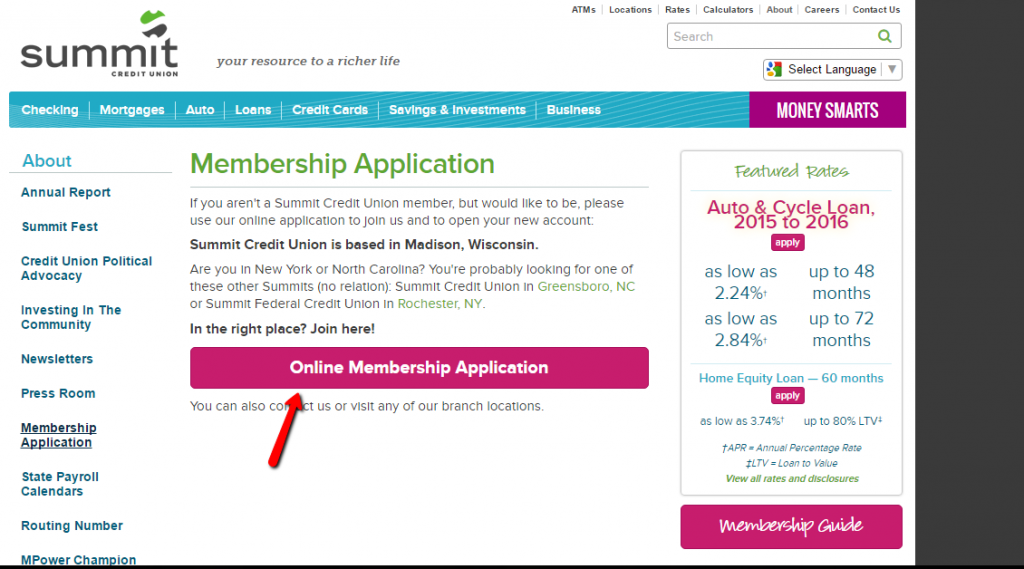

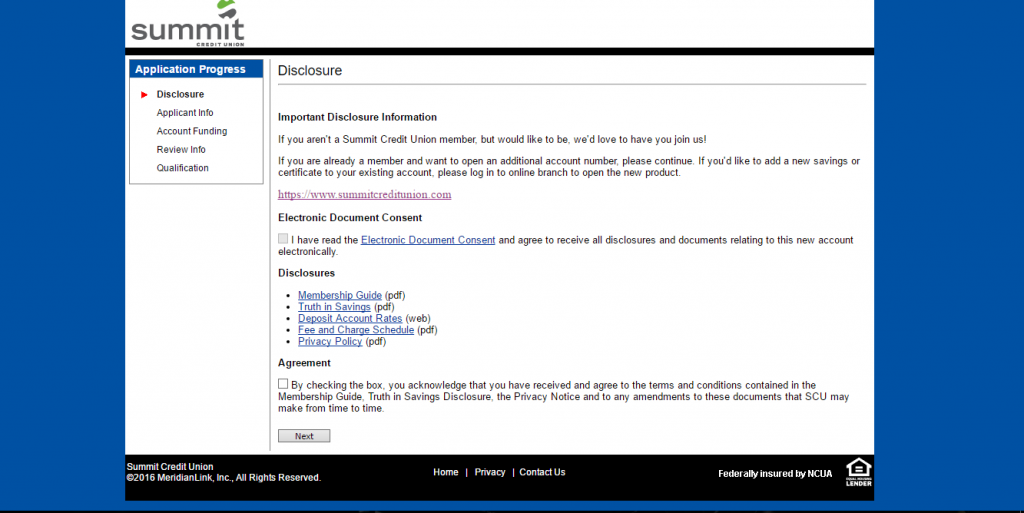

Summit Credit Union is a credit union based in Madison, Wisconsin. It has 35 branches and a total of $2 billion in assets under management. It is regulated by the National Credit Union Administration (NCUA). Its NCUA charter number is 67190.

