Citi Bank offers consumer and commercial banking services and products. Founded in 1812 and based in South Dakota, the bank operates as a subsidiary of Citicorp.

- Branch / ATM Locator

- Website: https://www.citi.com

- Routing Number: 021000089

- Swift Code: See Details

- Telephone Number: 1-888-248-4226

- Mobile App: Android | iPhone

- Founded: 1812 (213 years ago)

- Bank's Rating:

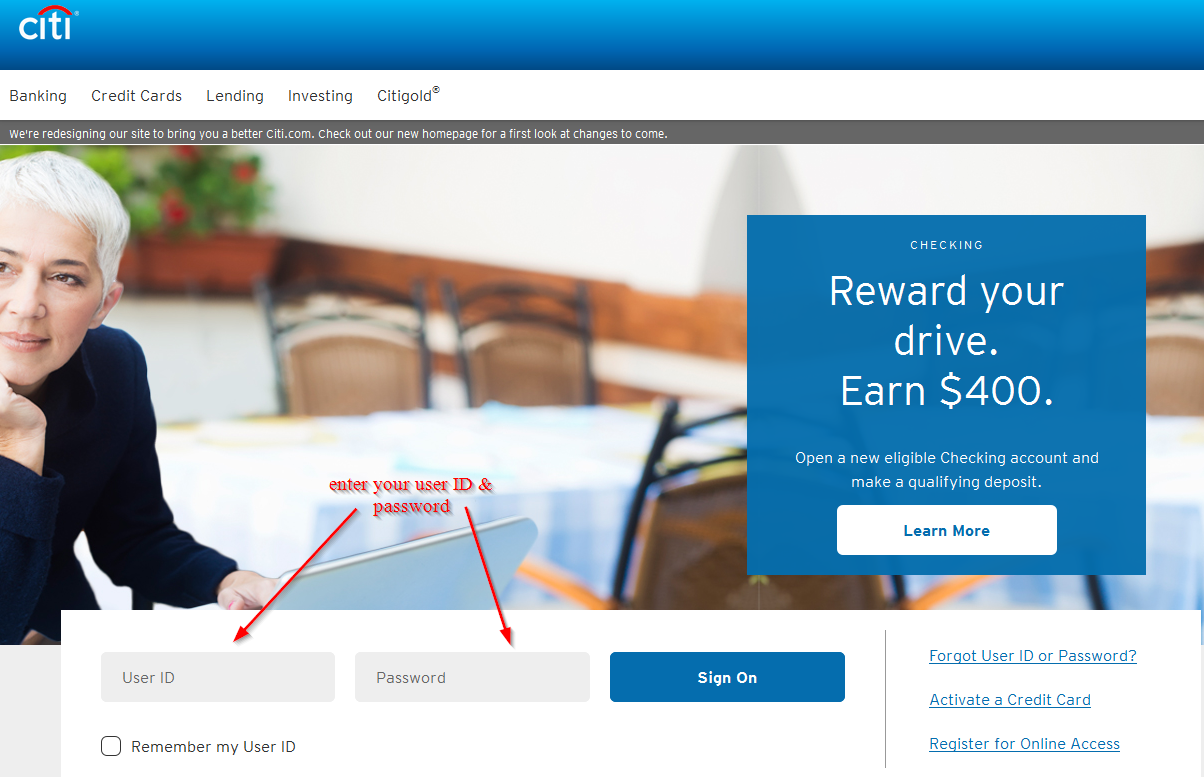

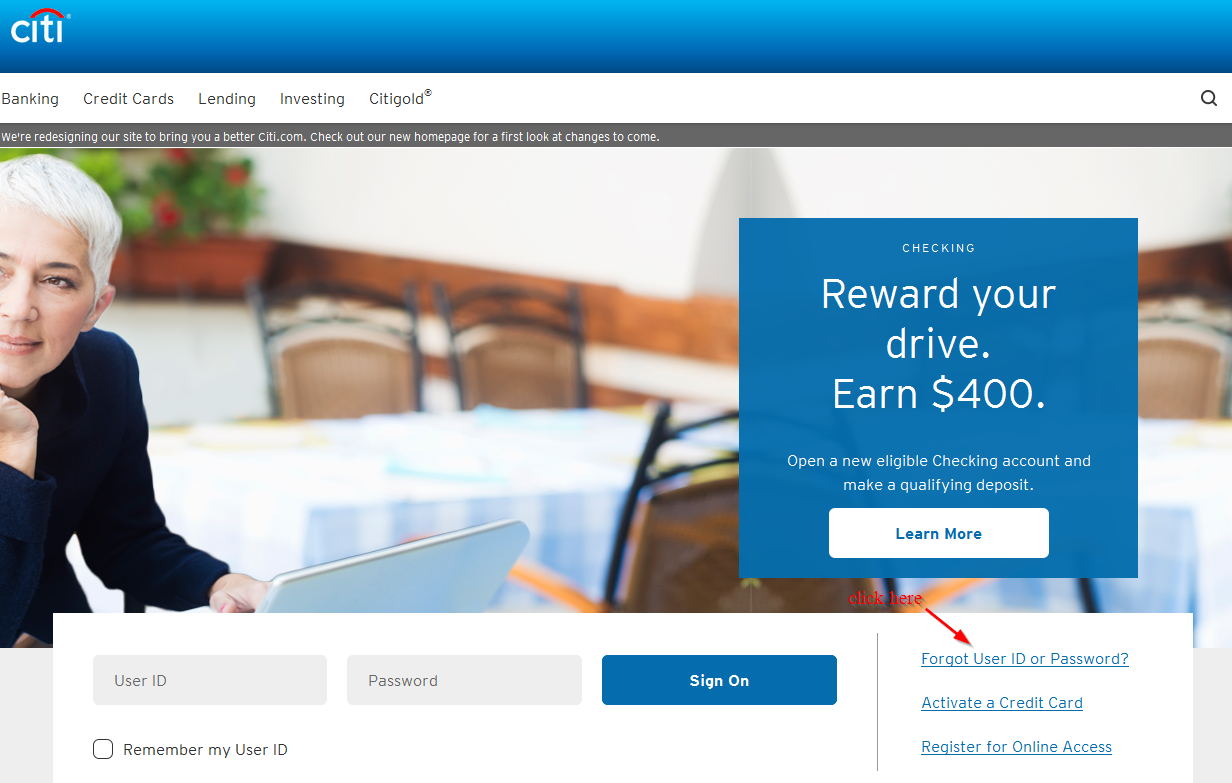

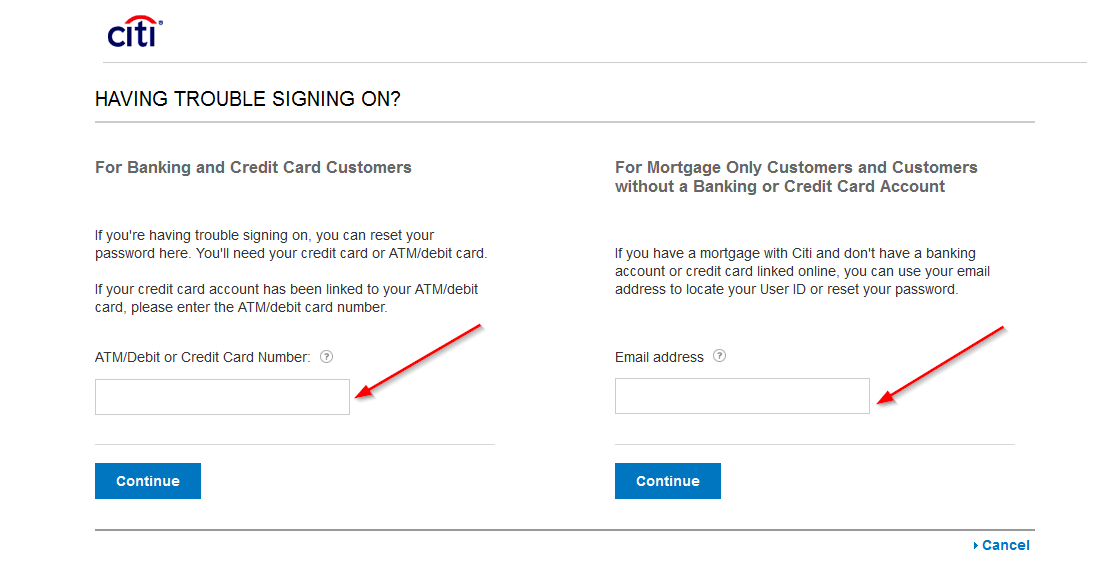

