Bank of the west offers a safe and secure access to your account thus allowing the opportunity to manage your finances from anywhere. The service is available to all customers registered online.

- Branch / ATM Locator

- Website: https://www.bankofthewest.com/

- Routing Number: 107002147

- Swift Code: See Details

- Telephone Number: +1 800-488-2265

- Mobile App: Android | iPhone

- Founded: 1874 (151 years ago)

- Bank's Rating:

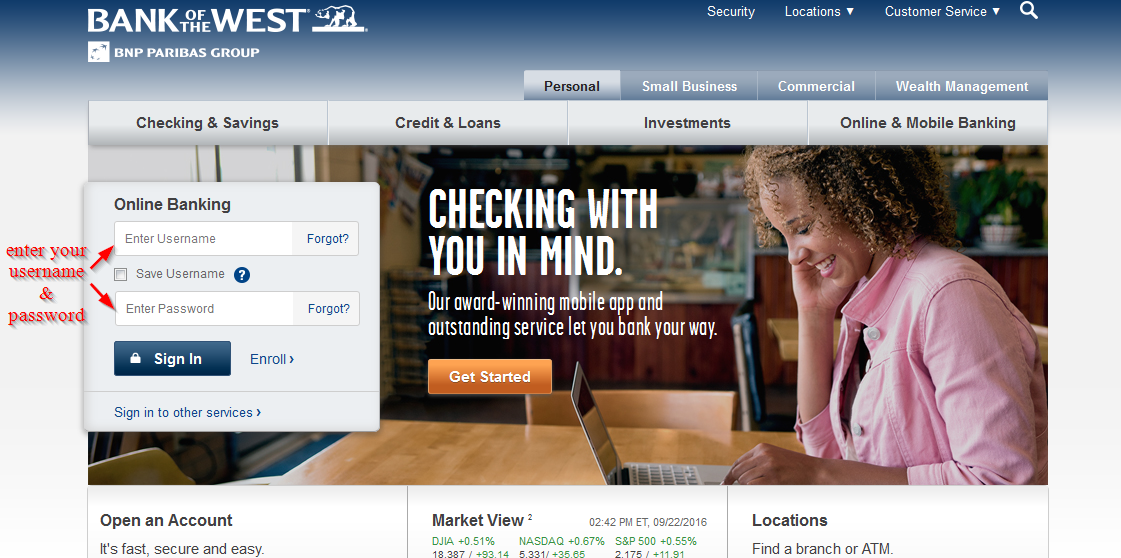

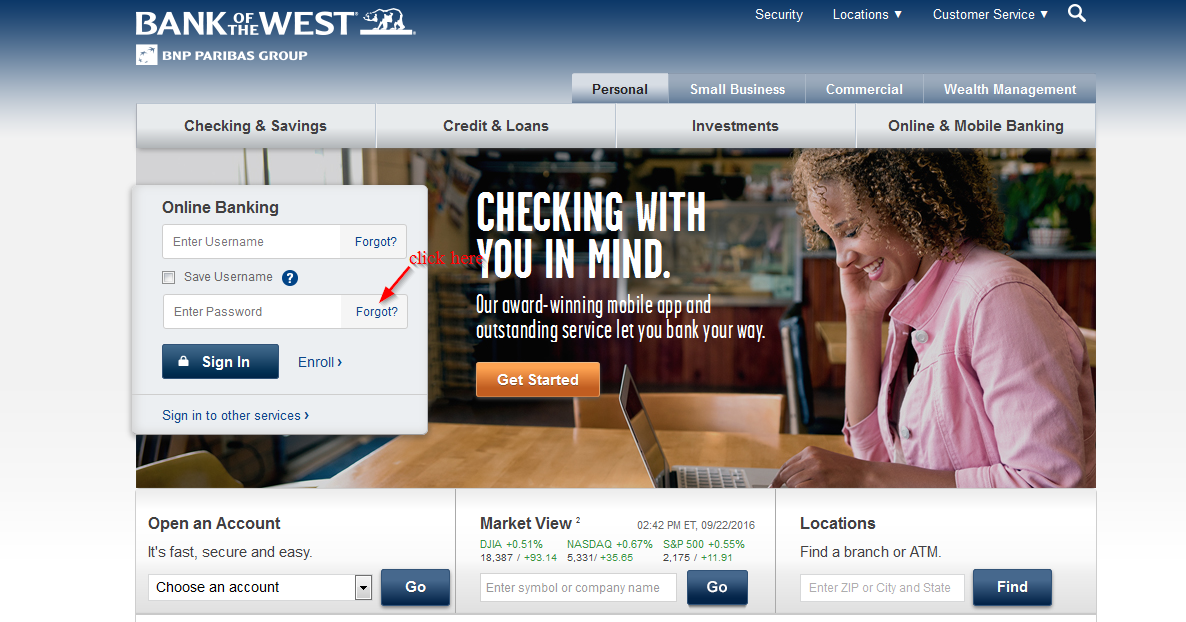

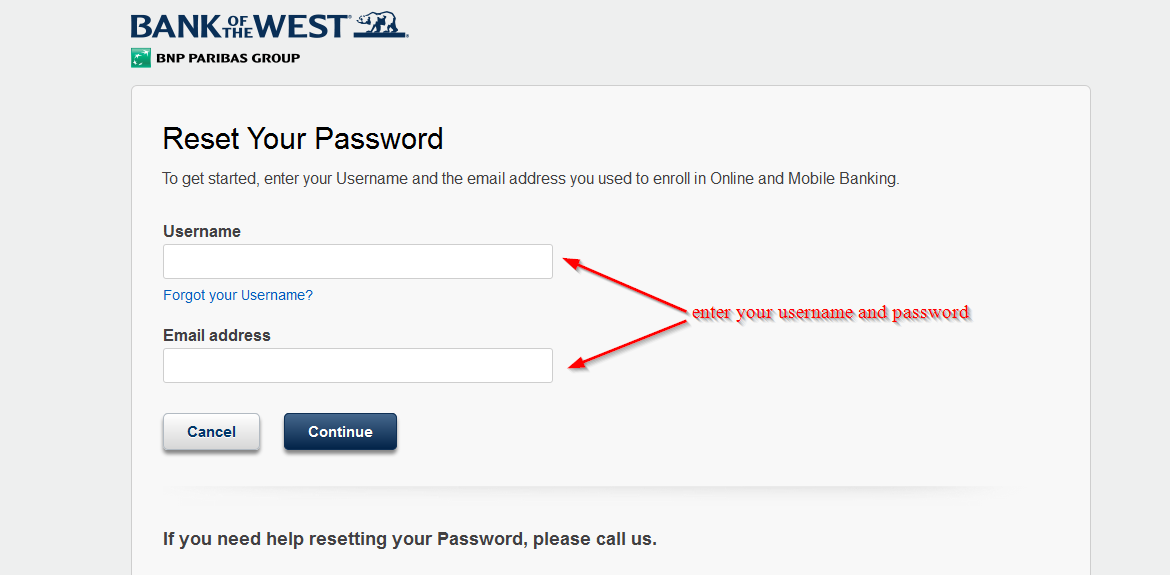

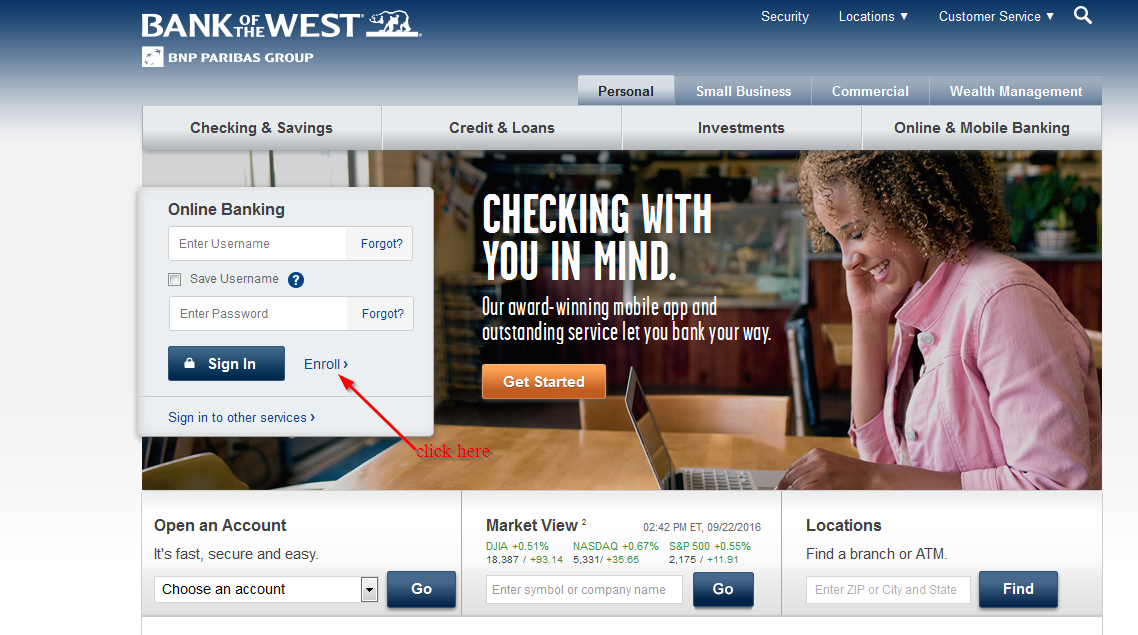

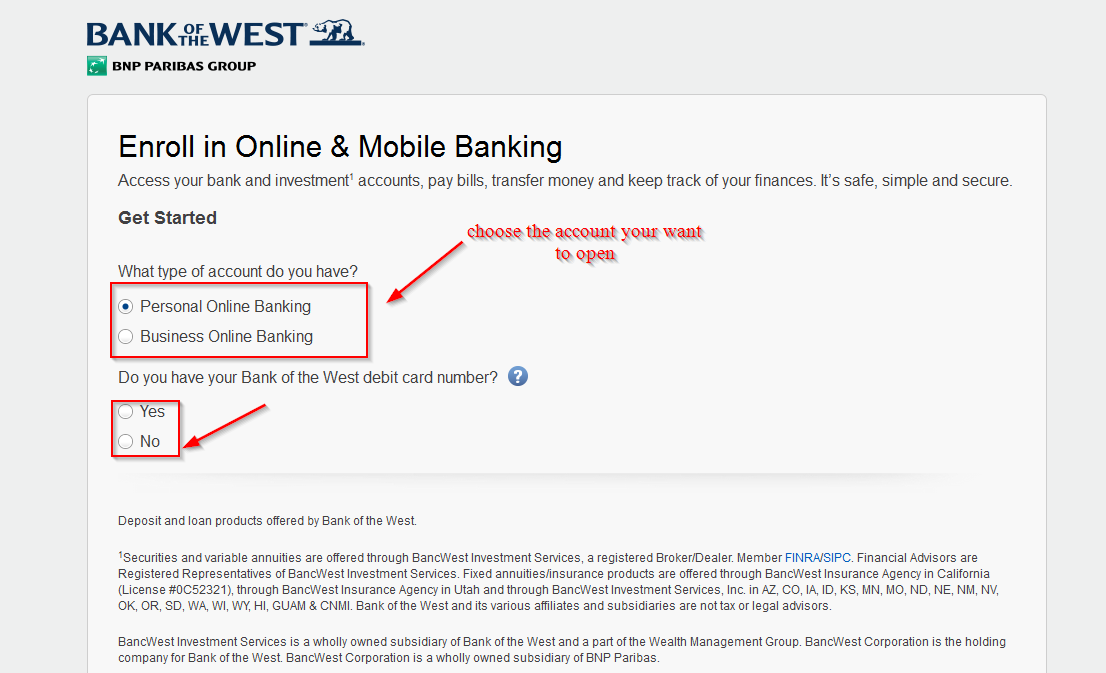

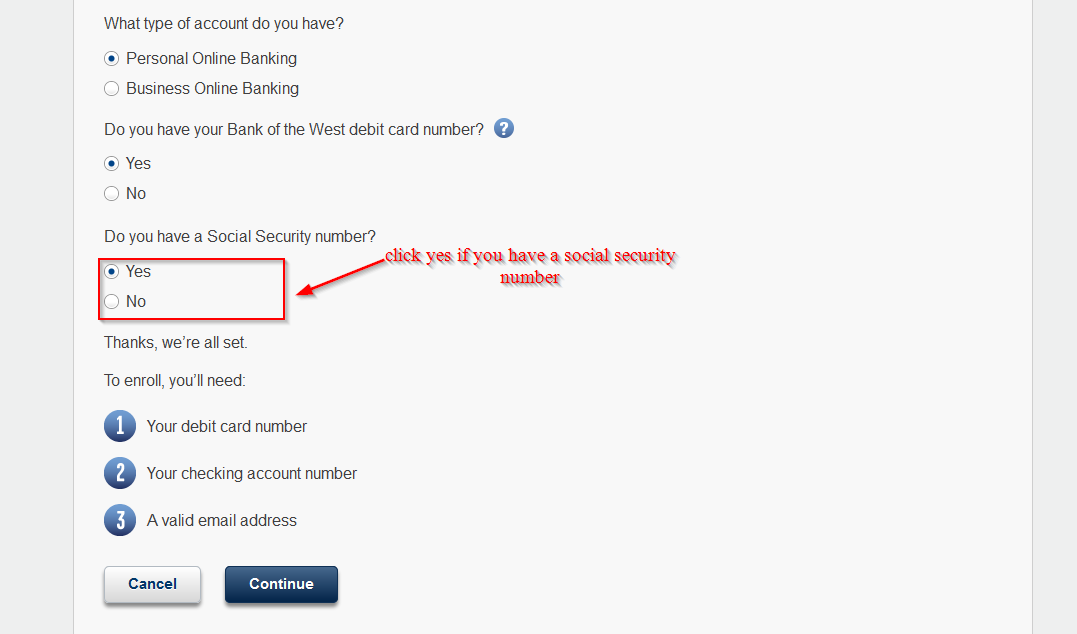

Bank of the West has made it a lot easy for customers to access their bank accounts from anywhere, anytime. All they need to do is register for the internet banking services offered by the bank. With this step by step guide, you will be able to login, reset your password and register for the internet banking services easily.