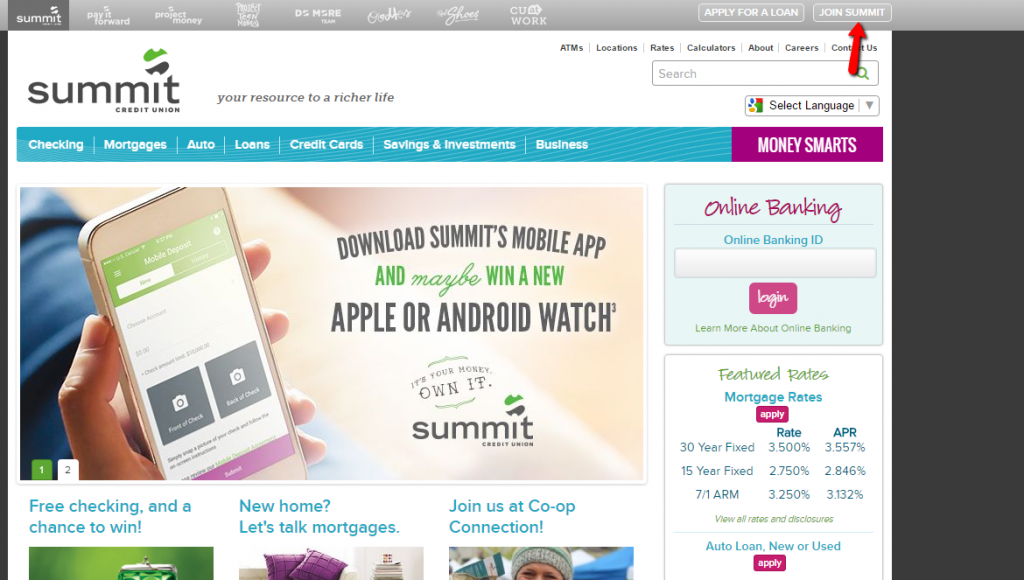

- Branch / ATM Locator

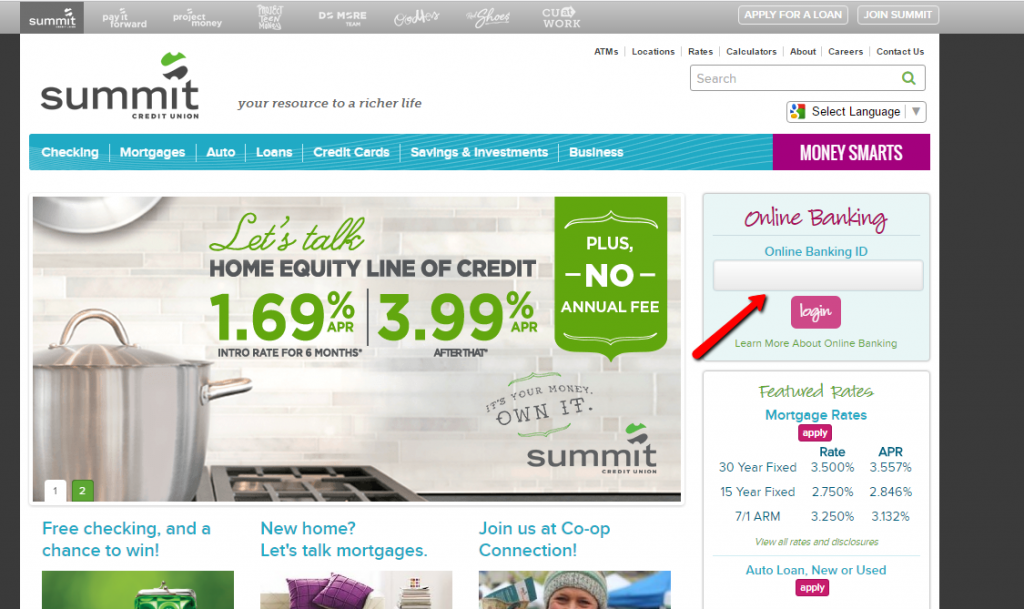

- Website: https://www.summitcreditunion.com

- Routing Number: 275979034

- Swift Code: See Details

- Telephone Number: (800) 236-5560

- Mobile App: Android | iPhone

- Founded: 1935 (90 years ago)

- Bank's Rating:

