Suntrust Bank offers banking solutions to small businesses. The company is based in Atlanta, Georgia and operates as a subsidiary of Sun Trust Bank Holding Company.

- Branch / ATM Locator

- Website: https://www.suntrust.com/

- Routing Number: 061000104

- Swift Code: See Details

- Telephone Number: +1 800-786-8787

- Mobile App: Android | iPhone

- Founded: 1956 (68 years ago)

- Bank's Rating:

SunTrust Bank offers internet banking services which enable customers to manage their bank accounts from anywhere provided they are connected to the internet. Customers can login into their accounts anytime using their computers or mobile phones. If you need clarifications on how to login into your online account, reset your password and enroll for the internet banking service, this guide will help you.

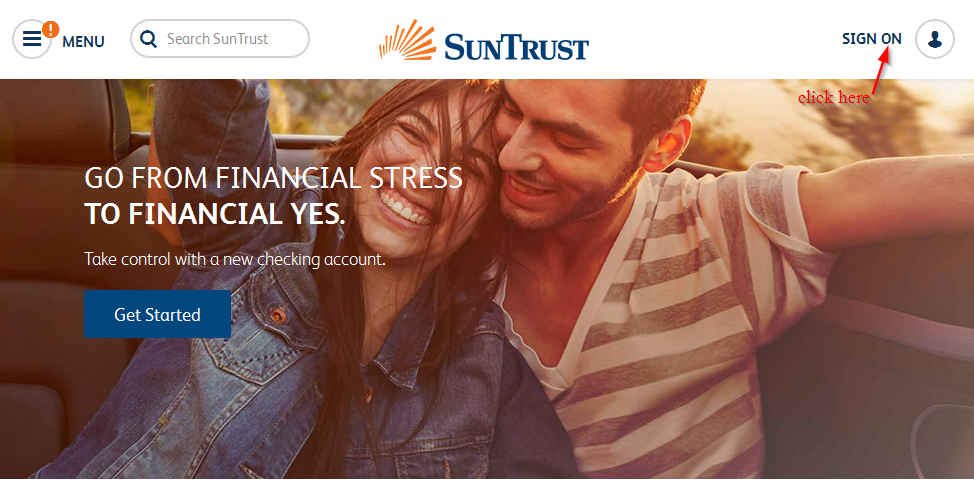

How to login

SunTrust Bank has an easy to use platform that enables customers to conveniently login into their online accounts. Just like other online accounts, you will need your login details. Following these simple steps to login into your SunTrust Bank online account:

Step 1-Open https://www.suntrust.com/ in your web browser

Step 2-Click “sign on”

