Credit One Bank, national association, a chartered bank, provides credit cards. The company is headquartered in Las Vegas, Nevada. It operates as a subsidiary of Sherman Financial Group LLC.

- Branch / ATM Locator

- Website: https://www.creditonebank.com/

- Routing Number: 122402133

- Swift Code: See Details

- Telephone Number: +1 877-825-3242

- Mobile App: Android | iPhone

- Founded: 1984 (41 years ago)

- Bank's Rating:

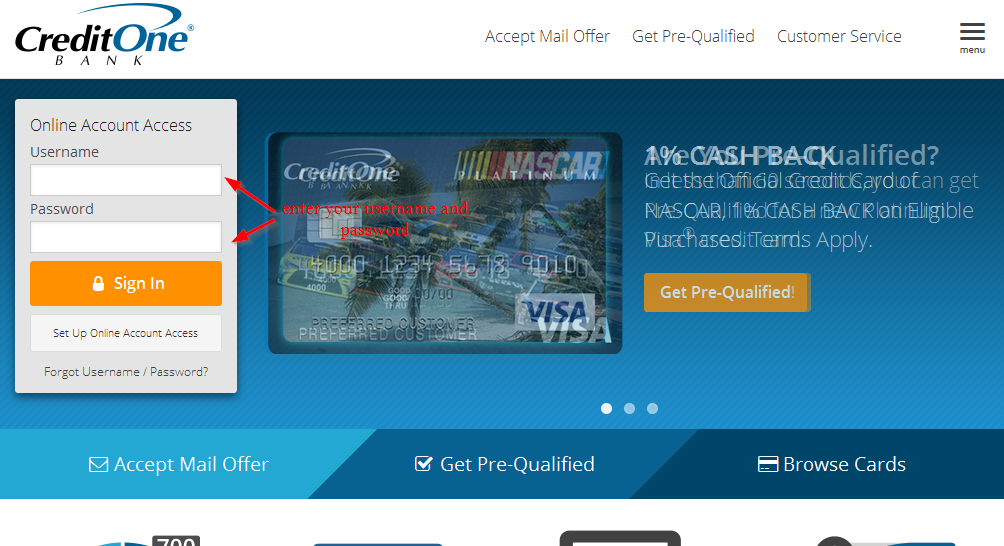

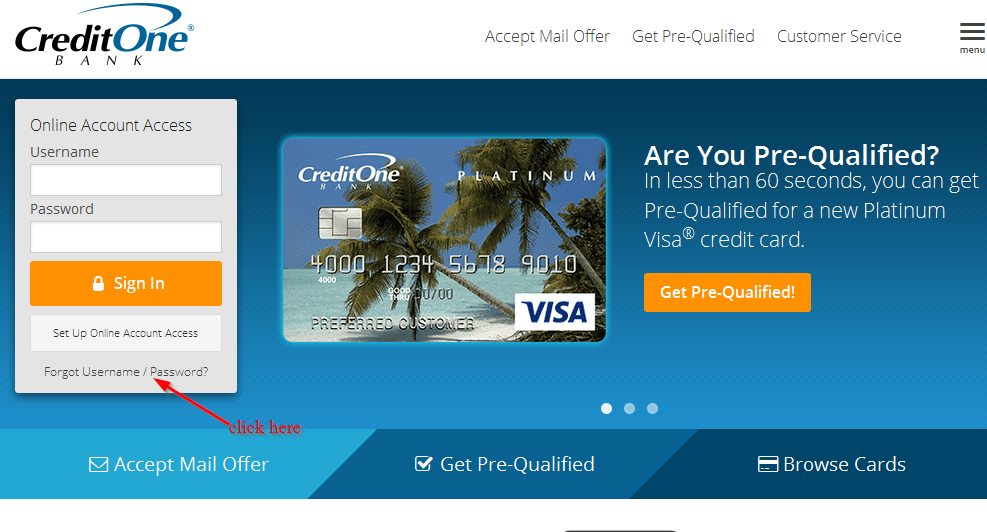

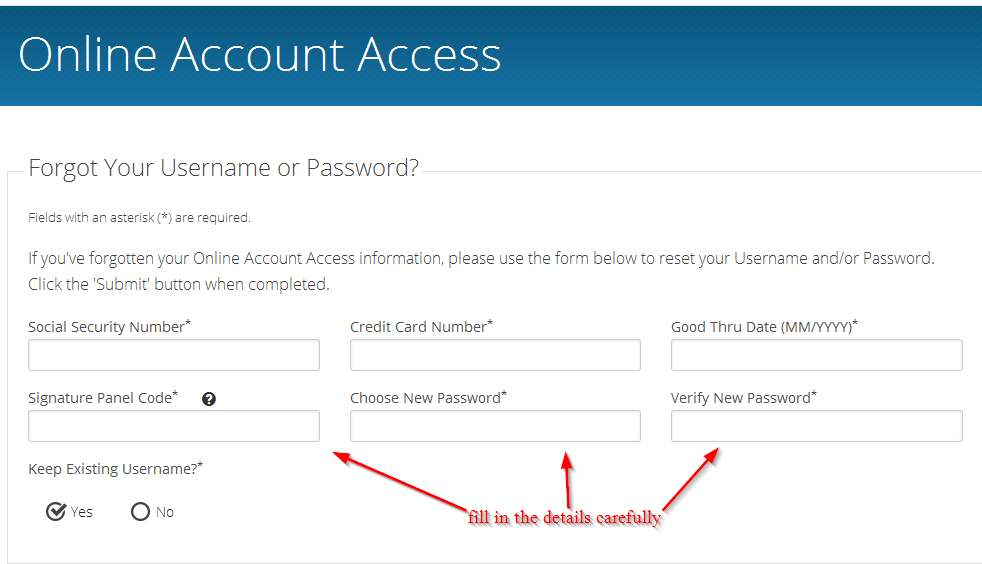

