Renasant Bank was established in 1904. It now has more than $8 billion of assets and a presence in a number of states. It has more than 175 finance services.

- Branch / ATM Locator

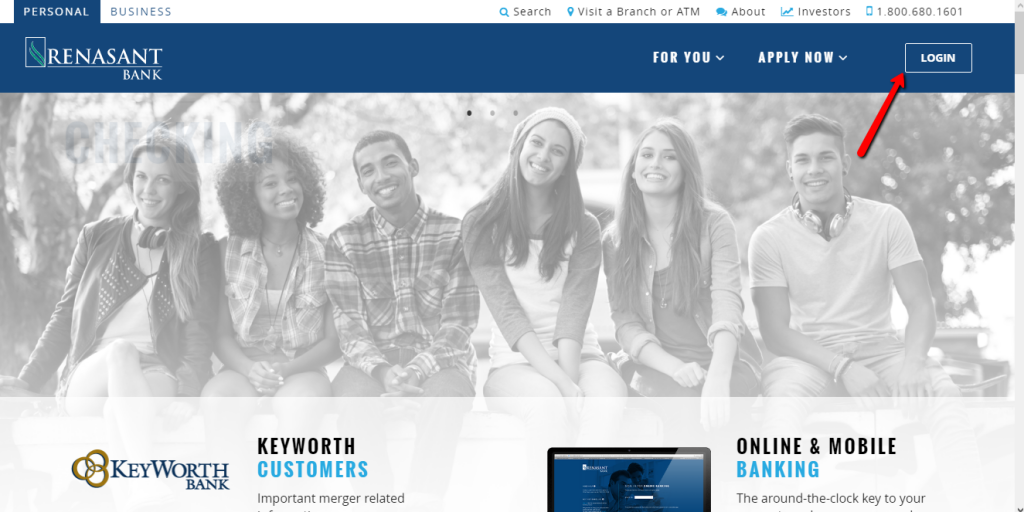

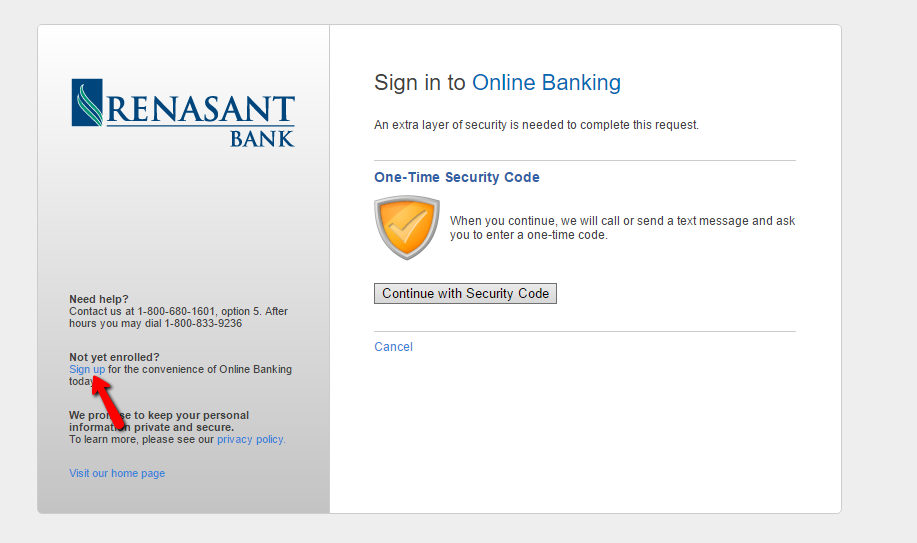

- Website: https://www.renasantbank.com

- Routing Number: 061121203

- Swift Code: RNSTUS42

- Telephone Number: 1.800.680.1601

- Mobile App: Android | iPhone

- Founded: 1904 (121 years ago)

- Bank's Rating:

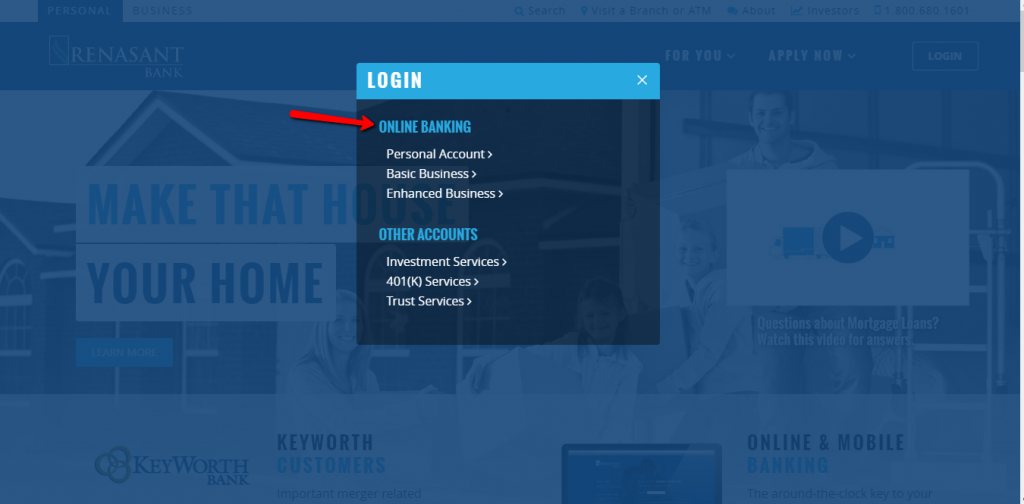

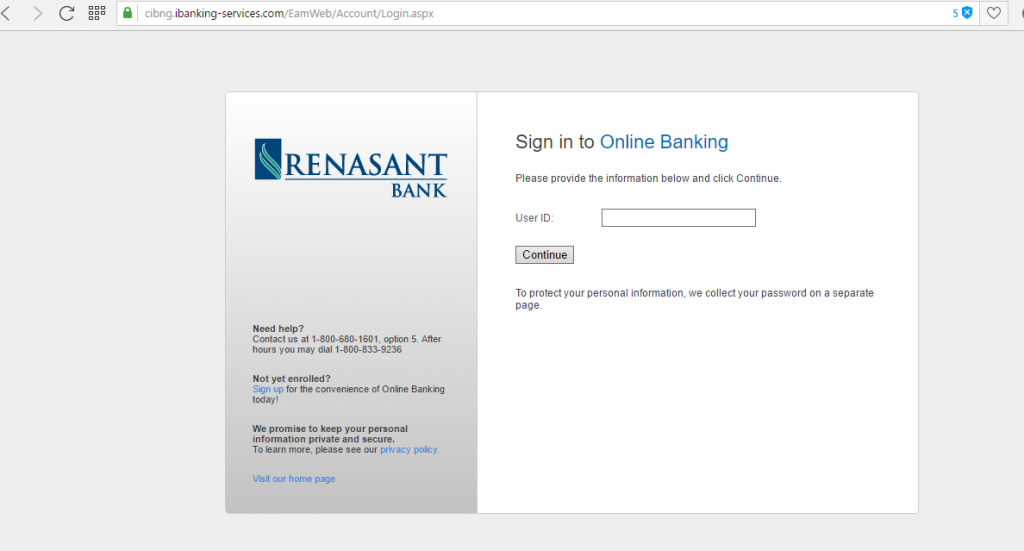

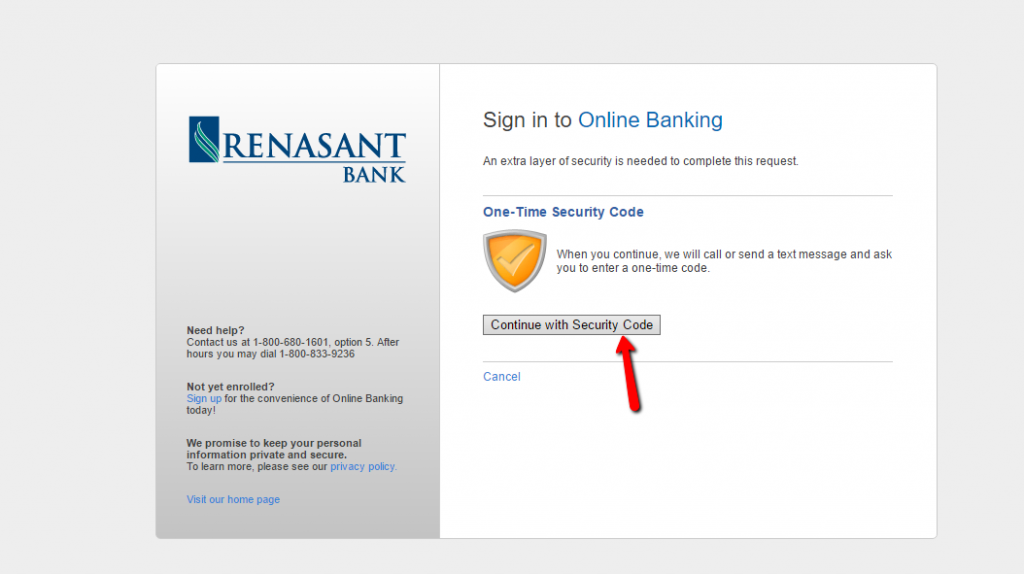

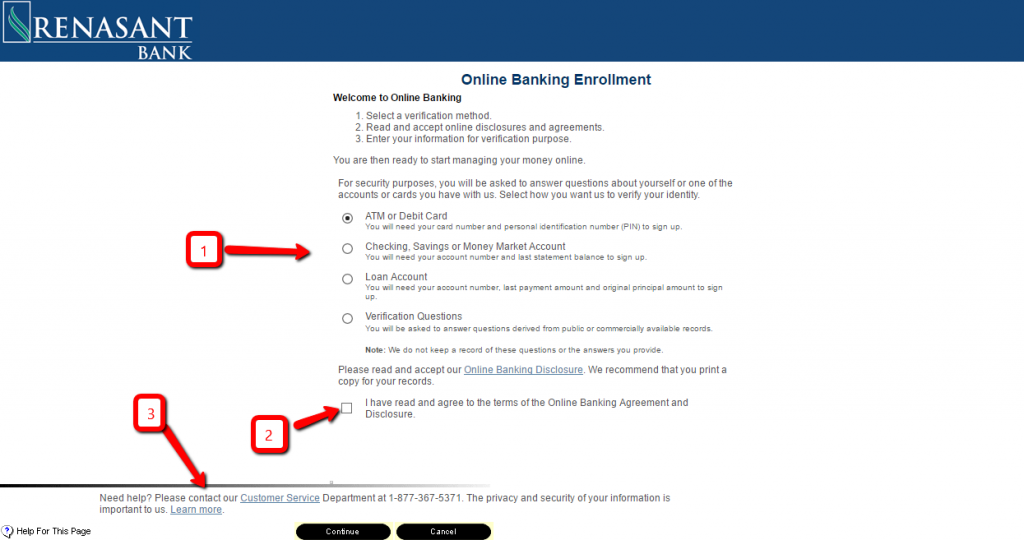

Renasant Bank is a major bank with assets valued at more than $8.3 billion. Its highly advanced internet banking platform helps clients get banking services at a go. There are different categories of its online banking platform which include: personal accounts, basic business, enhanced business, and other accounts.