Coastal Credit Union was established in 1967. It’s a non profit organization which is owned by the members. It provides banking solutions such as savings and credit to its members in its 16 branches and its online portals. The bank’s branches are located at Apex, Carrboro, Cary, Durham, Garner, Raleigh, and the Research Triangle Park.

- Branch / ATM Locator

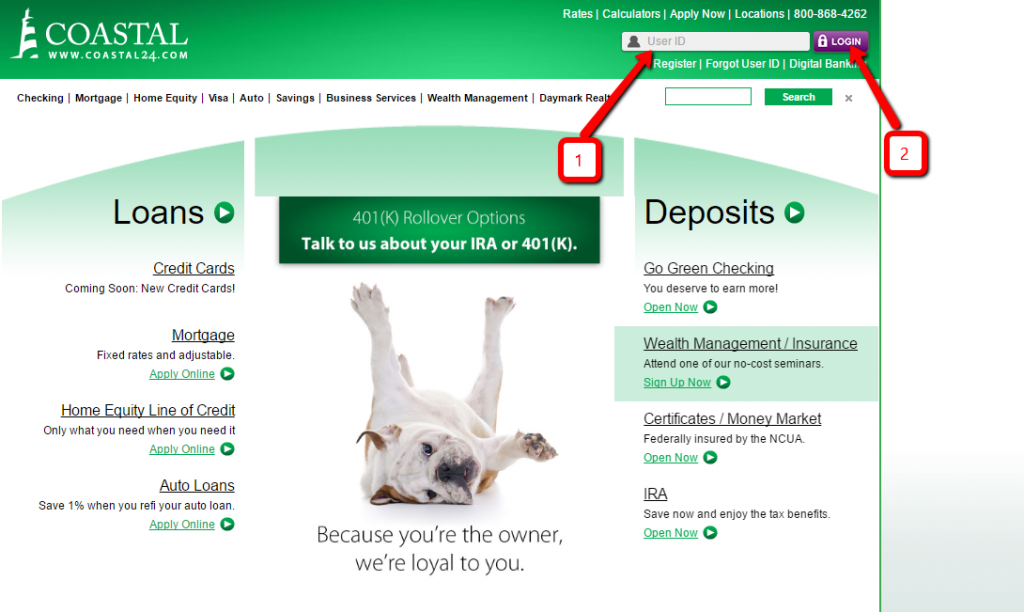

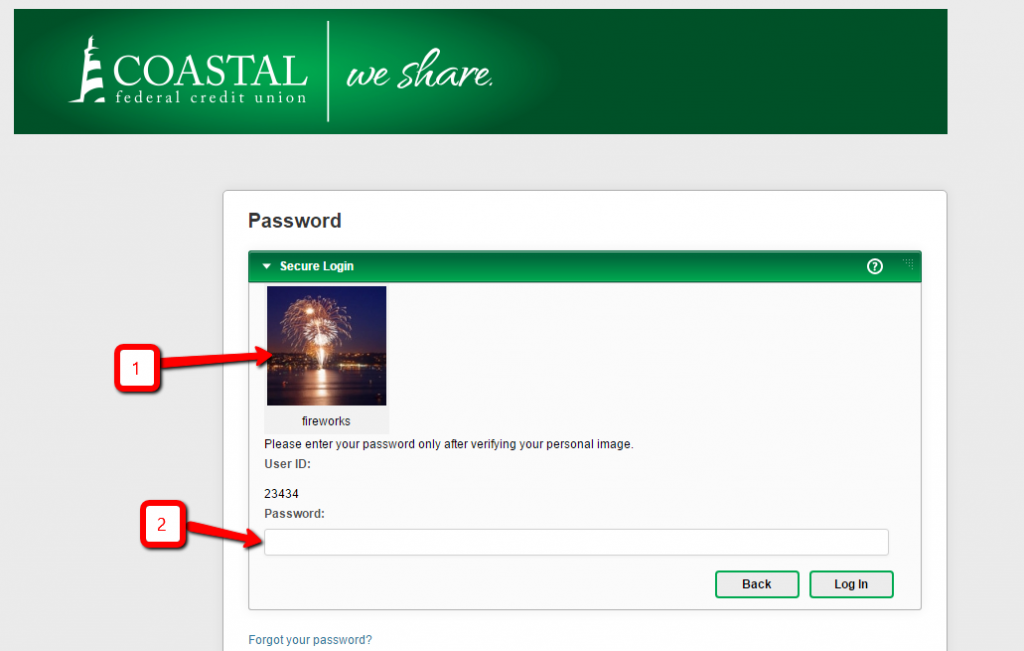

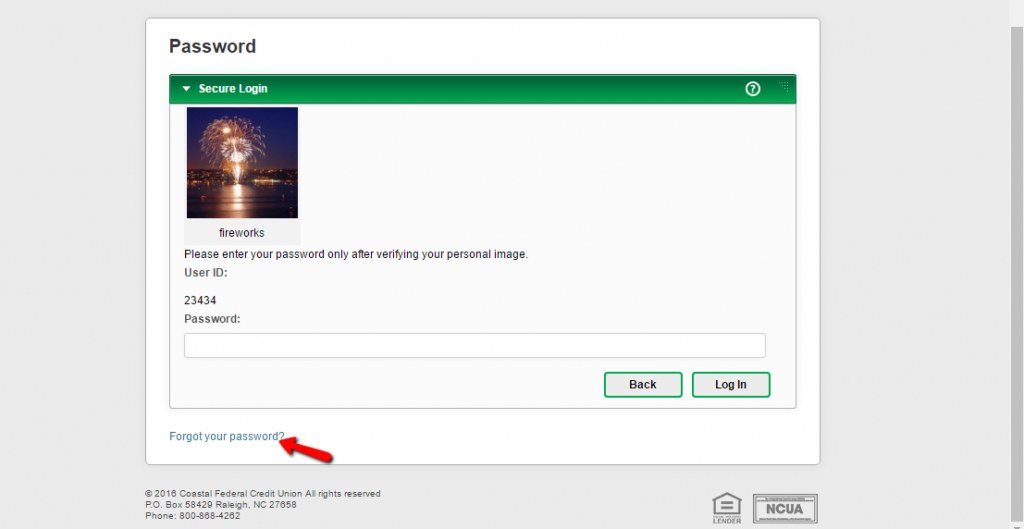

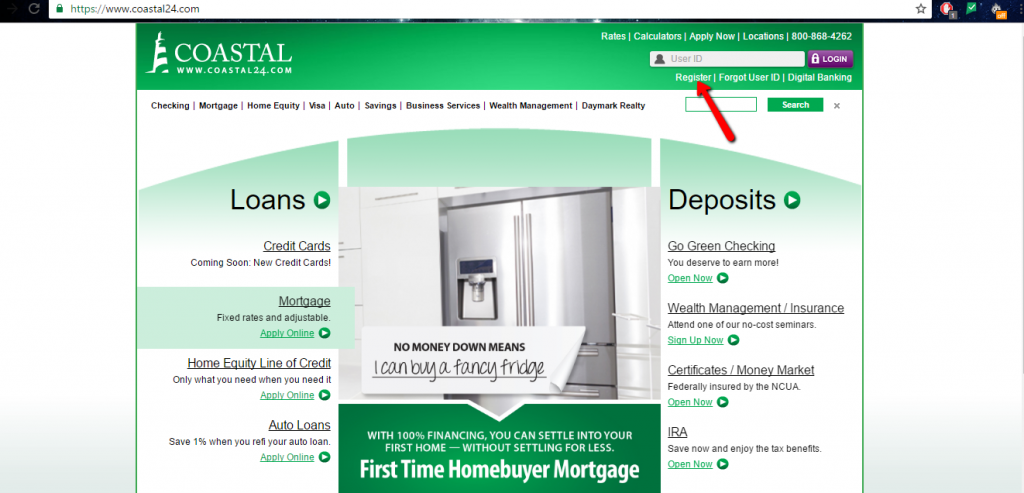

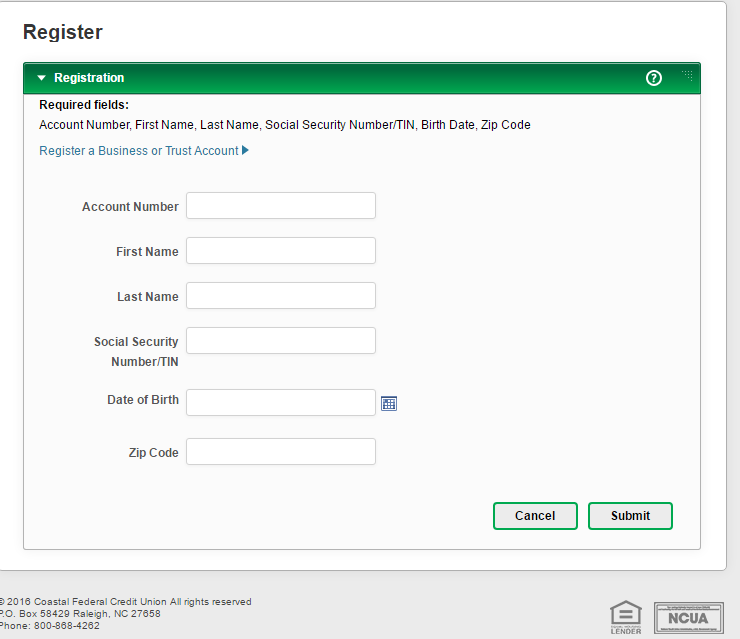

- Website: https://www.coastal24.com

- Routing Number: 253175494

- Swift Code: See Details

- Telephone Number: 800-868-4262

- Mobile App: Android | iPhone

- Founded: 1967 (58 years ago)

- Bank's Rating:

Coastal Credit Union is a members’ owned non-profit organization established in 1967 to offer banking services to its members. The organization serves its clients through its 16 branches and its online platforms which can be accessed from anywhere. Some of the services offered are mortgage, savings, home equity, and wealth management.