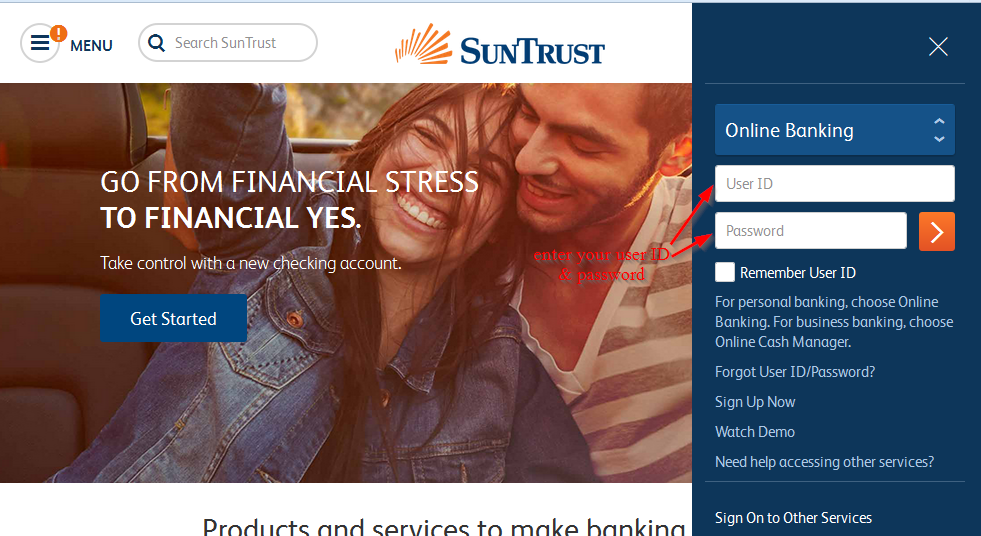

Step 3-Enter your user ID and password

If the username and password are correct, you will be directed to your account

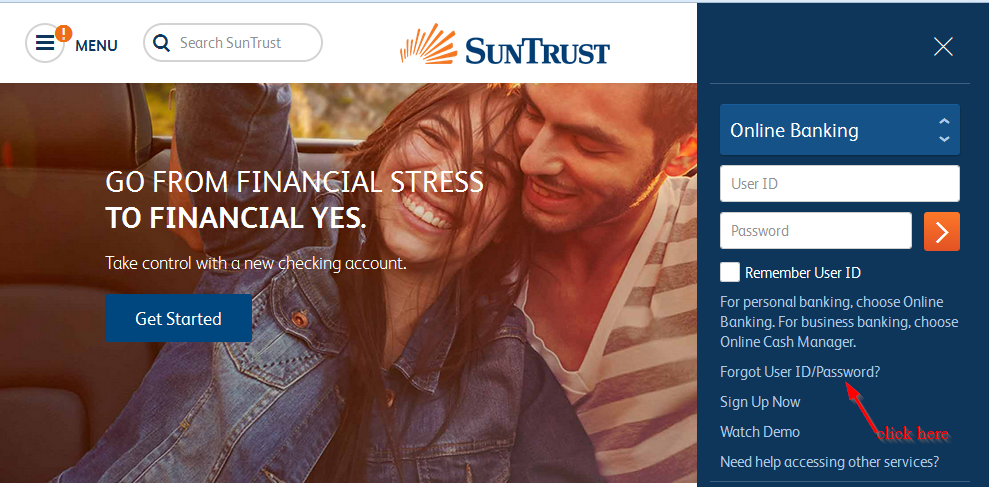

How to reset your password

If you can’t access your online account because you have forgotten your password, you can reset it to regain access. You will need your user ID to reset the password. Follow these steps to reset your password:

Step 1-Click “forgot user ID/password?”

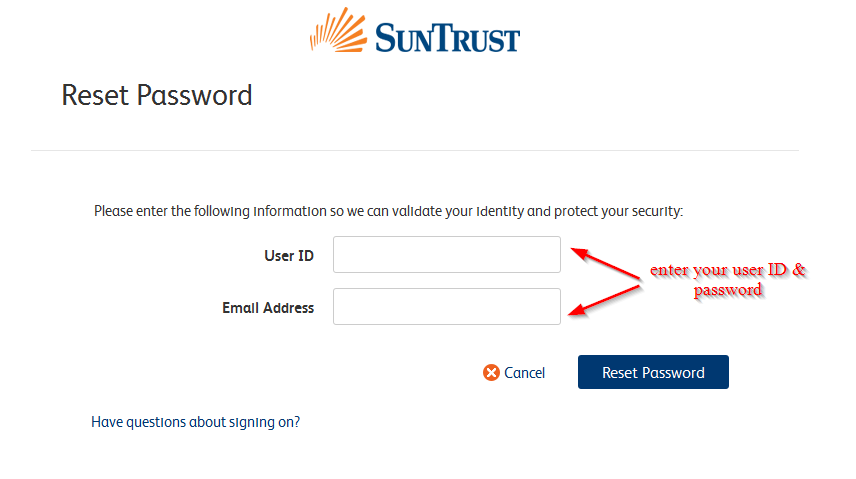

Step 2-Choose whether you want to reset your password, user ID or user ID and password

Step 3-Enter your user ID and password and click “reset password”

How to enroll

If you have an account with SunTrust Bank, you can create an online account with the bank. The good news is that it’s free to register. You will be required to provide some details about your bank account. Here are the steps you need to follow to enroll:

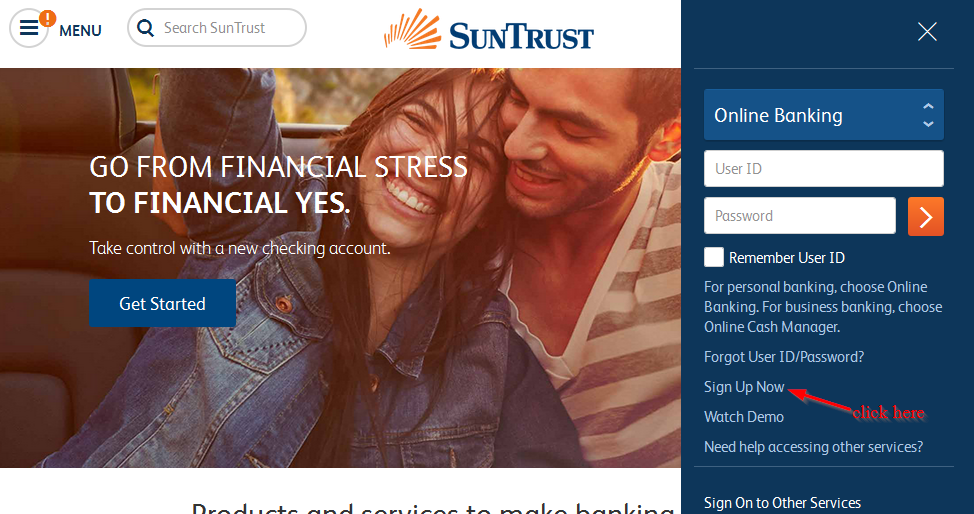

Step 1-Click “sign on”

Step 2– Then click “sign up now”

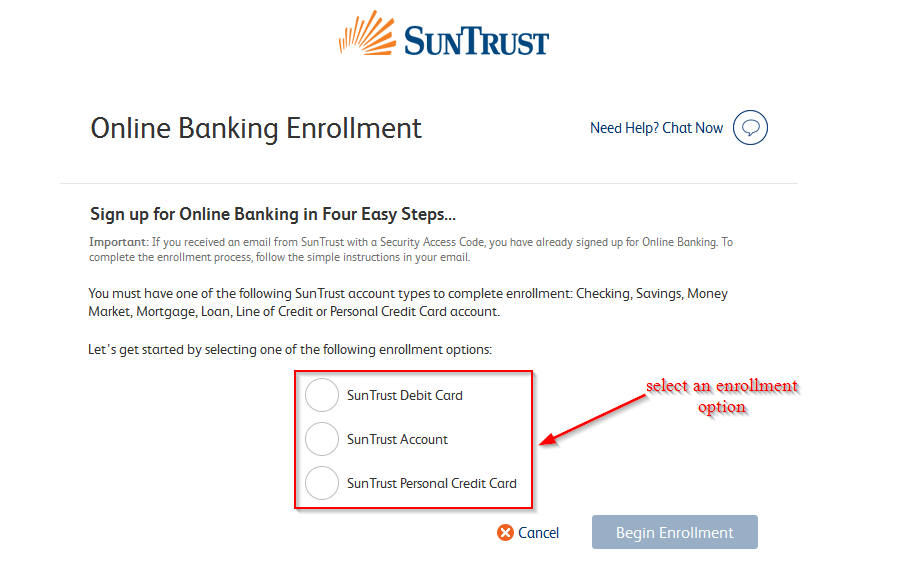

Step 3-Sect an enrollment option among those provided in the page (SunTrust Debit Card, SunTrust Account or SunTrust Personal Credit Card). In this case, we will choose SunTrust Debit Card.

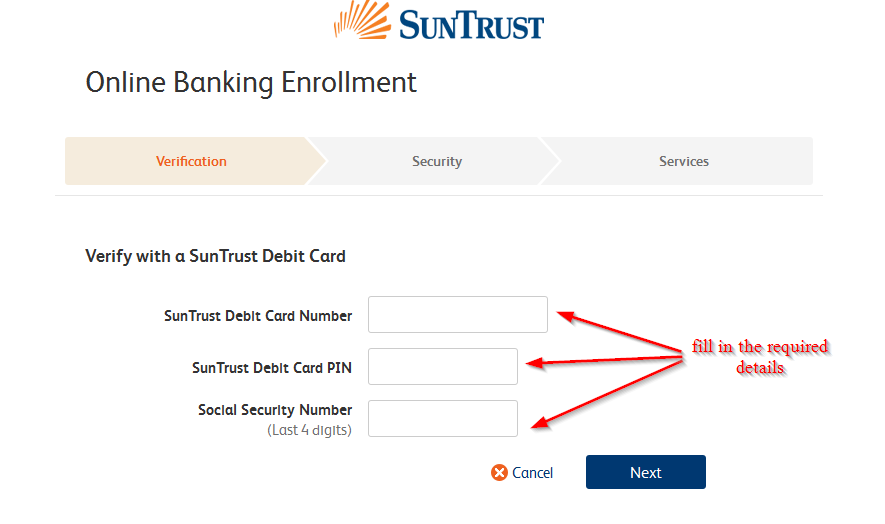

Step 4-Enter your card number, card PIN and SSN number and click “next”

