AW Credit Union was established in 1931 in the University of Wisconsin. It uses a not-for-profit cooperative business model to serve the community. The company takes in customer deposits and offers loans to its customers who needs it.

- Branch / ATM Locator

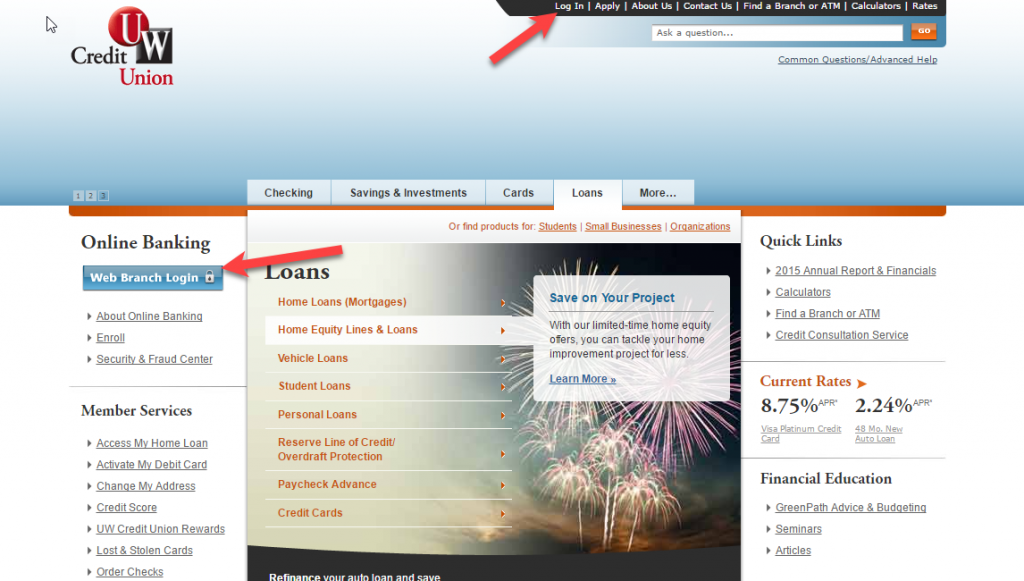

