Fidelity bank is a regional bank owned by The Fidelity Investment Company which was established more than 100 years ago. The bank offers a number of services such as savings, mortgage services, and banking solutions for local governments and businesses.

- Branch / ATM Locator

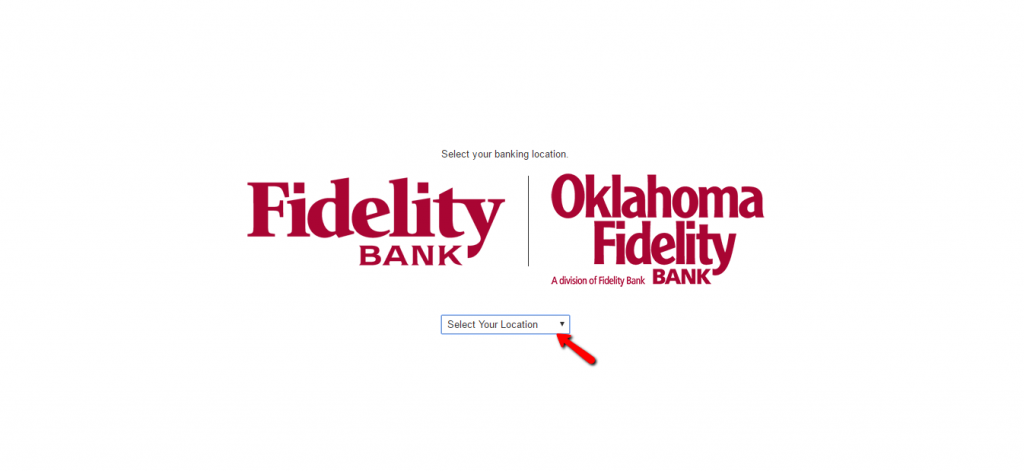

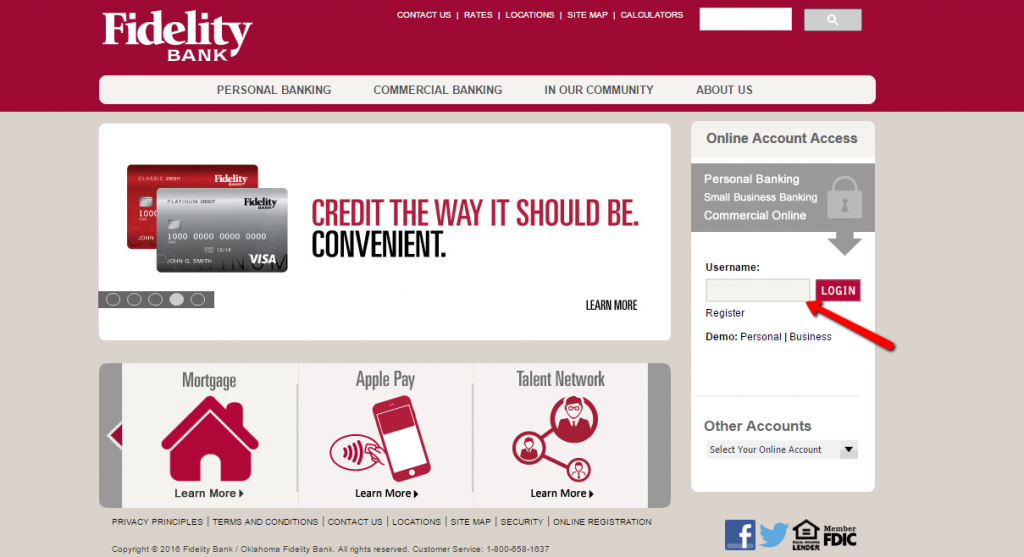

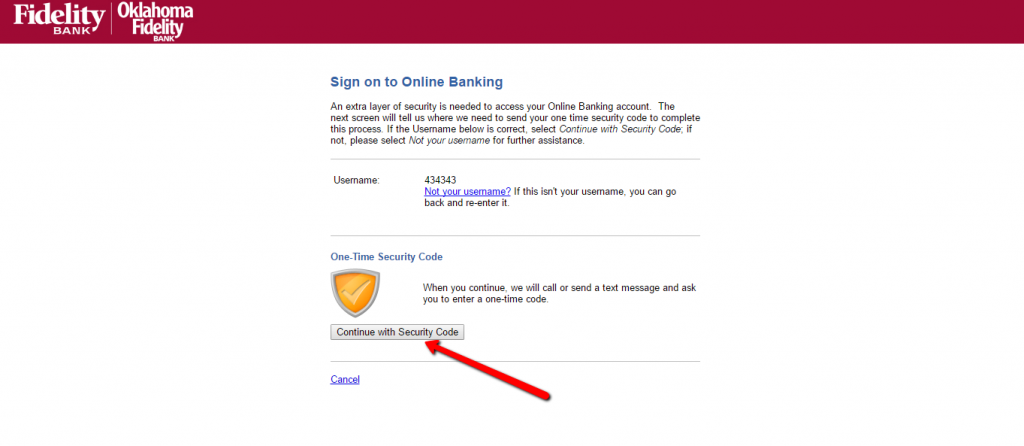

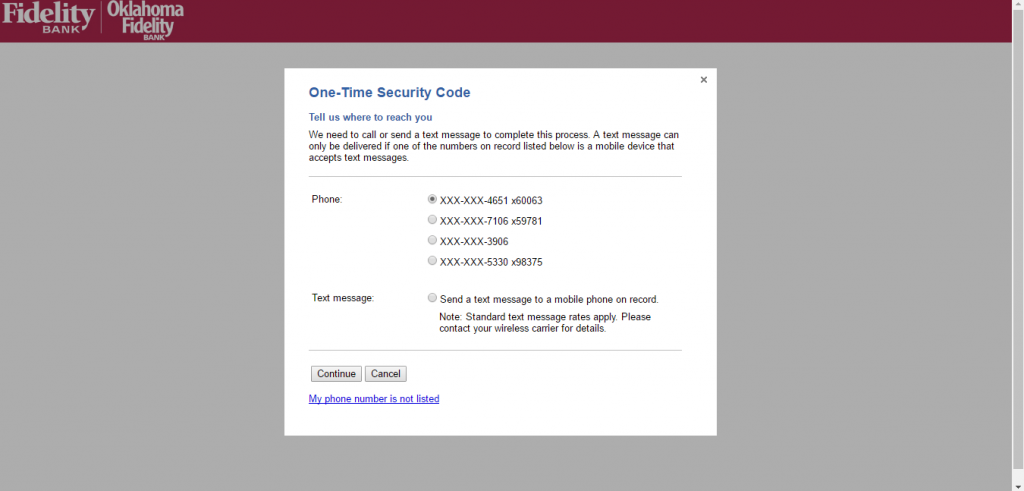

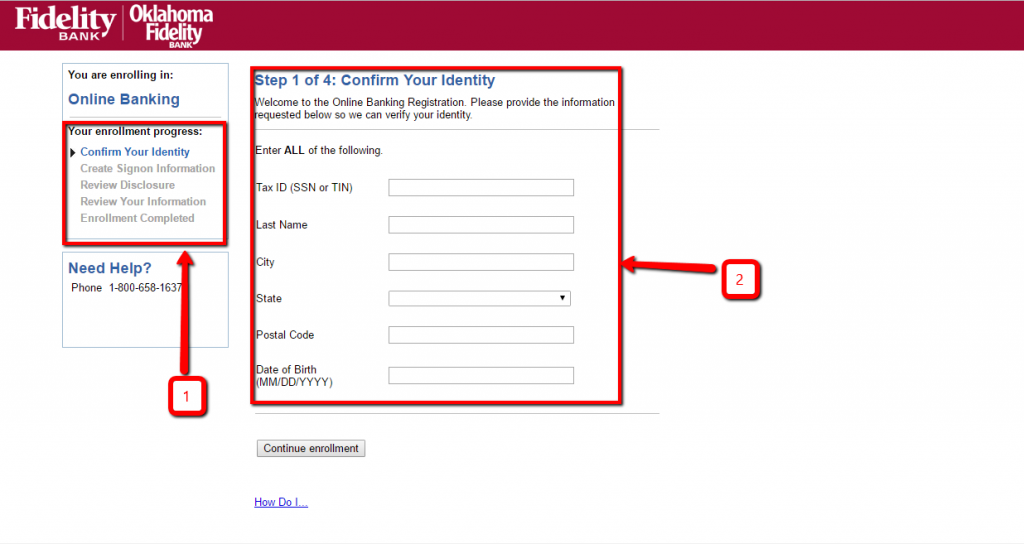

- Website: https://www.fidelitybank.com

- Routing Number: 061102400

- Swift Code: See Details

- Telephone Number: (800) 658-1637

- Mobile App: Android | iPhone

- Founded: 1905 (120 years ago)

- Bank's Rating:

Fidelity Bank is a leading financial institution in Oklahoma. The bank serves individuals and corporate clients with services such as savings and lending. The bank offers its services through its network of branches and its mobile applications.