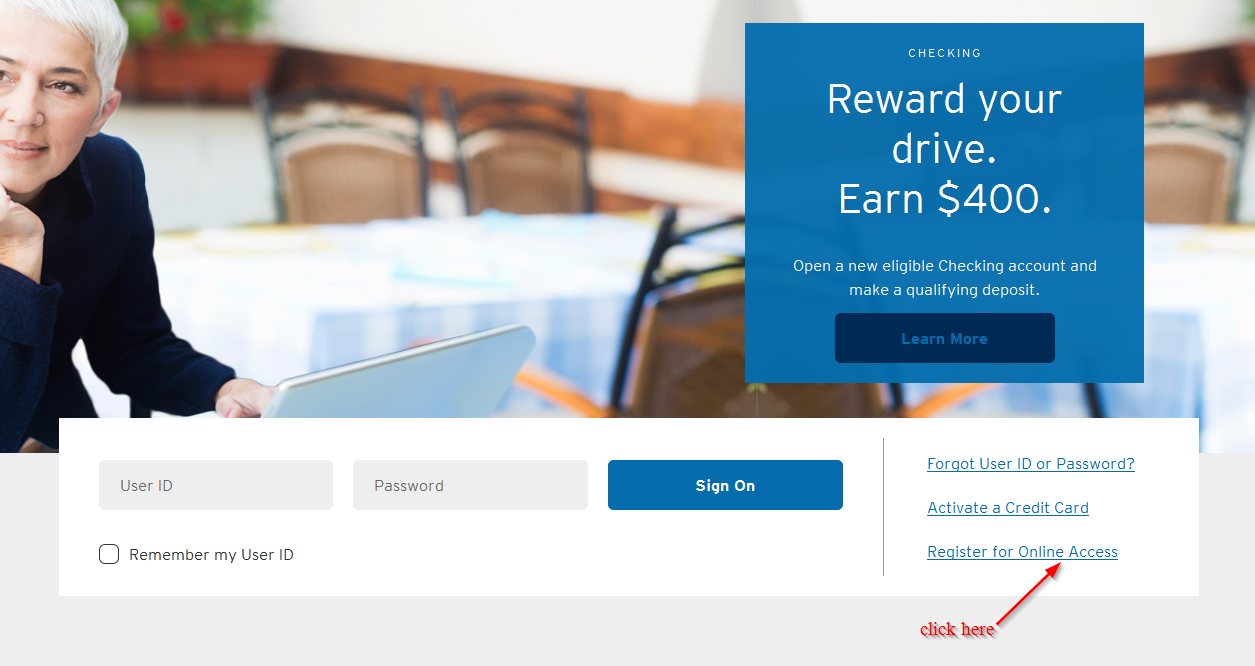

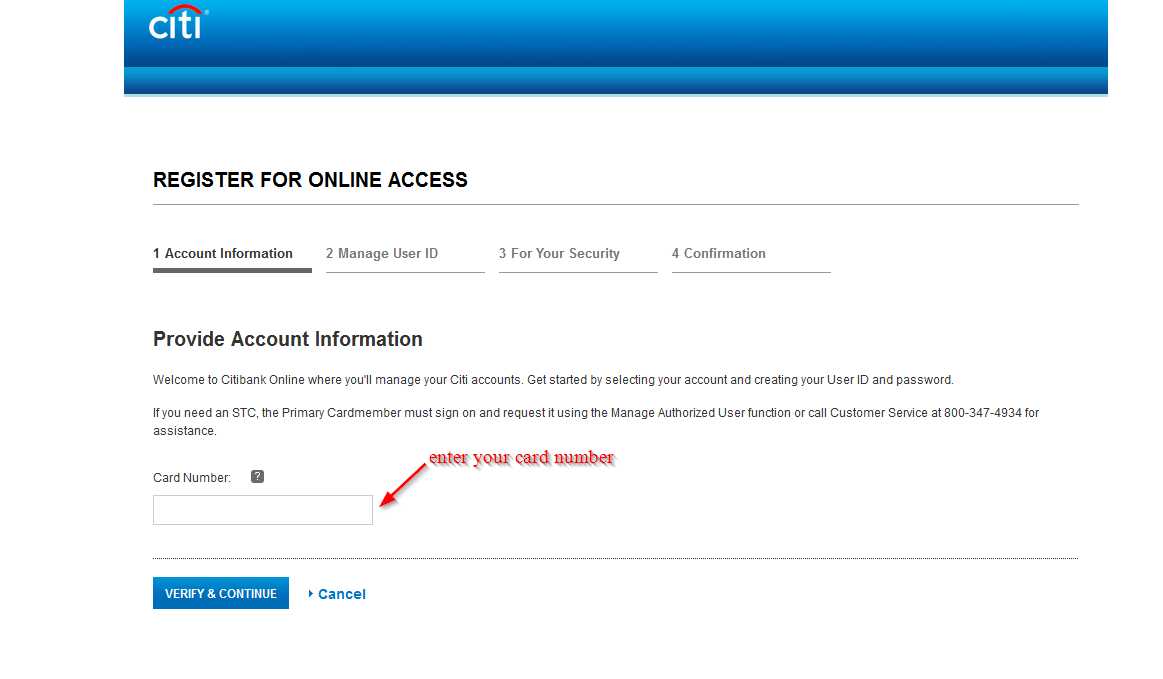

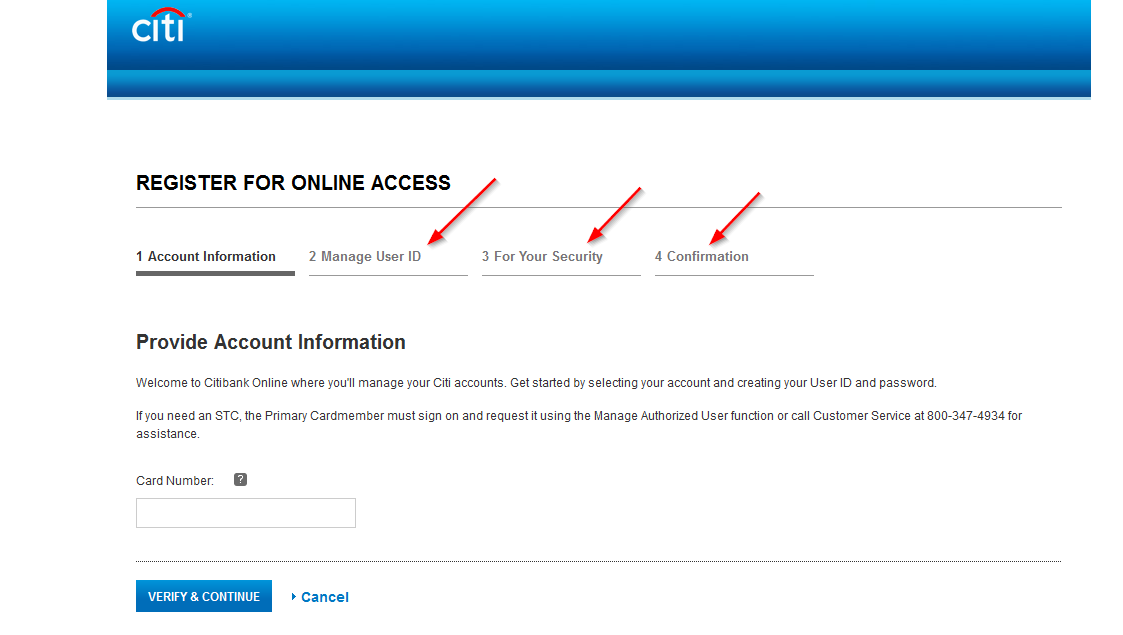

Citi Bank has made it easy for customers to access their bank accounts with its internet banking services. Its 100% free to register for the internet banking services and all you need is a few details about your bank account, a computer and internet connection to get started. In this guide, we will walk you through the process of access your online account, resetting your password and registering for the online banking services.