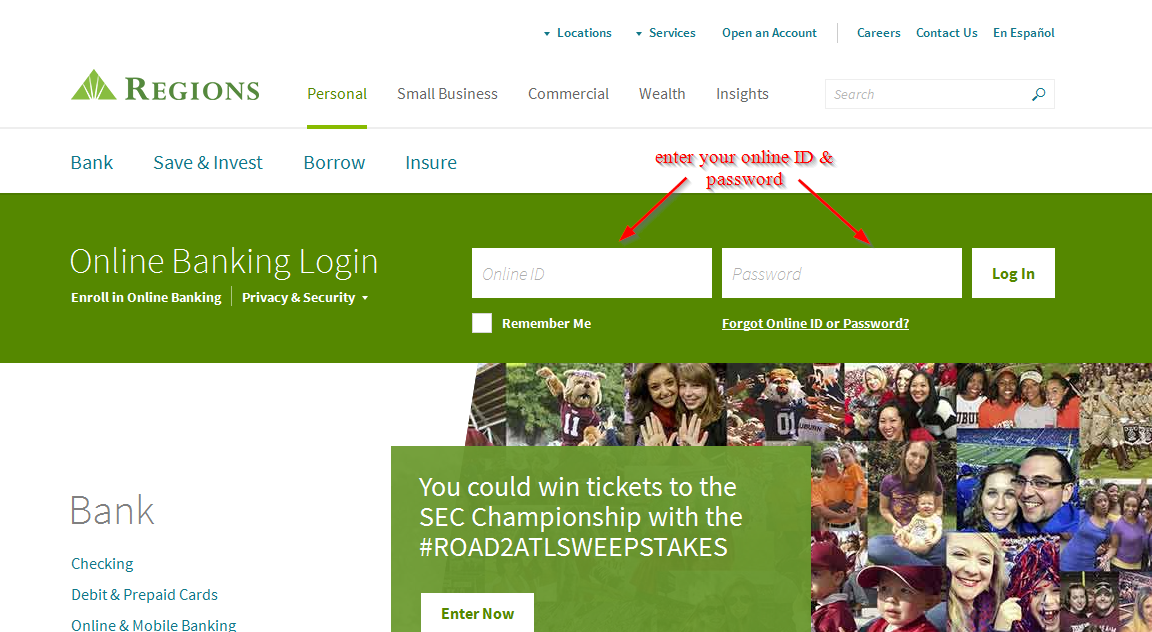

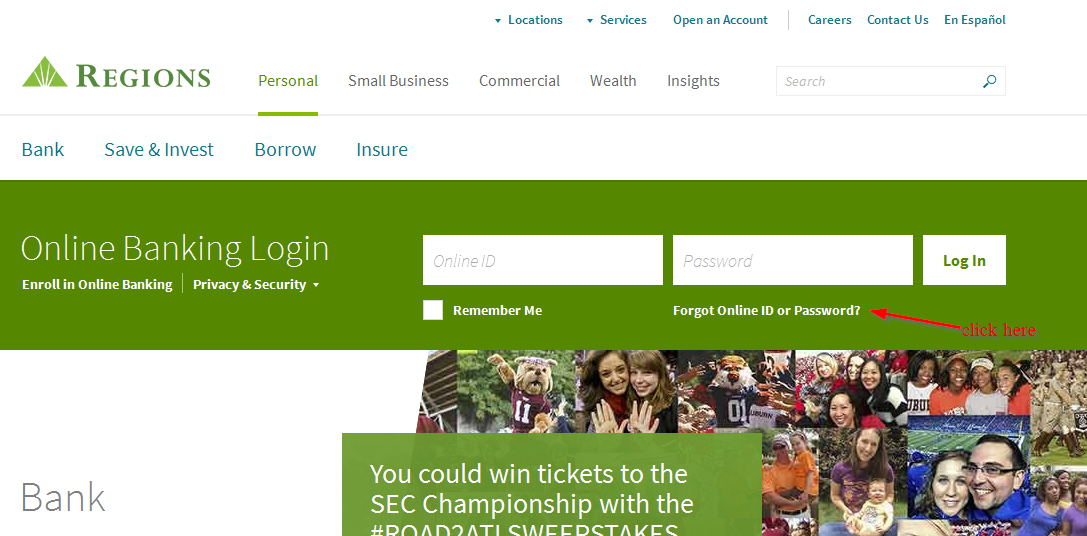

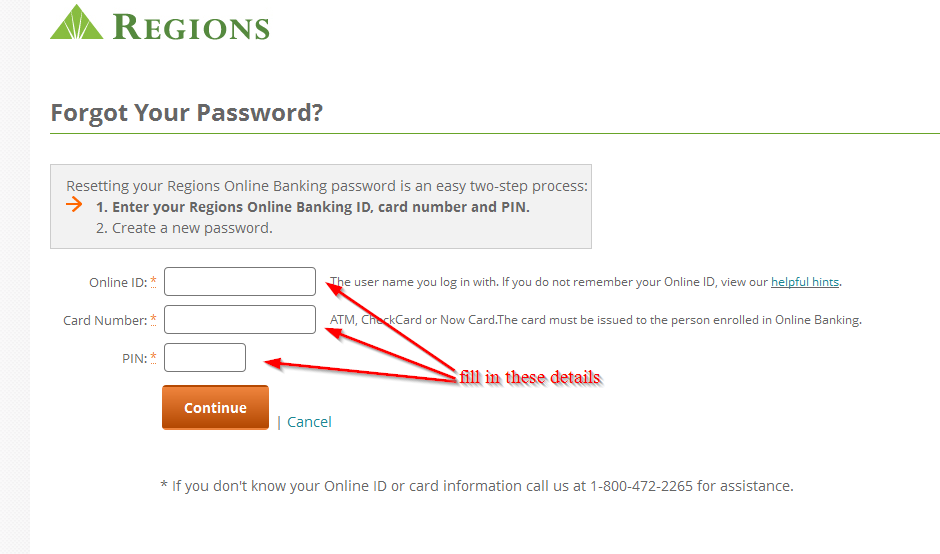

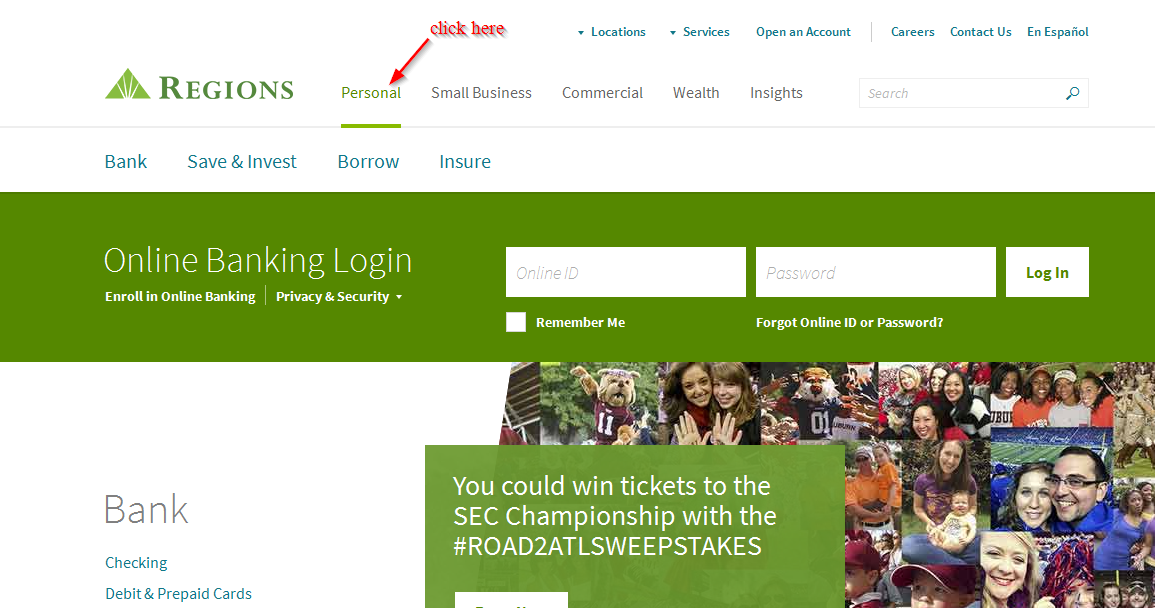

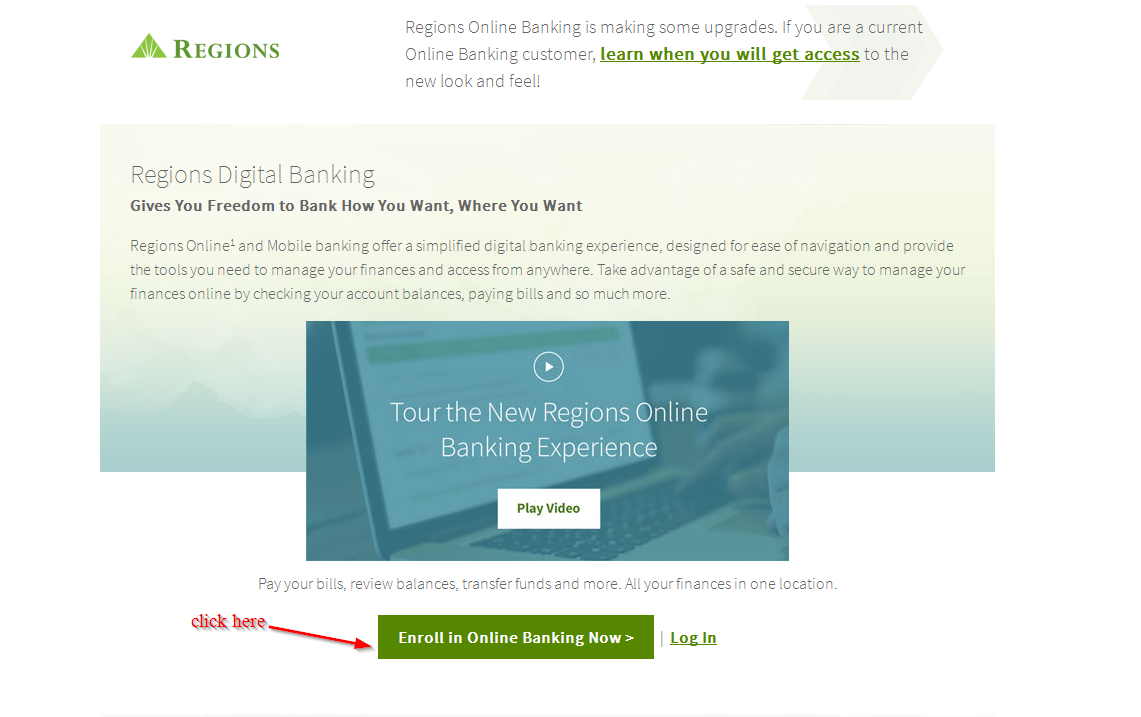

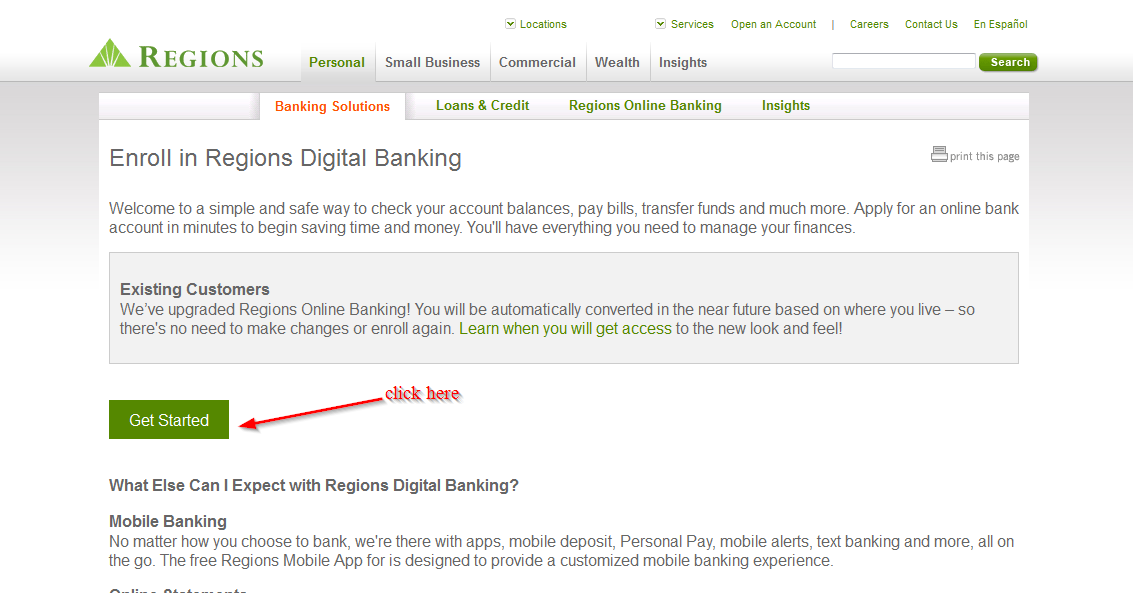

Regions Bank has embraced technology by offering internet banking services that allows customers to comfortably and conveniently access their bank accounts anytime. These services are available for customers who have personal and business banking accounts. The advantage is that access your online account is easy and it’s free to create an account. In this guide, will take you a step by step process on how you can login, reset your password and register.