Redstone Federal Credit Union, a federally chartered credit union, provides personal and commercial financial products and services in the United States. It was founded in 1951 and is based in Huntsville, Albama.

- Branch / ATM Locator

- Website: https://www.redfcu.org/

- Routing Number: 262275835

- Swift Code: See Details

- Telephone Number: +1 800-234-1234

- Mobile App: Android | iPhone

- Founded: 1951 (74 years ago)

- Bank's Rating:

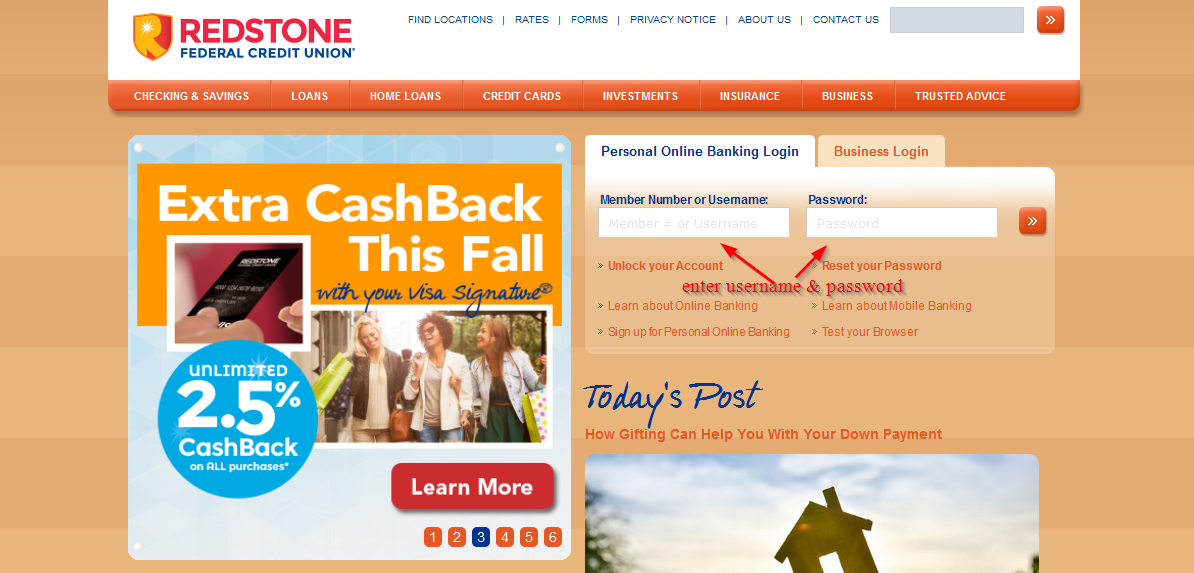

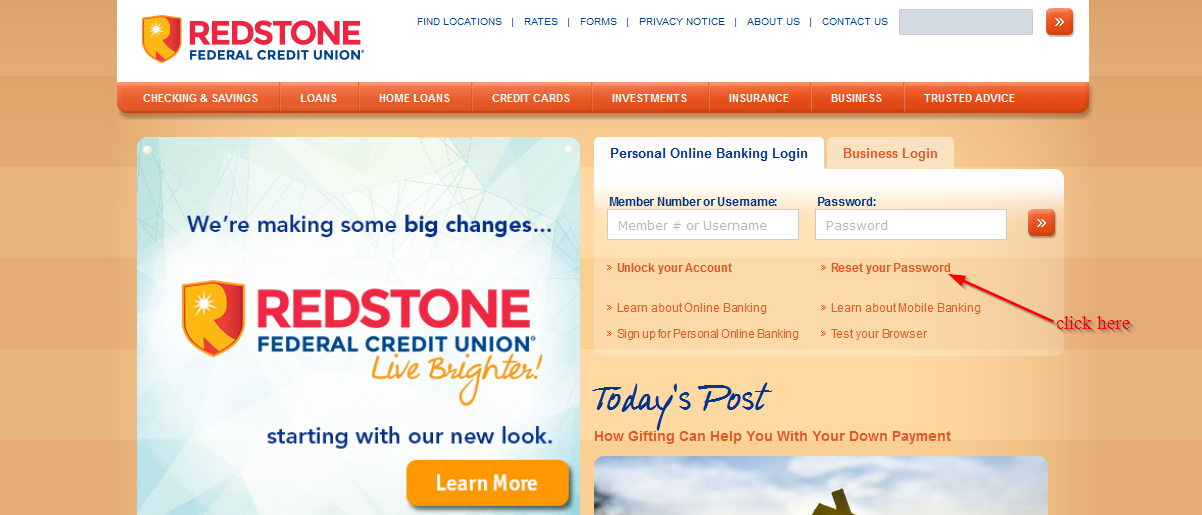

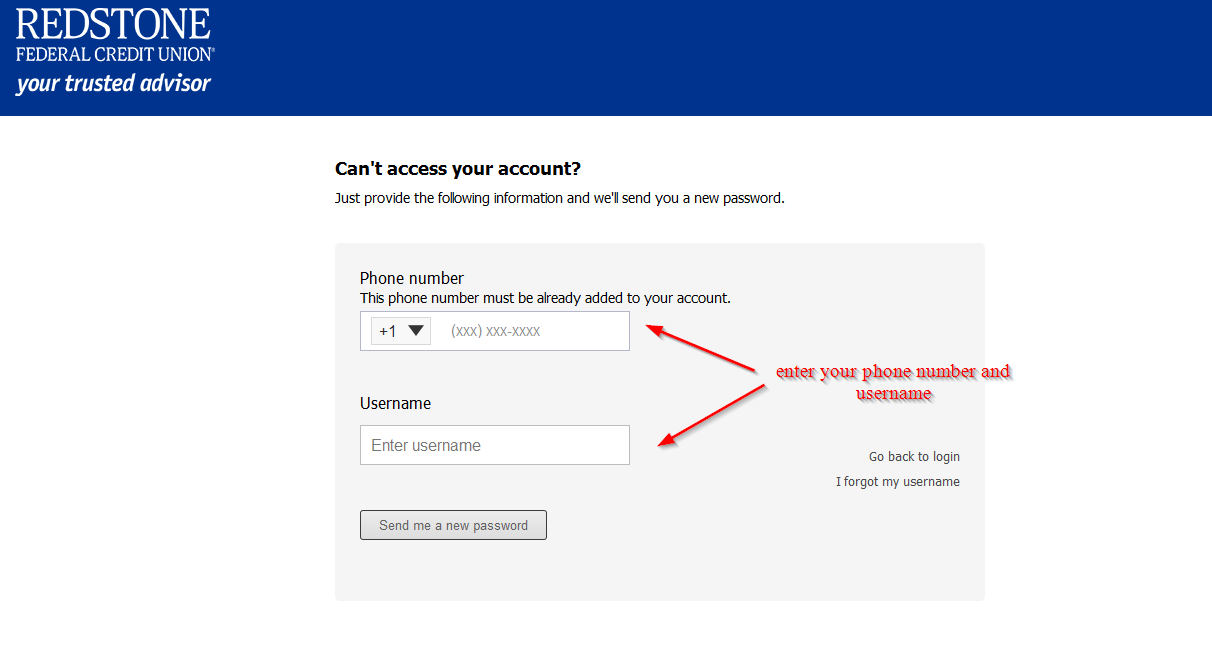