Manage your SunTrust Bank online account

When you create an online account with the bank, you will enjoy the following benefits:

- Make payments

- Apply for loans online

- Check you transaction history

- Check balances

- Transfer funds to other accounts

SunTrust Bank Review

SunTrust Bank is an American based bank founded in 1891 and headquartered in SunTrust Plaza, Atlanta, Georgia. As of September 2016, the bank was operating 1,400 branches and 2,160 Automatic Teller Machines in Washington D.C and southeastern states.

SunTrust Bank main business includes deposits, credit cards, trust and investment and lending services. The bank employs about 24,000 employees. In 2013, the bank was paid $1.5 billion to resolve claims of poor mortgage lending, and foreclosure practices.

Being one of the largest banks in the U.S., the bank offers a range of products to keep its customer’s finances on track. You can borrow from your equity, open a checking account, plan your retirement and start an emergency fund.

If your current bank doesn’t offer much with regards to financial products and customer service, then you may want to switch to SunTrust for a new banking experience.

Checking accounts

The bank offers four types of checking accounts to meet the individual needs of its esteemed customers.

Whether you are looking for a simple checking account that will help you to manager your daily expenses with the option of direct deposit or a bank account with benefits, the bank has the right checking account for you.

The options offered include: EZ Checking, Solid Choice Banking, Everyday Checking, Student checking and Signature Advantage Banking. Monthly maintenance fee ranges from between $4 and $17.

All SunTrust checking accounts have a debit card. In addition, there is free online and mobile banking which makes it easy to manage your bank account from anywhere in the world on your computer or mobile phone.

SunTrust Savings account

The SunTrust Bank savings account can certainly help you to prepare for that rainy day, save for a down payment or save for tuition. To open a savings account or Live solid savings account, you need to make a minimum deposit of $100

These accounts allow you to deposit and withdraw funds anytime, transfer money between accounts and use savings as overdraft protection for checking account.

With a SunTrust Bank savings account, customers can also earn interest on their balance and there is also the option of automate deposits.

Certificate of Deposit

You can take your savings account to the next level with the reliable SunTrust Bank certificate of deposit. The bank’s CD rates are competitive and you will get a guaranteed fixed rate with the terms ranging from 7 days to 10 years.

To open this account, you will need a minimum balance of $2,000 and no monthly maintenance fee is charged.

Online banking

I guess we all love the convenience of banking online. In today’s busy work, we usually don’t have enough time to visit a bank. SunTrust Bank online bank is convenient as you don’t need to visit a bank.

All that you need to do is to sign up for online banking on the bank’s website and manage your account from any location. You can check your balances, find the nearest branch or ATM, transfer funds between accounts, and view your eStatememnts and more.

Benefits

- Friendly service

The bank is relatively small in size, which gives it a small town fee. Customers can expect to get some really good southern hospitality from most of its branches. Many people who have dealt with this company have been treated well.

- Loan and mortgage interest rates

The bank has very reasonable rates when it’s compared to other players in the industry

- Many locations

For those who live down south, then you will not have any problem getting to their branch. The bank is well represented

- Low cost

The fees for all the banking services offered are pretty low

Downsides

- A review for SunTrust Bank isn’t complete without covering the negative reviews:

- Low savings and checking interest rates

- Although they have low loan and mortgage interest rates, this unfortunately carries over to their savings and checking accounts

- Poor quality tracking system

- The bank tends to have excessive amount of problems making simple transaction as a result of the bank’s poor tracking system

Conclusion

If you reside in the south and you want a bank that offers a range of financial products and high level of service, then SunTrust Bank is the right bank for you. The SunTrust Bank’s fees are fairly low.