Commerce Bank offers personal and business banking services. Headquarters in Texas and founded in 1865, the bank operates as a subsidiary of IBC Subsidiary Corporation.

- Branch / ATM Locator

- Website: https://www.commercebank.com/

- Routing Number: 101000019

- Swift Code: See Details

- Telephone Number: +1 800-453-2265

- Mobile App: Android | iPhone

- Founded: 1865 (160 years ago)

- Bank's Rating:

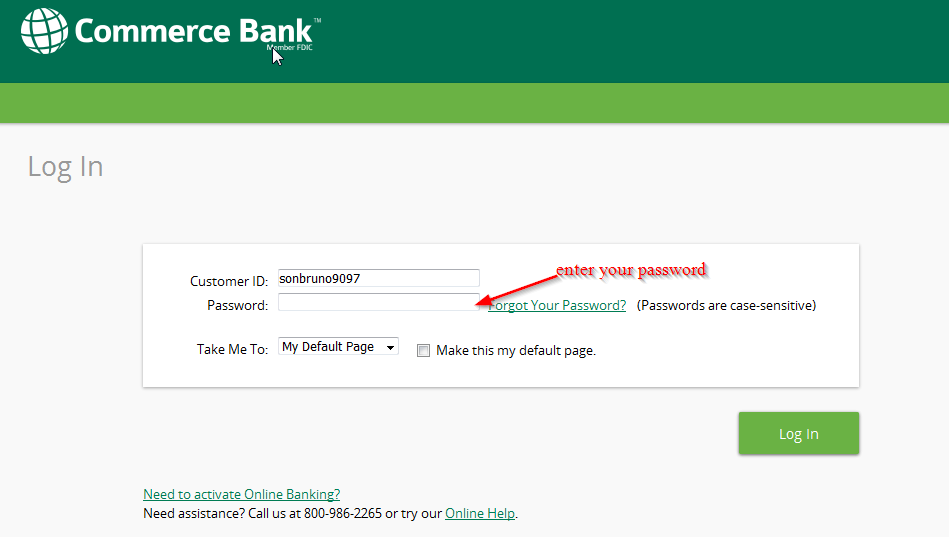

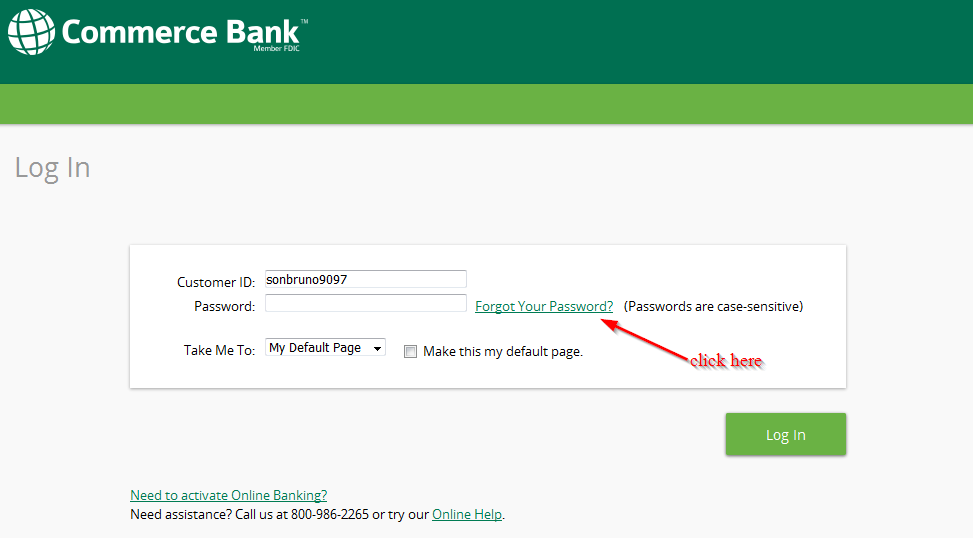

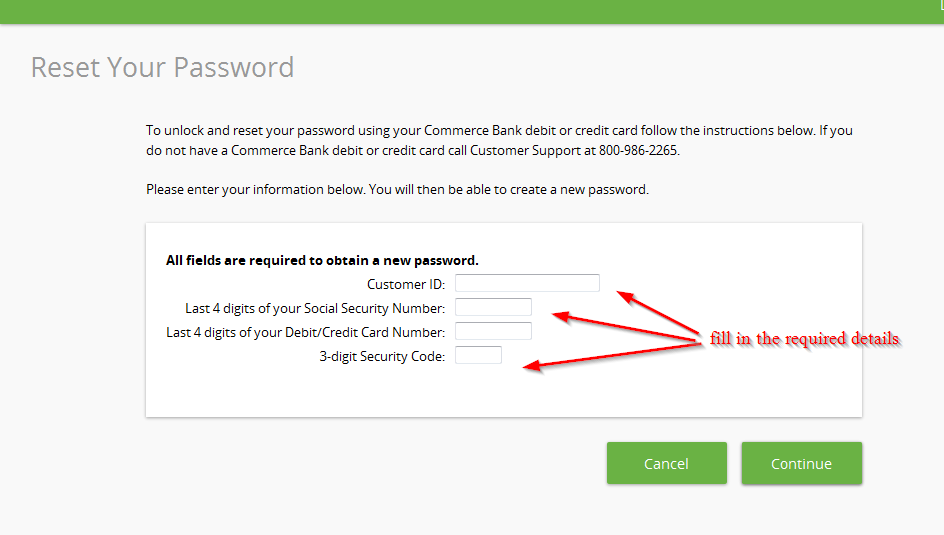

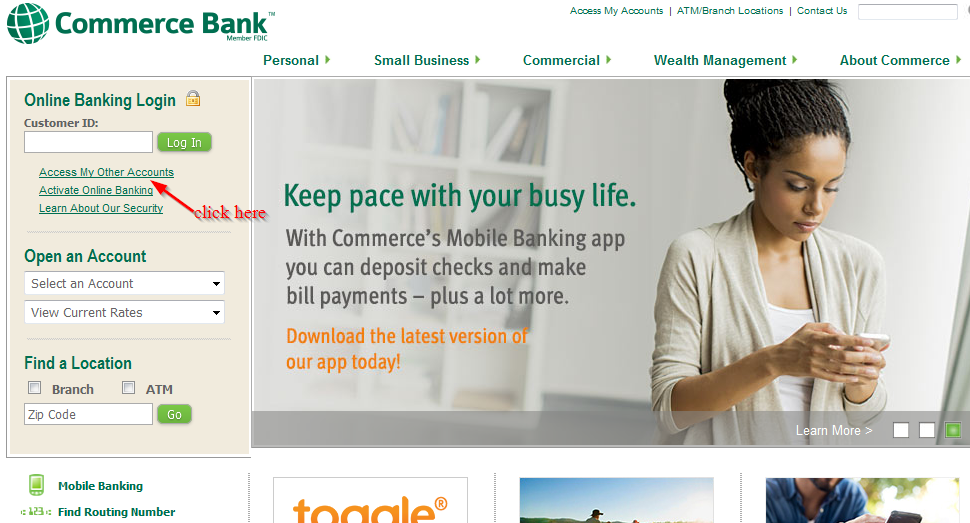

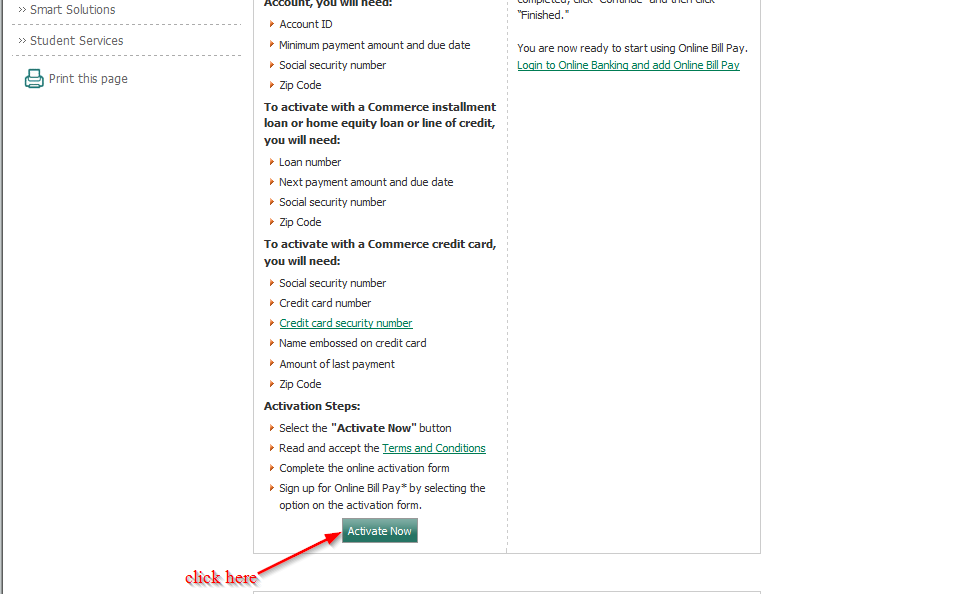

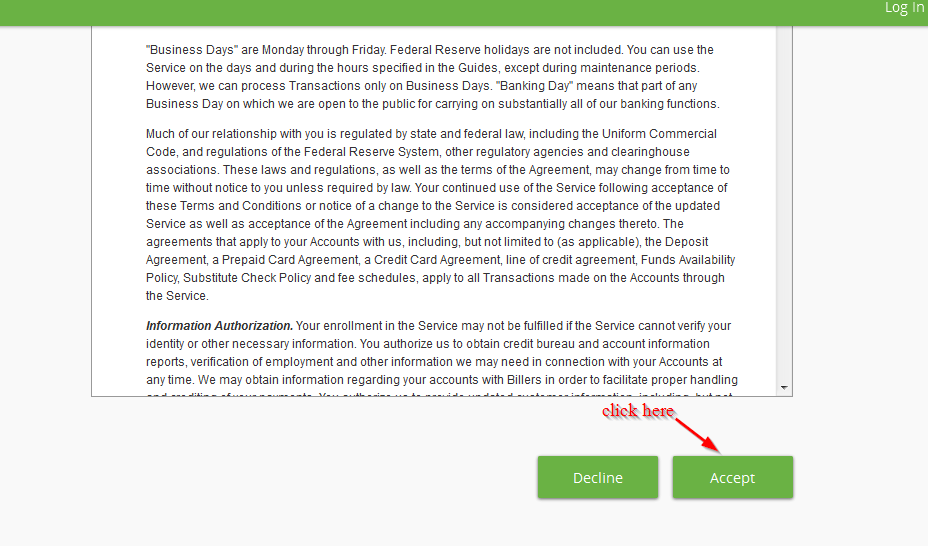

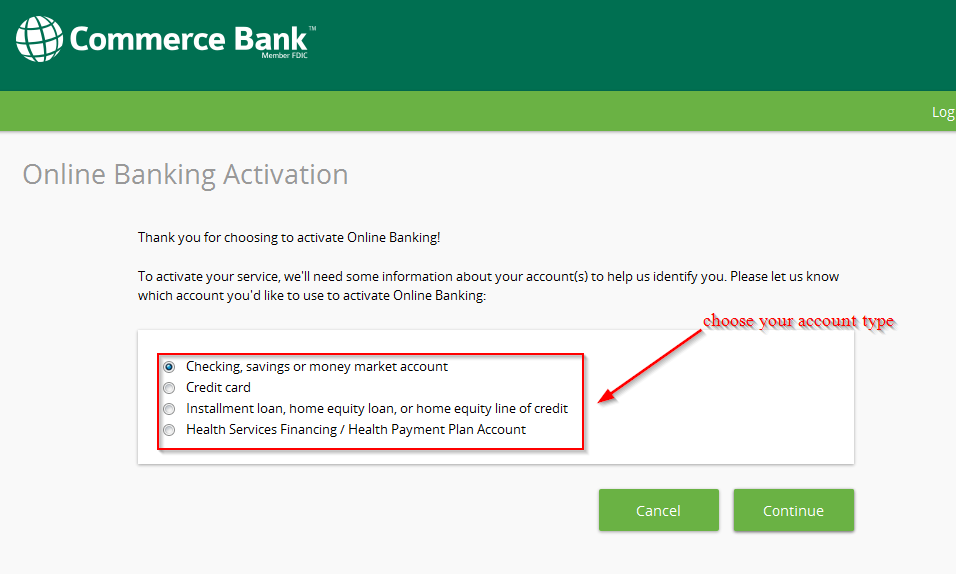