- Website: https://www.uwcu.org/

- Routing Number: 275979076

- Swift Code: See Details

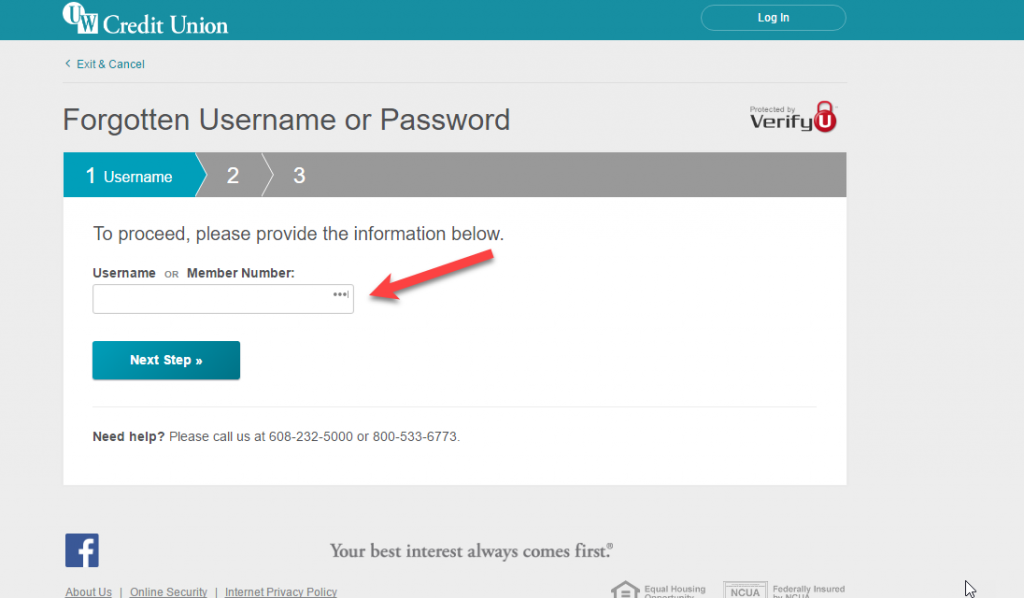

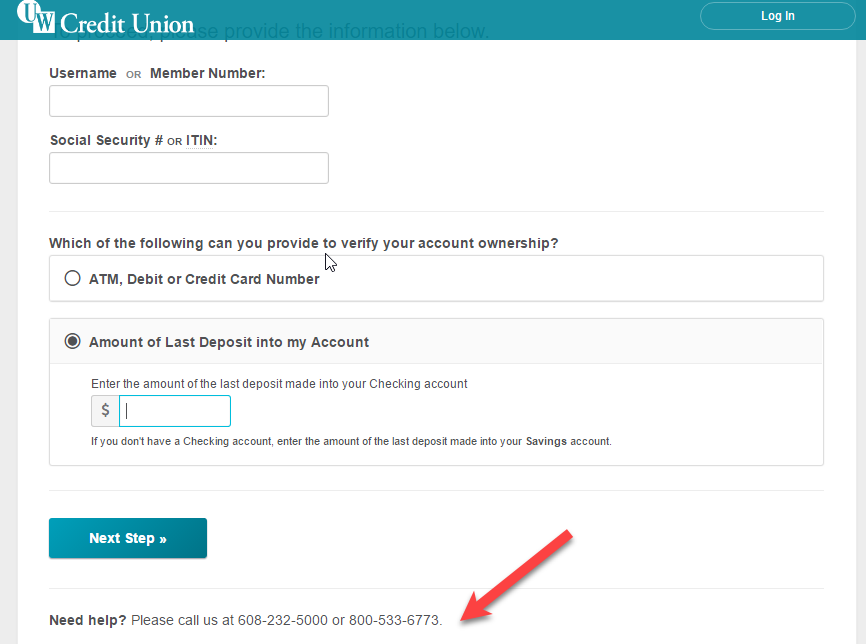

- Telephone Number: 608-232-5000

- Mobile App: Android | iPhone

- Founded: 1931 (94 years ago)

- Bank's Rating:

