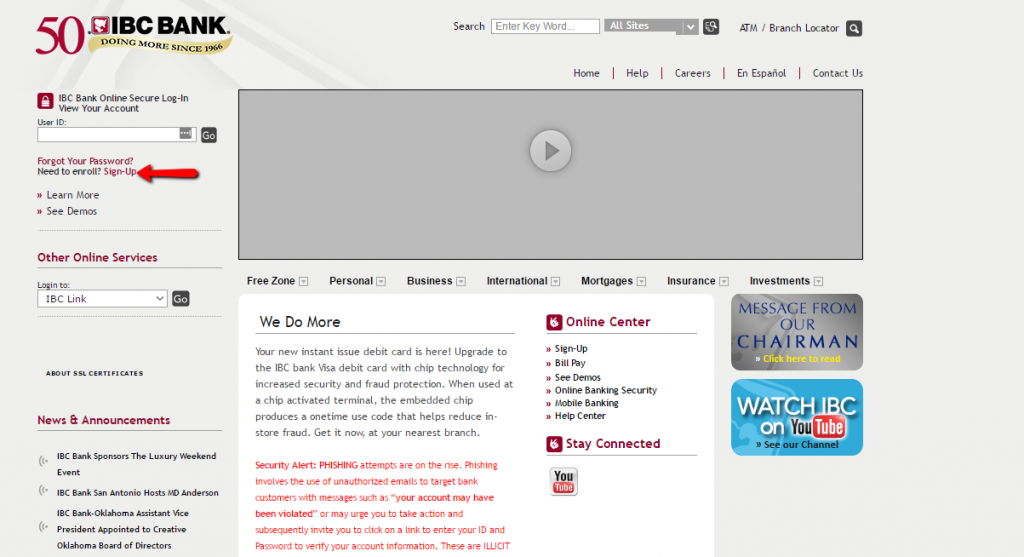

International Bank of Commerce (IBC) was established in 1966. It is owned by International Bancshares Corporation. It provides various banking solutions to both individual and commercial clients through its 215 branches.

- Branch / ATM Locator

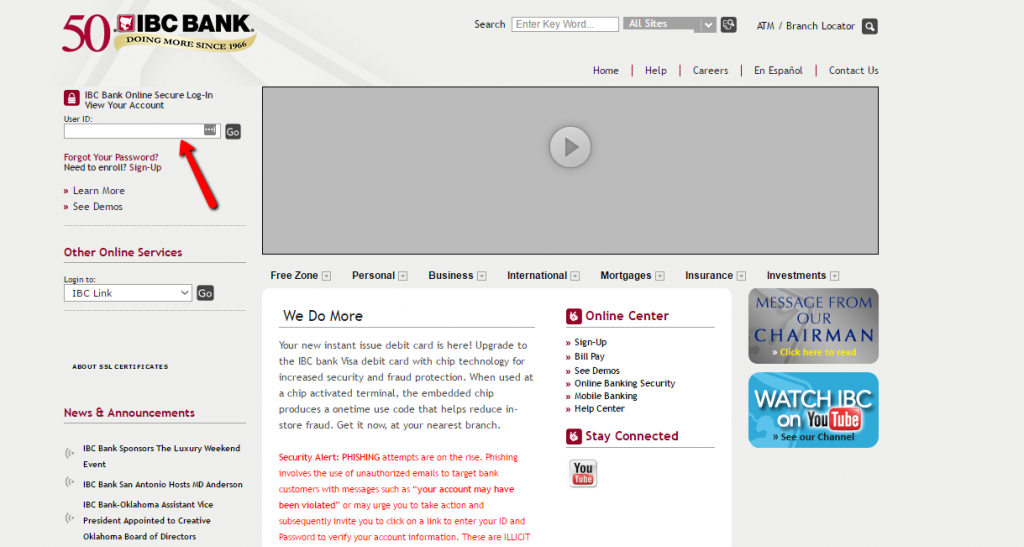

- Website: https://www.ibc.com

- Routing Number: 114909903

- Swift Code: IBCLUS44

- Telephone Number: (956) 722-7611

- Mobile App: Android | iPhone

- Founded: 1966 (59 years ago)

- Bank's Rating:

International Bank of Commerce (IBC) is a leading banking corporation headquartered in Toledo, Texas. The bank offers a number of solutions to customers who include individuals and corporations. Customers can also perform online banking through its website and mobile applications. The bank has received a number of awards such as the America’s 100 Most Trustworthy Financial Companies by Forbes where it appeared in the 50th position.

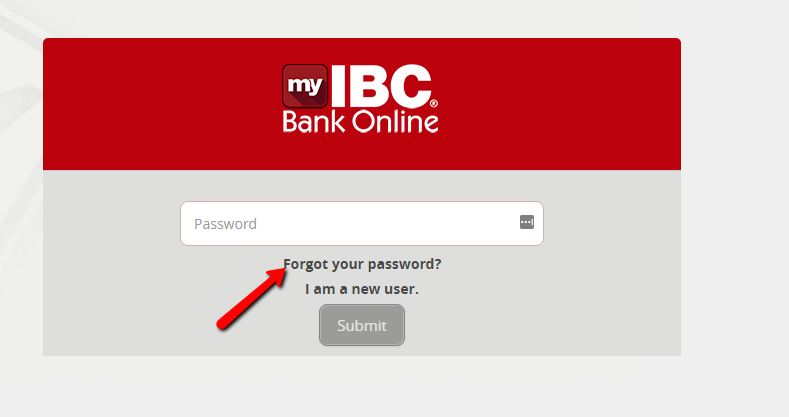

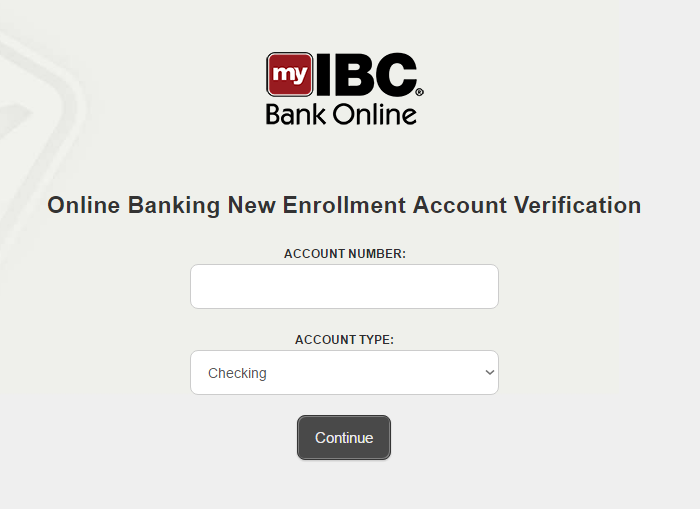

If you have the number, you should select YES which will take you to the next step.

If you have the number, you should select YES which will take you to the next step.