First Financial Bank operates as a community bank that offers personal and business banking services. The bank was founded in 1834 and it operates as a subsidiary 0f First Financial Banc Corporation.

- Branch / ATM Locator

- Website: https://www.bankatfirst.com/

- Routing Number: 111301122

- Swift Code: See Details

- Telephone Number: 800-511-0045

- Mobile App: Android | iPhone

- Founded: 1834 (191 years ago)

- Bank's Rating:

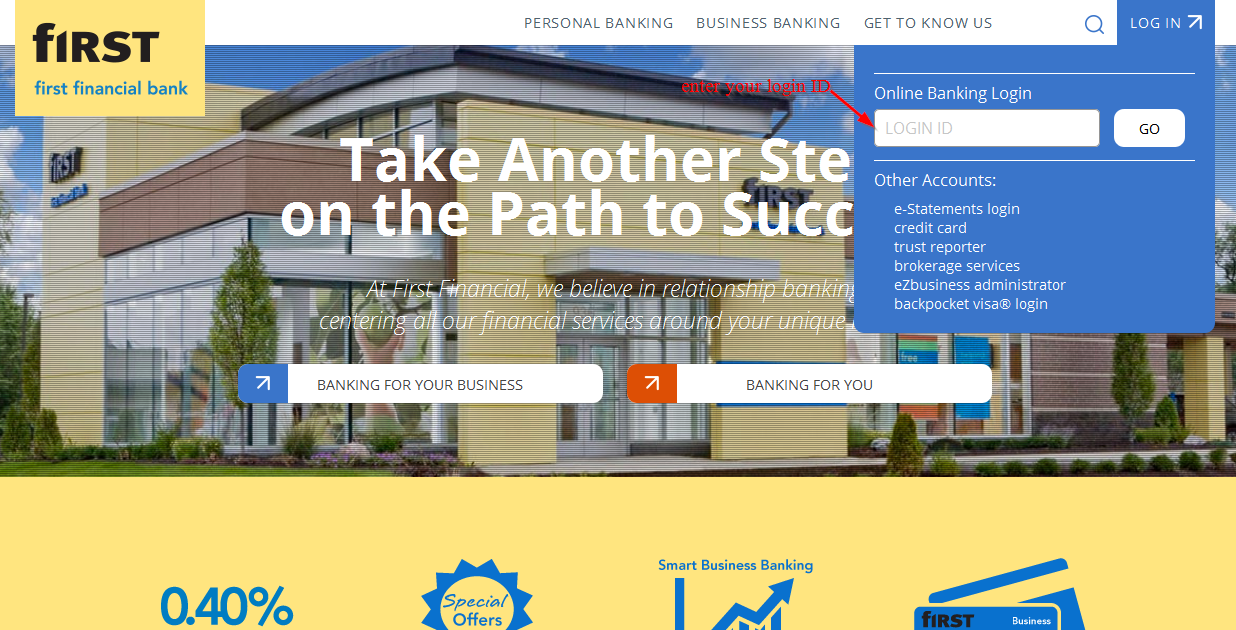

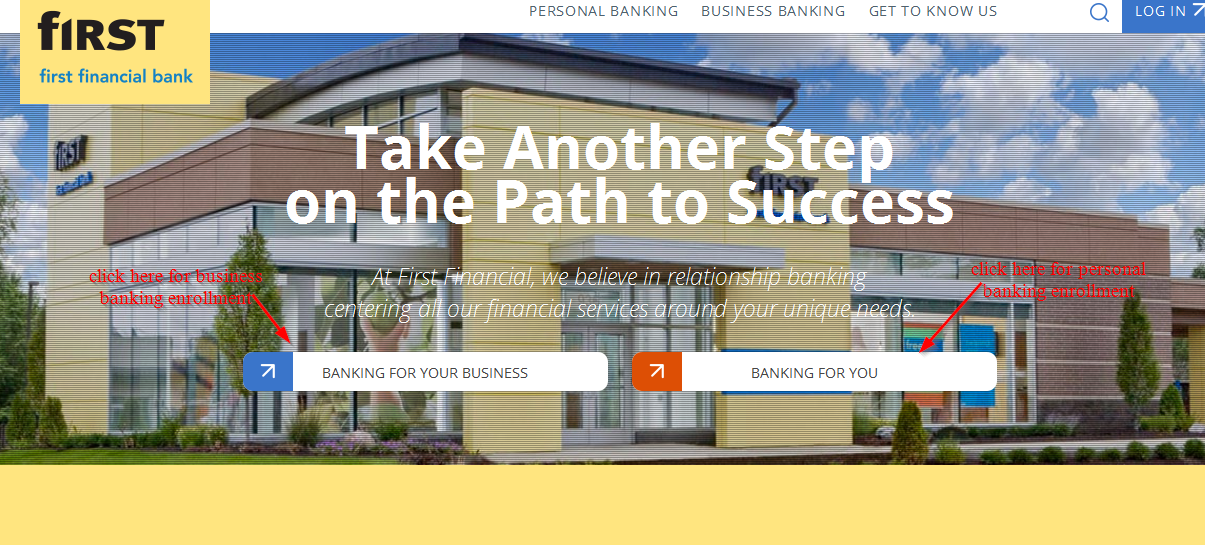

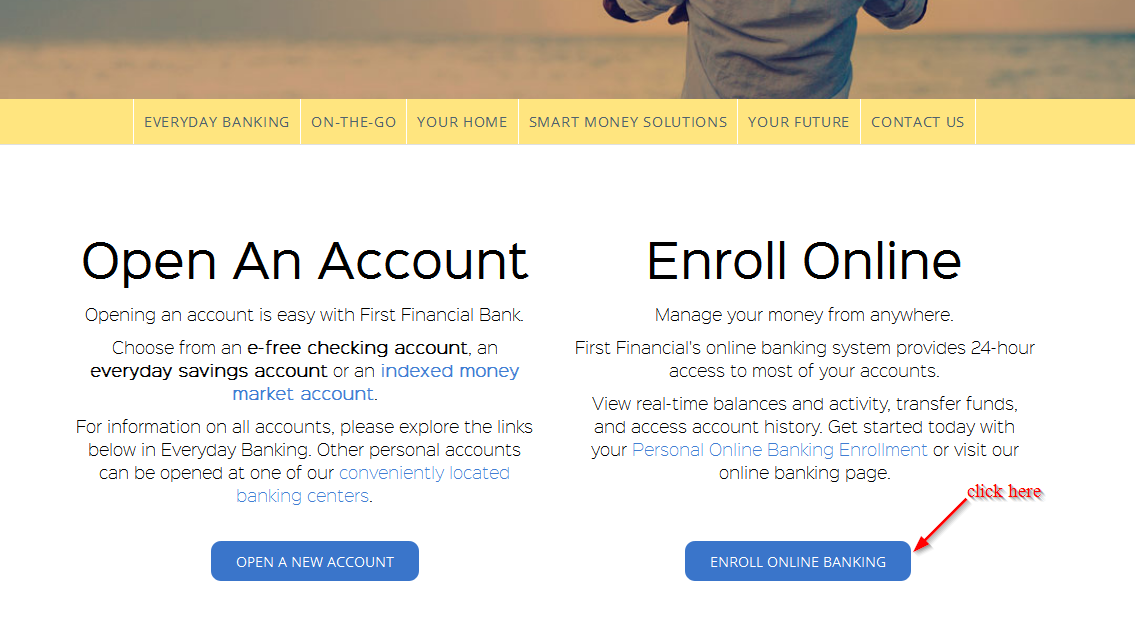

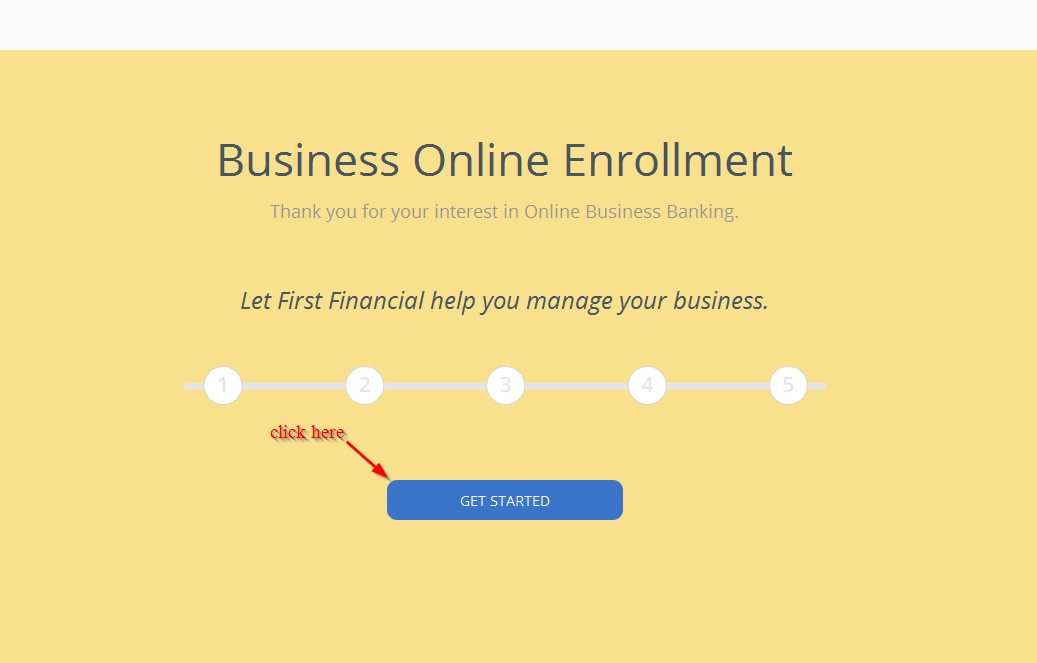

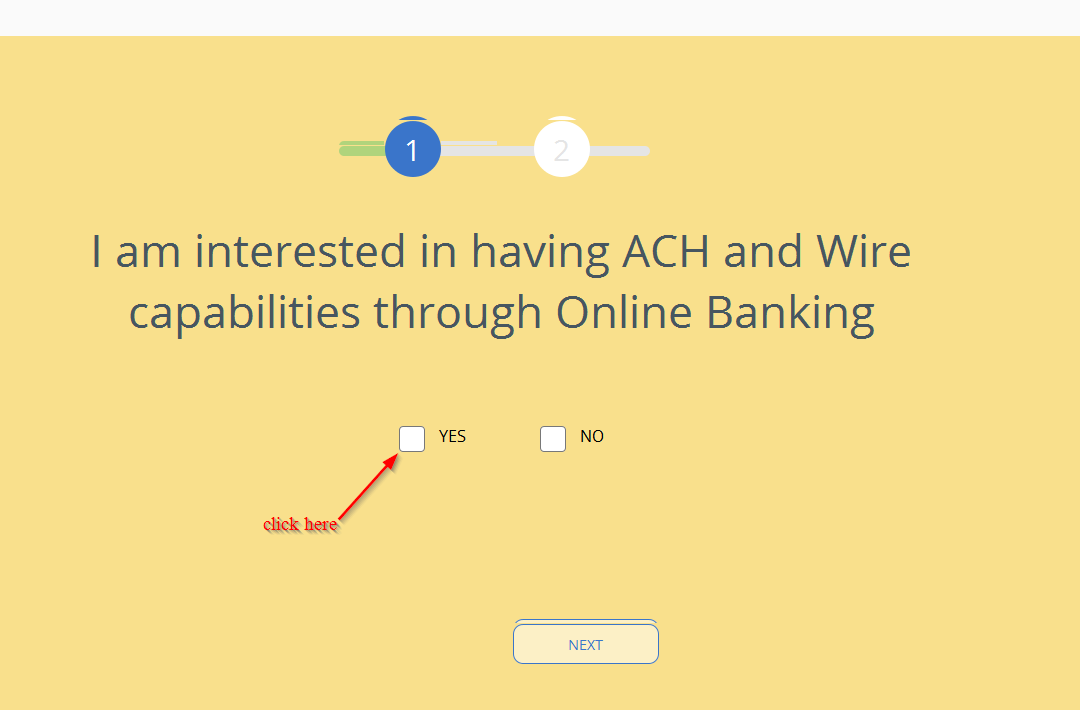

With First Financial Bank internet banking services, you don’t have to queue at the bank or an ATM to pay your bills or check your account balance. The online banking services offered by the bank are completely free and customers can login anytime to manage their bank accounts. Follow this guide to learn how to login into your online account, reset your password and register for the internet banking services.