Synchrony bank offers personal and business services and products. It offers deposit certificates, saving accounts and money market as well as online and mobile banking options.

- Branch / ATM Locator

- Website: https://www.synchronybank.com/

- Routing Number: 021213591

- Swift Code: See Details

- Telephone Number: +1 866-419-4096

- Mobile App: See Details

- Founded: 2003 (22 years ago)

- Bank's Rating:

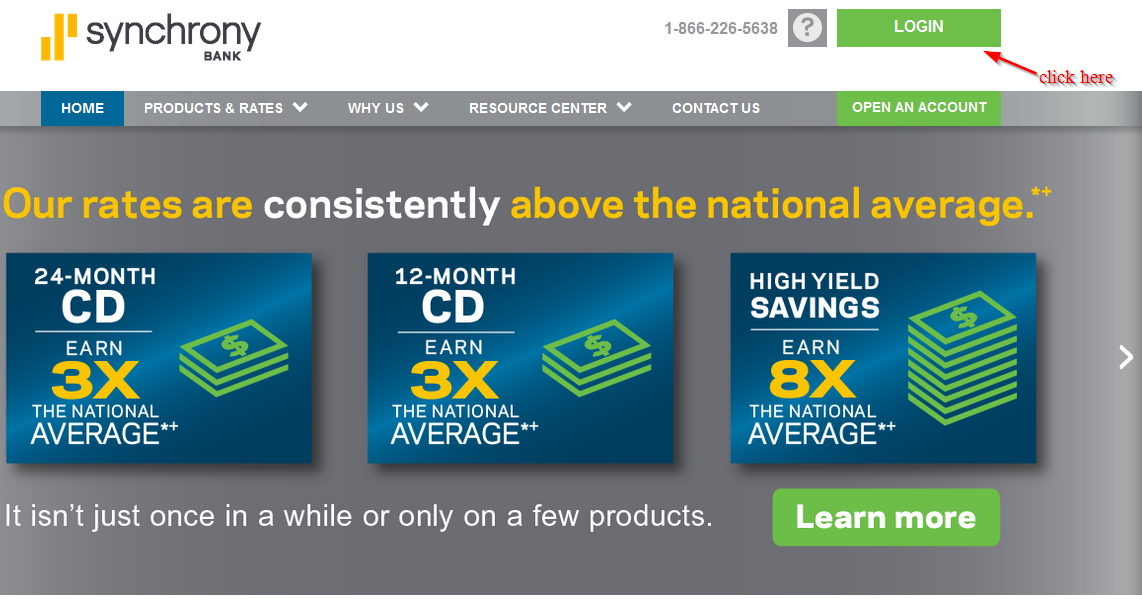

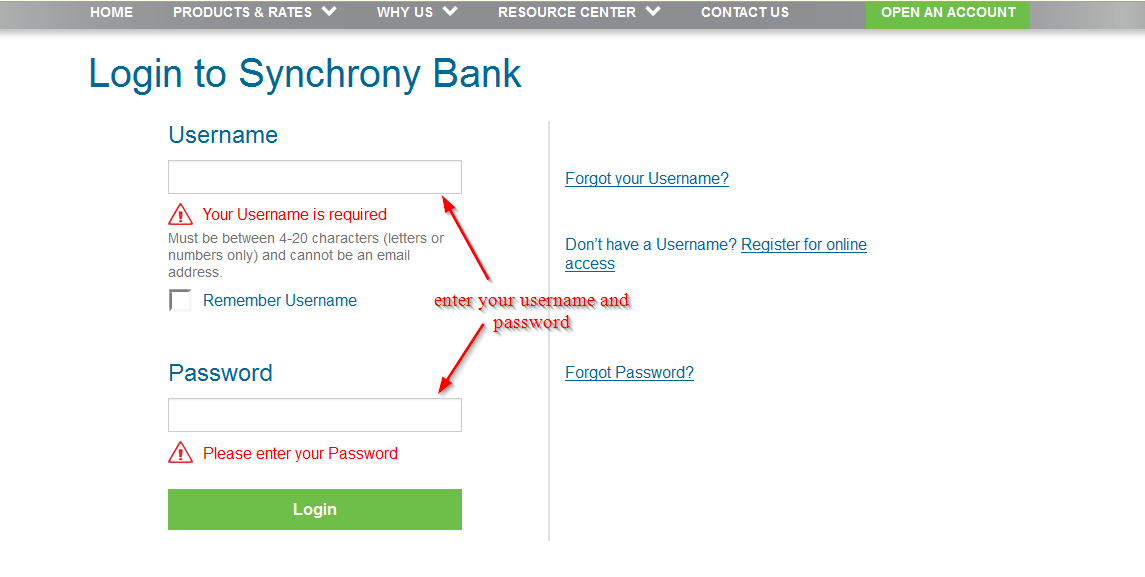

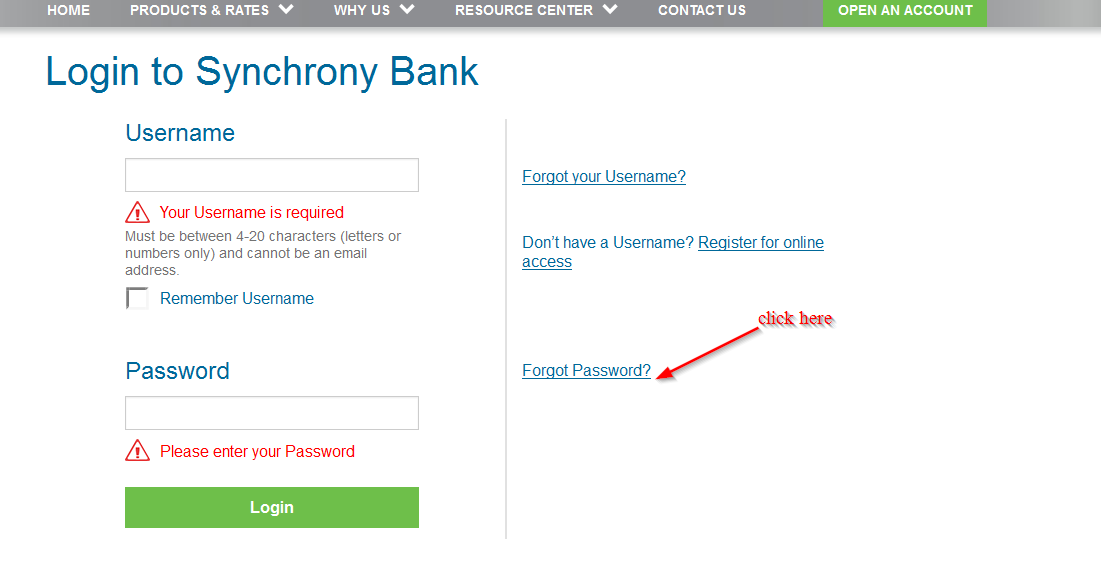

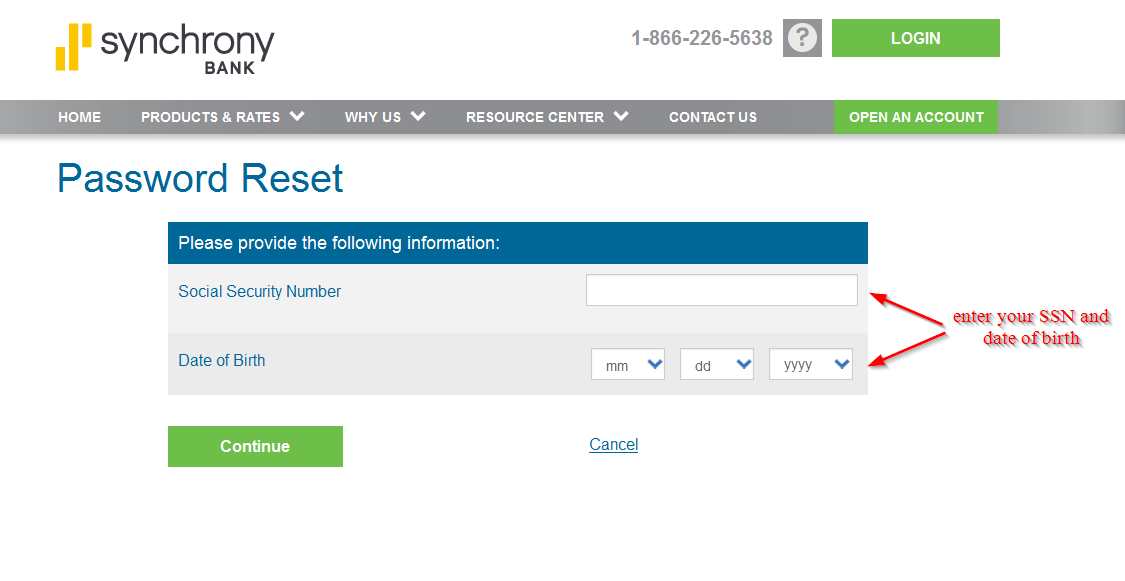

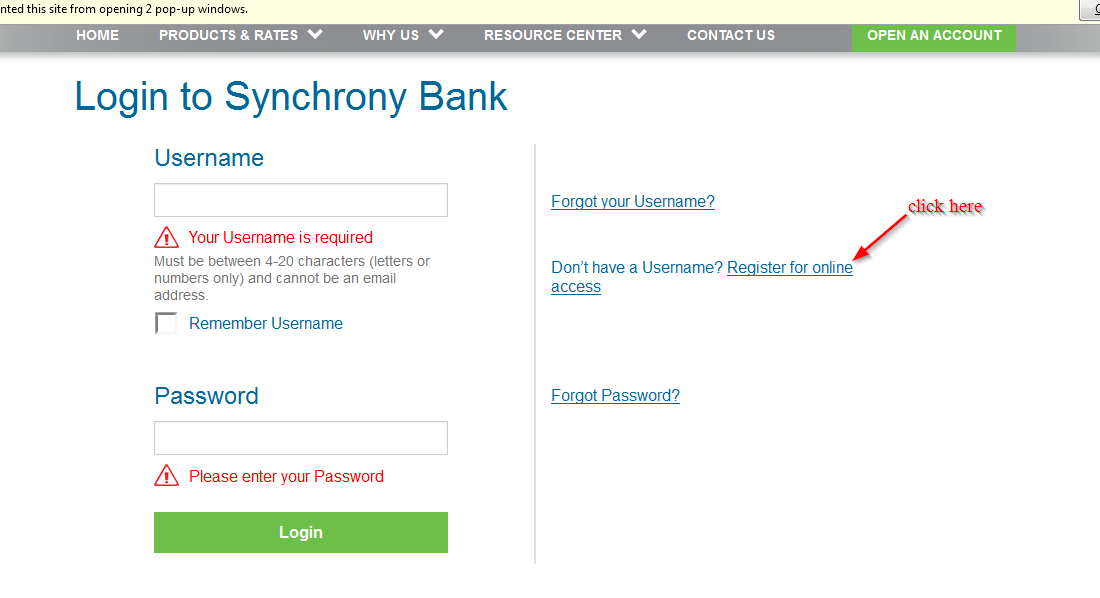

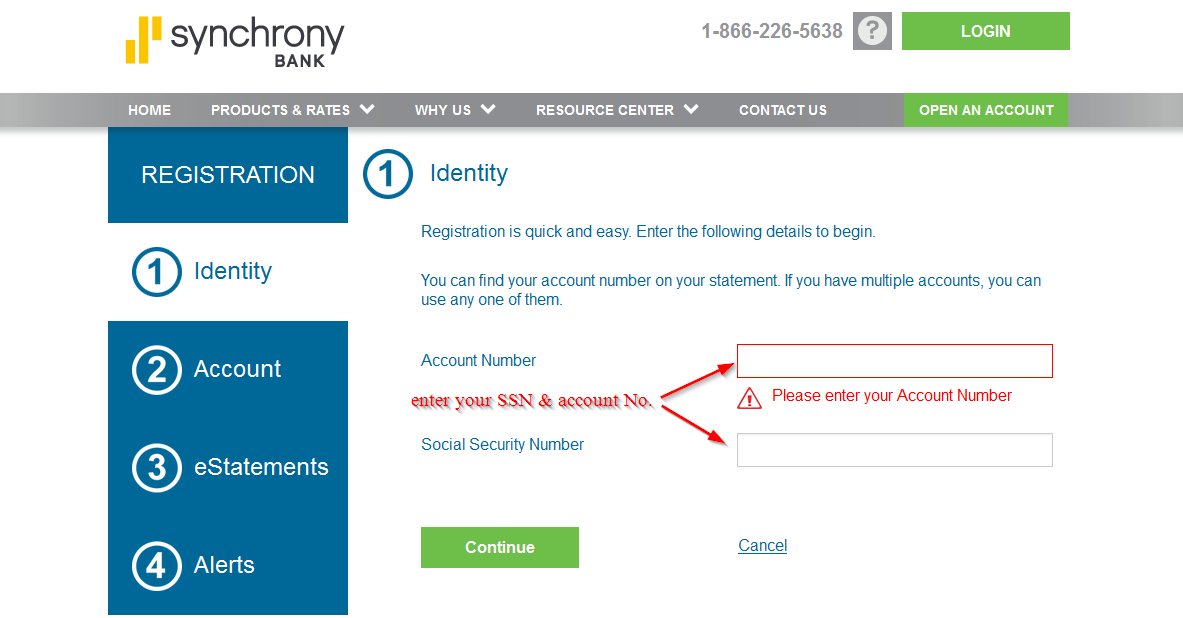

The internet has made it a lot easier for business to operate these days, including banks, and Synchrony Bank now offers internet banking services that enable customers to access their bank accounts. Customers can access their bank accounts using their PCs on mobile web browsers or mobile apps on Playstore and iTunes. In this post, we will guide you on how to login into your online account, how to reset your password and how to register for the online banking services.