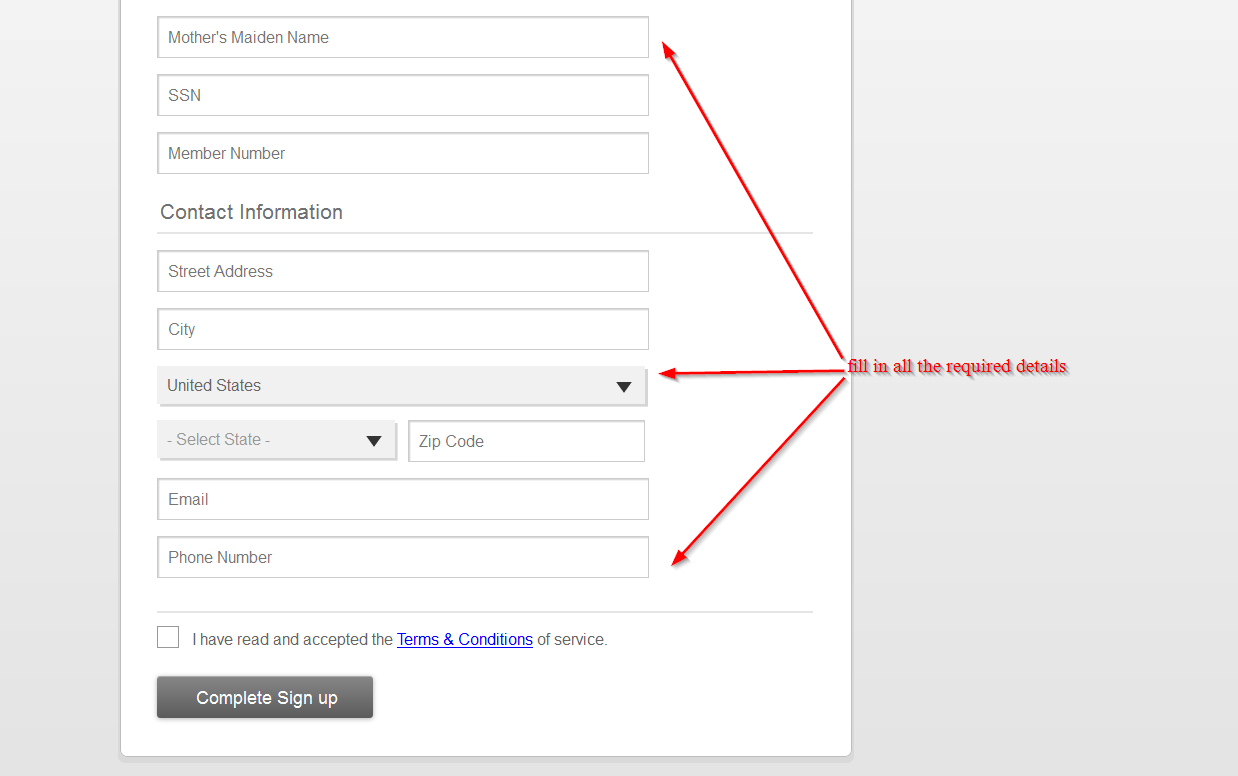

With internet banking services offered by Redstone Federal Credit Union, you don’t have to go queuing in the bank to get some cash to pay your bills. You can carry out a transaction from the comfort or your home or anywhere around the globe provided you have enrolled for the internet banking services and you have internet connection. There many things that you can do with you online account that we will be mentioning later one. Let’s first look at how to login, how to reset password and how to register.