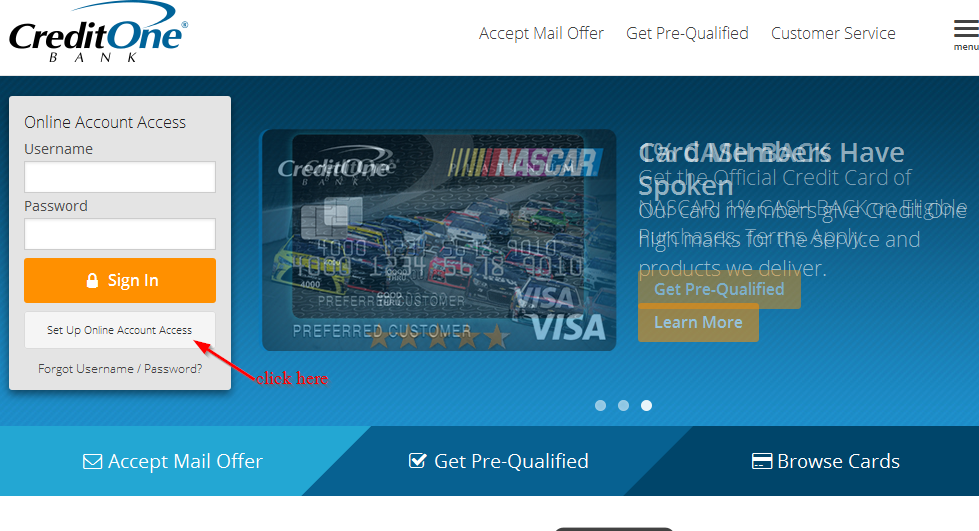

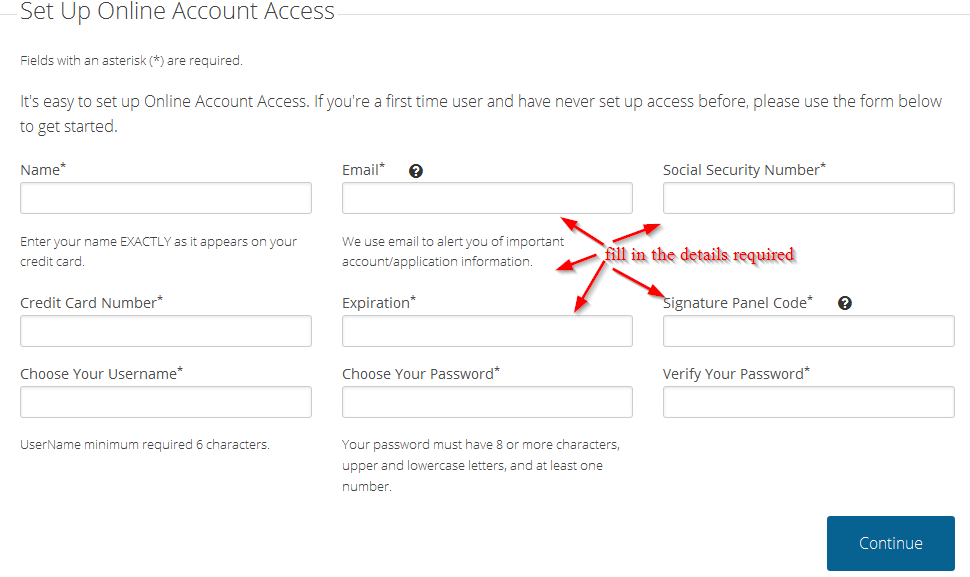

If you have an account with Credit One Bank, you can register for internet banking services so that can have access to your bank account 24/7. You can say goodbye to frequent trips to the bank or ATMs. You can pay your bills and check your account balance from your computer, tablet, ipad or mobile phone. Here are the steps for logging into your online account, resetting your password and registering for the internet banking services.