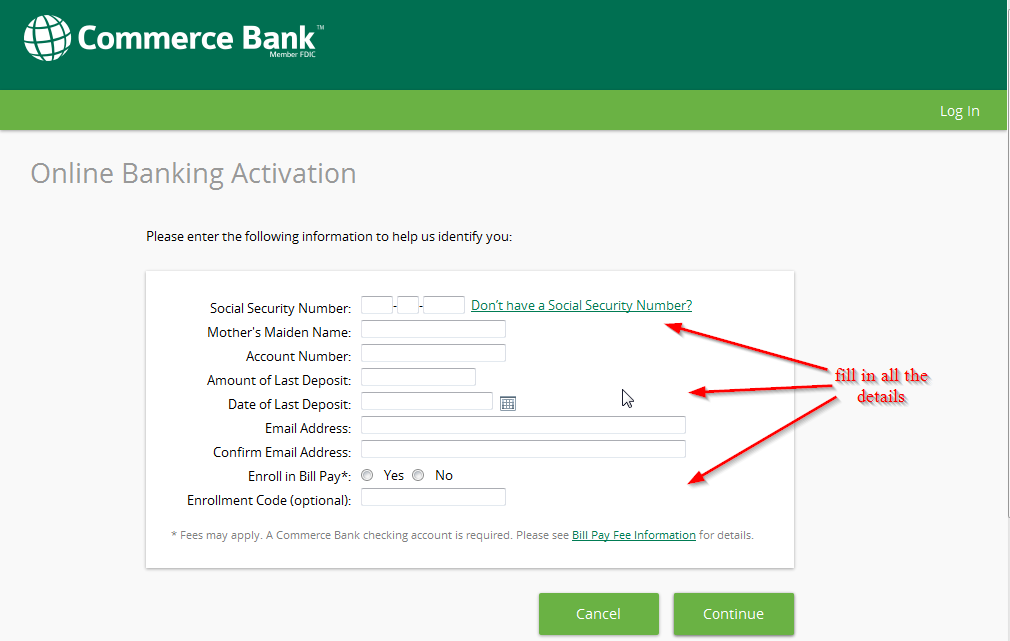

Commerce Bank is among many banks that are offering internet banking services to enable customers to gain access to their bank accounts via the internet. To access these services, all you need to do is visit the bank’s website and enroll. If you are interested, follow this guide to learn how you can login, reset your password and enroll.