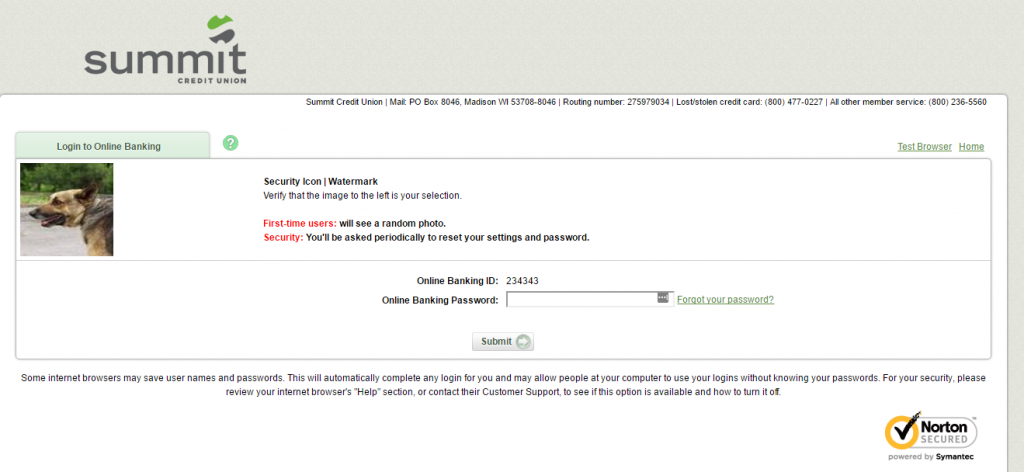

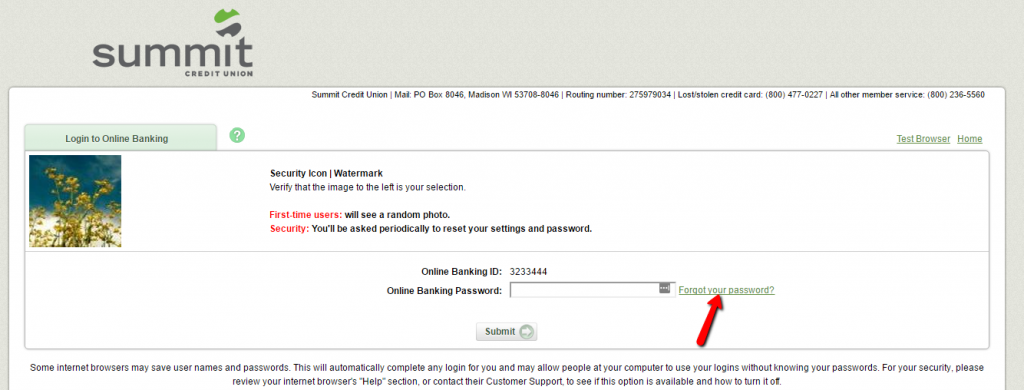

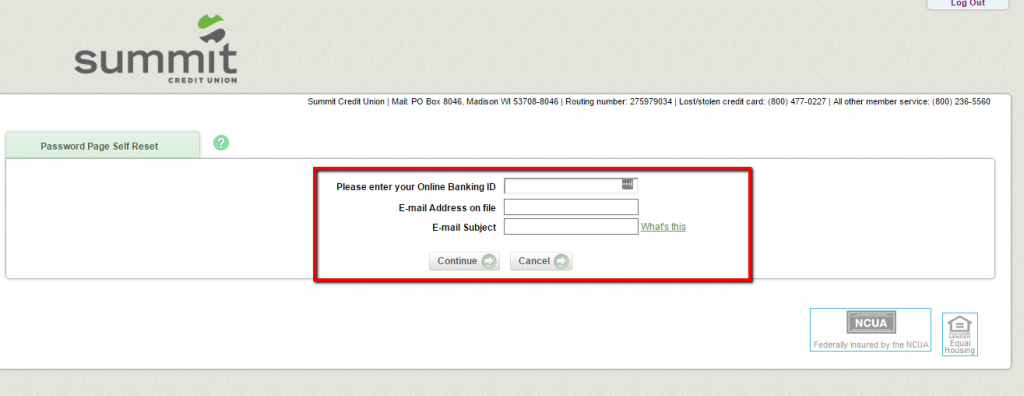

Summit Credit Union is a credit union founded in 1935 and headquartered in Madison, Wisconsin. The Credit Union has 35 branches. Customers can also receive their services through its online banking platforms which includes its website and android and iOS mobile applications.