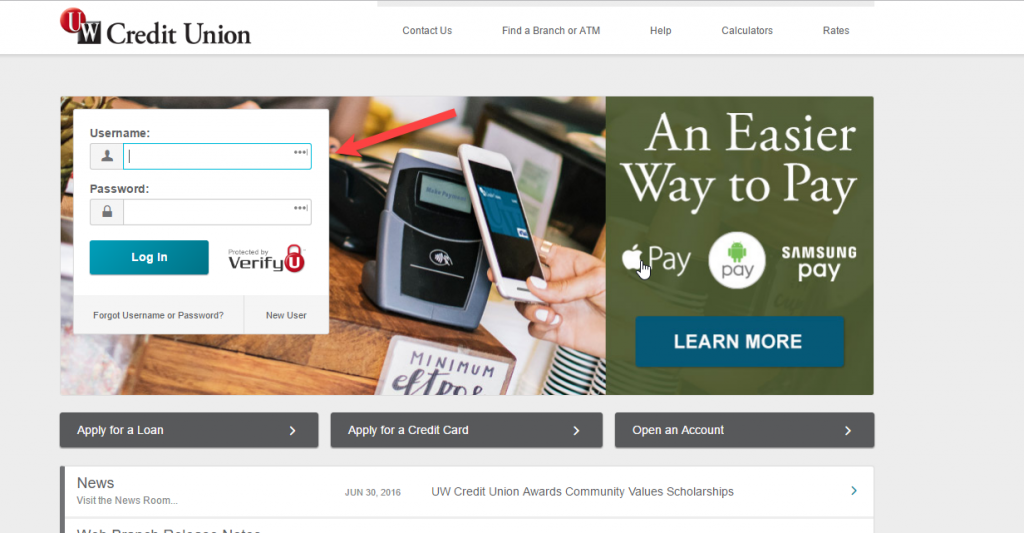

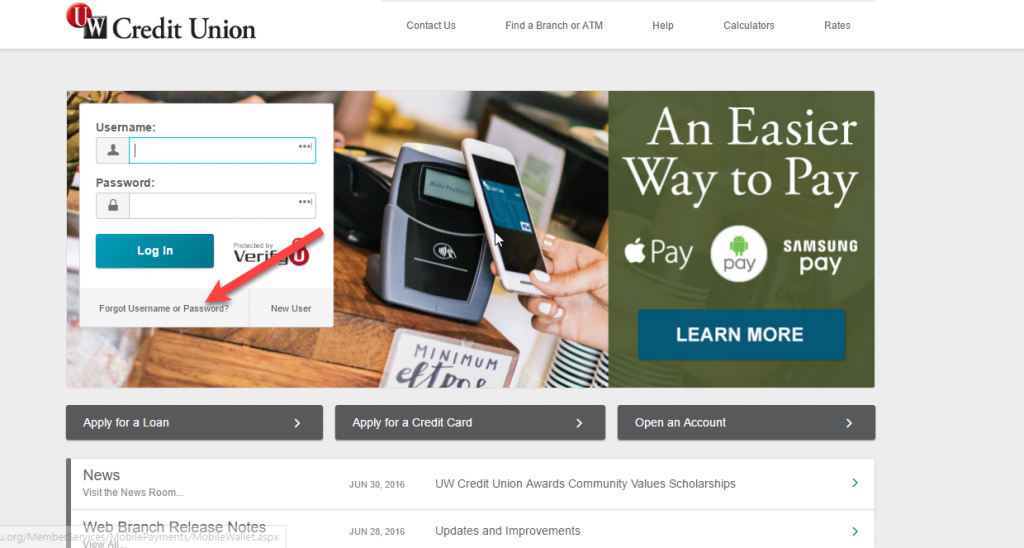

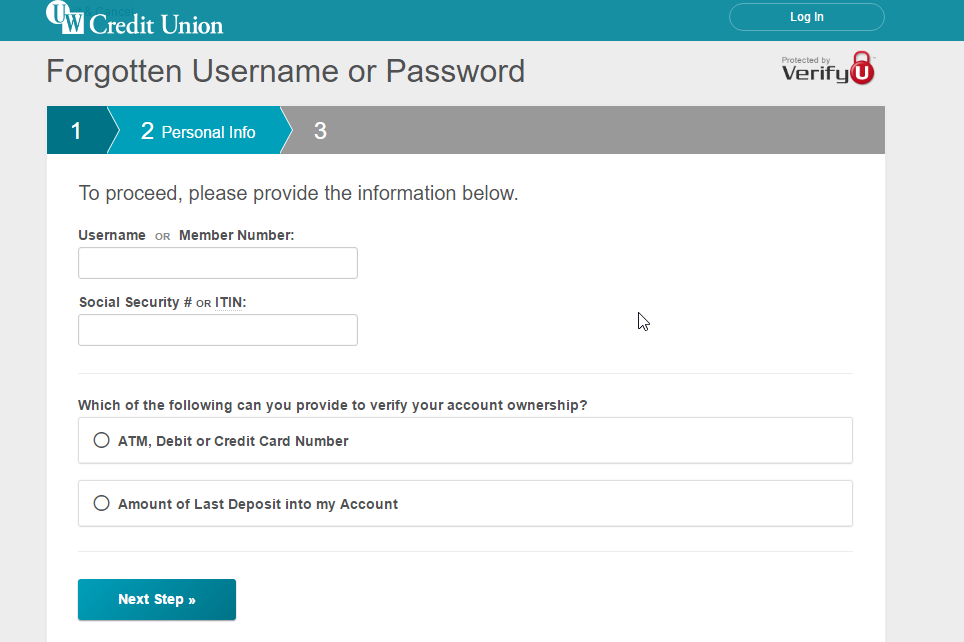

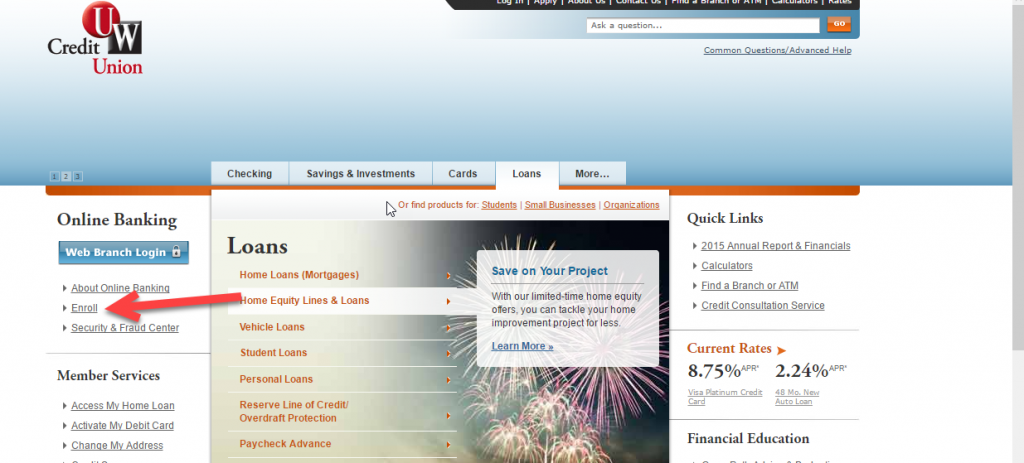

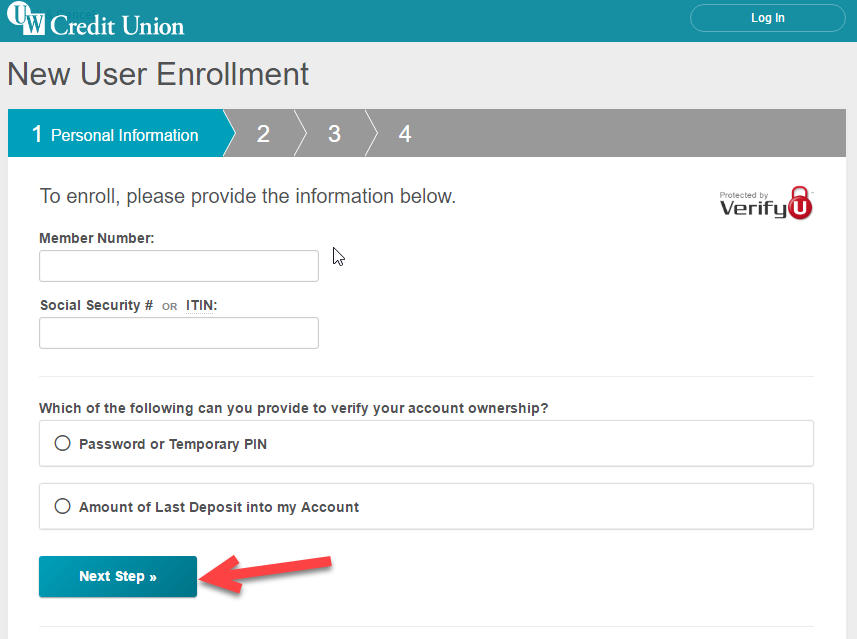

UW Credit Union is a not-for-profit organization that takes customers deposits and offers affordable loans to its clients. It offers an online banking platform where customers can conduct transactions such as deposits, withdrawals, text banking, money transfer, web pay, email and text alerts, web check copies, mobile banking, and check balance.