Suncoast Credit Union, a not-for-profit financial cooperative, operates as a credit union in Florida. The company was founded in 1934 and is based in Tampa, Florida.

- Branch / ATM Locator

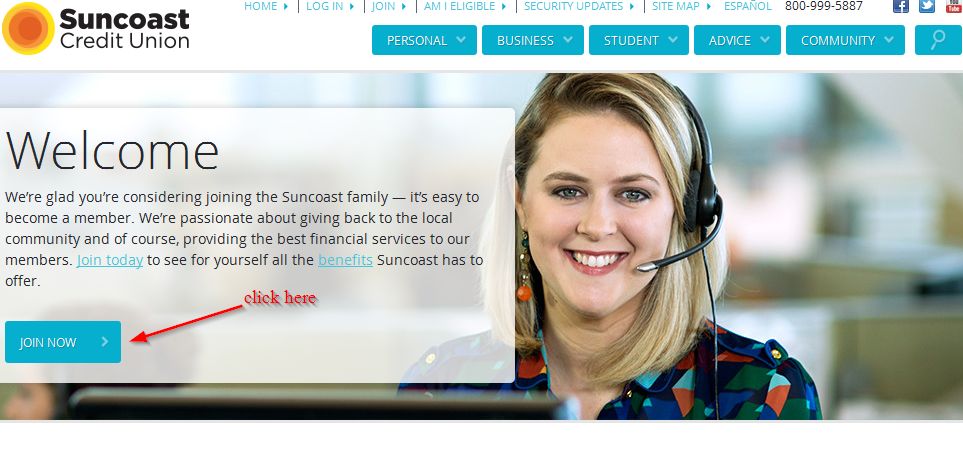

- Website: https://www.suncoastcreditunion.com/

- Routing Number: 263182817

- Swift Code: See Details

- Telephone Number: +1 800-999-5887

- Mobile App: Android | iPhone

- Founded: 1934 (91 years ago)

- Bank's Rating:

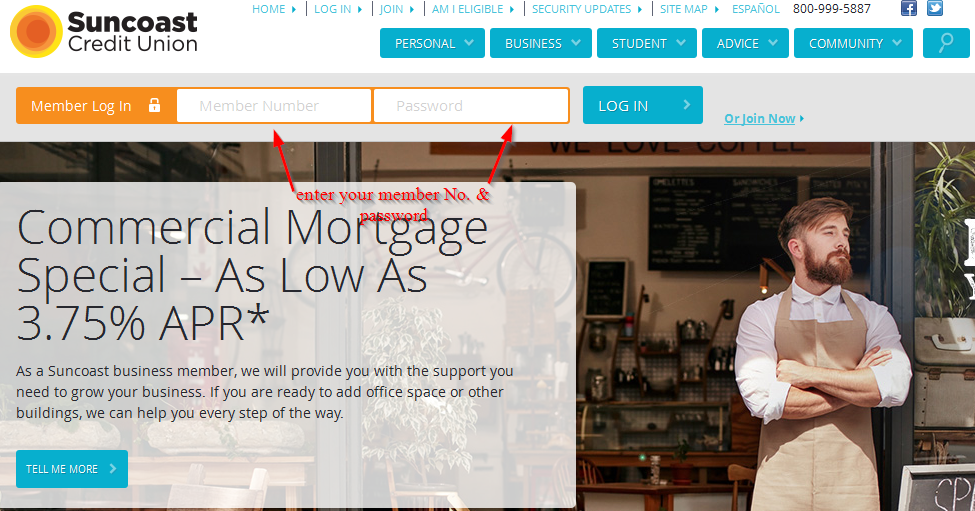

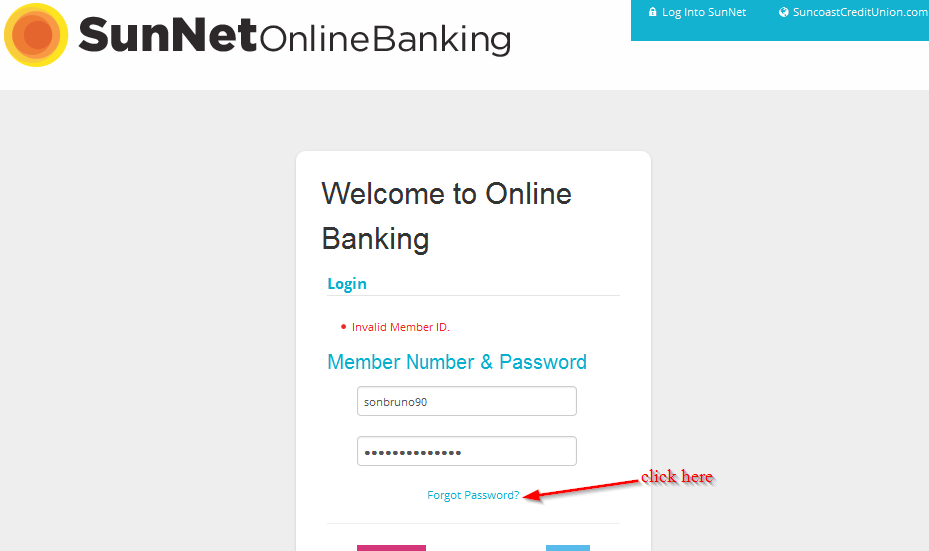

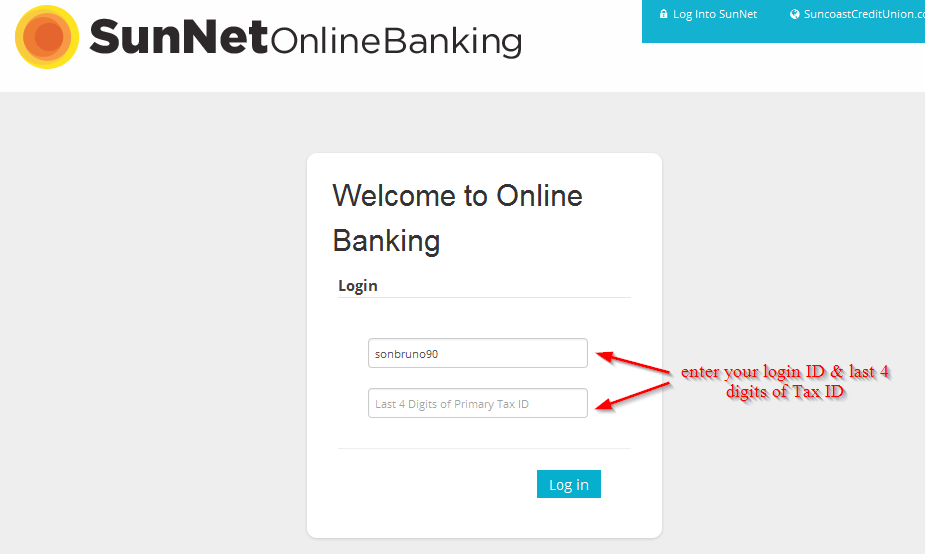

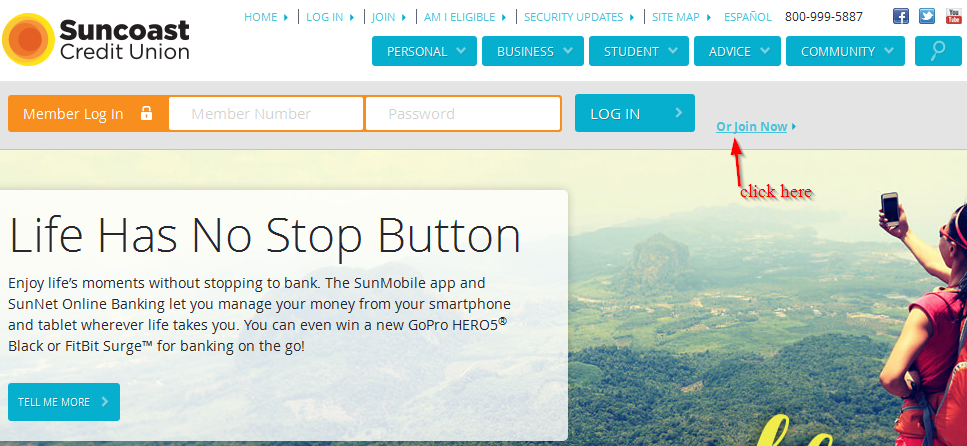

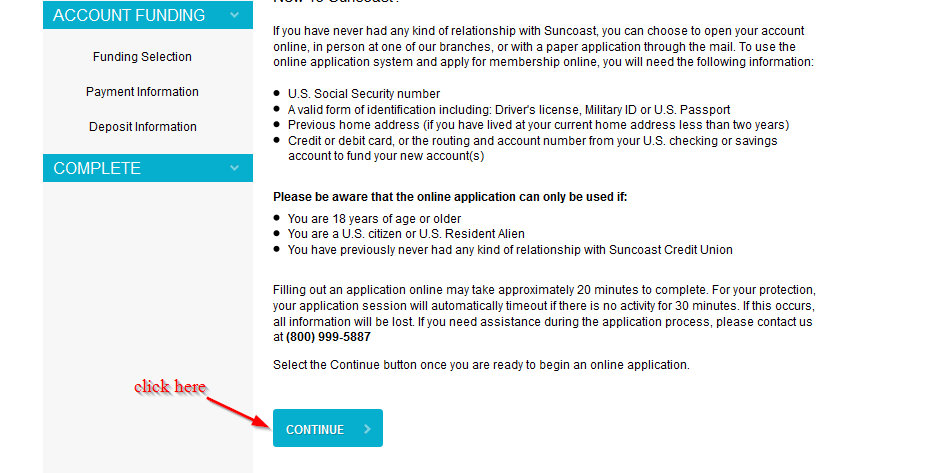

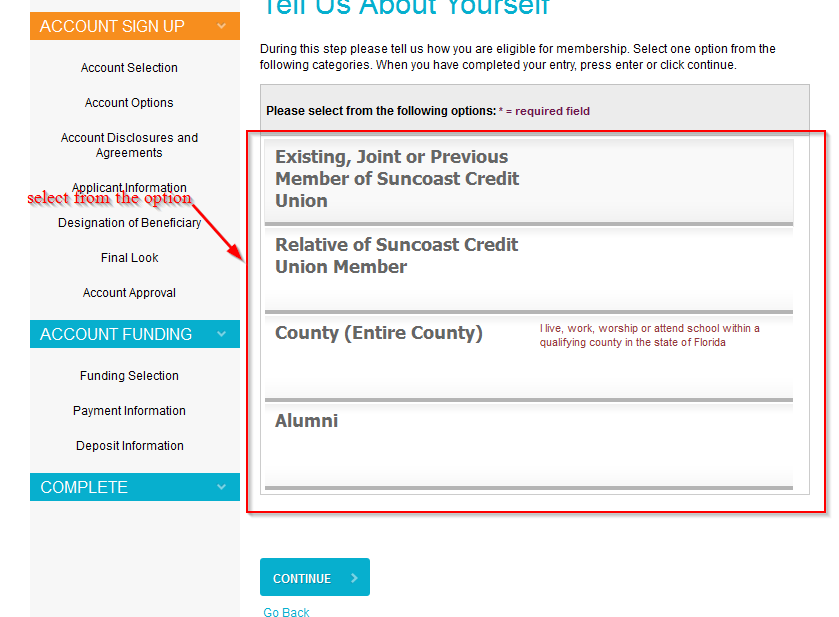

Suncoast Credit Union has made it easy for customers to bank anytime, anywhere provided they have registered for the internet banking services. These services are 100 percent free and customers also use mobile apps provided on itunes and playstore to login using their mobile phones. In this post, you will take you through the steps involved in logging into you online account, resetting your passcode in case you forgot and enrolling for the internet banking services.